Discovering a new oil field is a major accomplishment. But effectively producing hydrocarbons from that field is seen as a truly exceptional, massive success.

As you can probably imagine, it's a rare occurrence.

So, when a small oil and gas exploration company reaches that milestone, investors are wise to pay very close attention.

Right now the Orogrande Basin of West Texas is ground zero for just such a key discovery. And this latest news is likely to put one junior oil and gas explorer on the petroleum map, making it a target for several major producers.

It's one big reason analyst Clive Maund told his subscribers he views this small-cap energy company as a "strong buy," a call he reiterated on February 25 when he wrote, "Torchlight is rated an immediate buy as soon after the open as possible."

Major Milestone to Catapult Oil & Gas Explorer

Torchlight Energy Resources Inc. (TRCH:NASDAQ) is a small-cap oil and gas explorer.

But don't be misled, because the company controls a major play in the newly emerging West Texas Orogrande.

And as TRCH's newest press release reveals, its latest results are off the charts. Torchlight just announced it has measured substantial Initial Potential (IP) oil and gas hydrocarbon recoveries from the recently drilled and completed Cactus A35 #1H well.

Greg McCabe, Torchlight's chairman, stated, ". . .With the play consisting of 134,000 acres all under one D&D unit with University Lands, having oil and gas present in the hydrocarbon system is a major development for Torchlight and its shareholders."

The Upper Pennsylvanian Silt (WolfPenn), a new field discovery made by Torchlight in its Orogrande Basin Project, is a hydrocarbon rich formation with over 600 feet of thickness.

Despite all the right markers, the first horizontal well drilled into this zone, the Founders A25 #1H well, encountered very high gas rates with almost no liquid hydrocarbons.

Gas rates reached over 2 million cubic feet per day, with a stabilized rate of 1.2 million cubic feet per day, from a small 1,000-foot frac interval. Extrapolated to a 10,000' lateral, this well would be stronger than most Cotton Valley gas wells, and approaching many Haynesville gas wells.

Still, in the aftermath of those promising but inconclusive results, Torchlight hired a team of petroleum scientists, led by Mike Zebrowski.

Their task was to examine these incongruous gas well results. After all, the formation clearly appeared liquids rich.

They eventually concluded that the Wolfpenn displayed a dual porosity system, much like the Wolfbone and Wolfberry Plays of the Permian Basin. Interestingly, early wells in the western portion of Wolfbone encountered the same dichotomy of results, with wells making an inordinately high gas-to-liquids ratio compared to expectations created by the petrophysics.

Some larger operators, including EOG, Concho and Cimarex, realized that the solution was to perform a much larger frac, able to penetrate both porosity systems. That turned out to be exactly the right move. Spectacular results followed, with a large liquid hydrocarbon component being liberated, but also significantly higher gas rates in their wells.

On the basis of this analogy Torchlight drilled a short lateral into the Wolfpenn formation in the Cactus A35 #1H well. The company made the decision to only perforate a 100-foot interval and put a significantly larger frac on this well. Torchlight used 3,000 pounds per foot of sand instead of the 2,000 pounds per foot used on the Founders A25 #1H gas well.

The injection rates were increased from 60 barrels/minute to over 80 barrels/minute. As historically seen in the western Wolfbone wells, the results have proved the potential for high volumes of oil production.

The dual porosity system hypothesis turned out to be spot on, with oil and gas rates increasing significantly. To date, Torchlight's peak 24 hour production rates are 15 barrels of oil per day (BOPD) and 110 thousand cubic feet per day (33 barrels of oil equivalent per day [BOEPD]). Equating this to a 10,000 foot lateral, the Cactus well can be extrapolated to make 1,500 BOPD and 11 million cubic feet per day potentially, or combined 3,300 BOEPD.

This type of well production has the potential to be significantly better than most Midland Basin wells from a moderate depth of only 5700 feet.

Persistence and Tenacity Pay Off

Management has spent the past three to four years drilling test wells to prove up this thesis, and to position itself for an eventual buyout from a petroleum major.

The initial significant news from Torchlight regarding the Orogrande Basin came in April last year. That's when the company announced a new field discovery, along with a third party reserve estimate of 3.678 billion barrels in recovery potential from unconventional zones. TRCH has a 72.5% working interest in approximately 134,000 net acres.

Consulting geologist Rich Masterson is a recognized Permian Basin expert, and part of the company's management team. He's a brilliant geologist, credited with originating the Wolfbone Play, and developed the thesis for the Orogrande Basin (WolfPenn).

It's hard to overstate how this latest news confirms a huge milestone.

Additional Discovery Potential

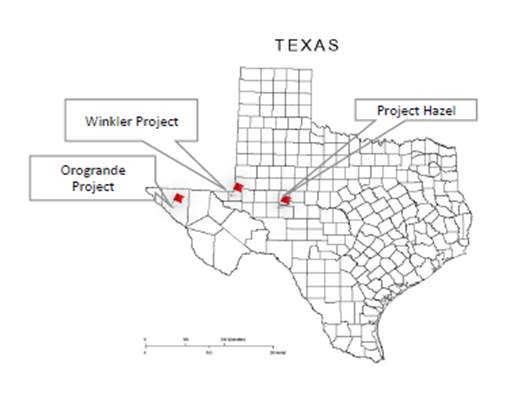

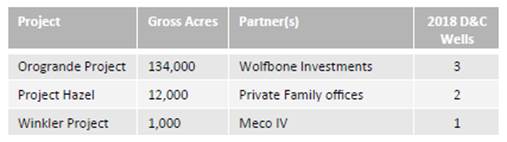

Despite its main focus on Orogrande, Torchlight has a couple of other interesting plays.

In the Midland Basin of West Texas (Project Hazel), TRCH controls about 12,000 gross acres (9,600 net acres), 100% of which will be operated. Its interest is 75% of net revenue.

19 contiguous sections with a potential of up to 300 horizontal drilling locations target the Wolfcamp A & B formations. To date, three vertical test wells have successfully drilled and verified horizontal potential, with horizontal drilling having started in June 2017.

The estimated potential, based on analogous Midland Basin EUR's is 4 to 6 million barrels per section. Additionally, TRCH controls approximately 1,100 gross acres in the Delaware Basin, in Winkler County, West Texas.

Torchlight holds a 75% NRI on the project. 5,000- and 10,000-foot laterals can be drilled. The first well spud came in Q2 2018, and is currently producing from the Wolfcamp A interval. This project contains five prospective benches or "stacked pay zones," where as many as 20 long laterals and potentially 19 short laterals can be drilled.

A Takeover Target in The Making

With Torchlight, the bottom line is this.

Its superb management team has the right skills to create shareholder value through successful organic growth, driven by science. They also have pertinent experience with top independent and integrated oil and gas companies.

Keith Kohl, editor of the Pure Energy Trader newsletter, said, "We know Torchlight has a tremendous amount of oil underground, and is currently courting some big suitors to take this multi-billion-barrel field off their hands."

High insider ownership of 27% means management is clearly aligned with shareholders.

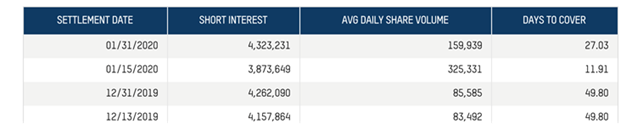

Over the last couple of months, the short position on the stock has looked like this.

Given the company's latest news, demand for shares could well blow up this huge short position, causing shares to scream higher. All the while, big boy oil and gas producers must be circling.

In my view, Torchlight not only has the goods, it's conclusively demonstrated its production potential.

Now's the time to buy Torchlight, whose shares have the potential to trade at a multiple of current levels in very short order.

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.