Ximen Mining: Ready to go?

The novel coronavirus is spreading fear and panic on a global scale. Over the last few days, the Dow Jones Index crashed almost 3,000 points lower. Yesterday alone, the leading stock market index lost 1,190.96 points (-4.42%), making Thursday, February 27, 2020, the biggest daily point loss in the history of the Dow Jones.

On the positive side, this is not the first time that the popular stock indices are in crash mode, pulling down almost everything including gold stocks. A look into the past, however, shows that gold stocks may only fall for a limited period of time during such panic-driven selling waves. In the last major stock market crash of 2008, gold prices and gold stocks only briefly fell to their knees and were able to quickly make up for their losses. The gold price started a strong upward trend after the 2008 crash and appreciated by 175% (from $700 to $1,923 USD/ounce) within only 2 years. During that time, gold stocks were amongst the biggest winners.

Updated chart: https://schrts.co/bkPAYnVw

In a recent Kitco article it was discussed which (rare) breed of gold stocks may provide the biggest profits for investors going forward, respectively in case the gold price can continue its upward trend. The result: “Companies with the path to production within three years.”

While the gold price increased by 20% last year, the stocks of seniors (large gold producers) rose twice as strong, averaging about 40%. However, investors in a different class of gold stocks returned even higher profits: Companies with the path to production within 3 years vastly outperformed, up 70% to 80%, relatively to the seniors. This trend may continue well into the future as “Investors are starting to realize that there is a dearth of quality projects in good jurisdictions to feed the dozens of producers for future production“, the Kitco article noted.

On the other hand, the class of gold explorers had a hard time last year and continue to struggle in general (there exist, of course, notable exceptions) as this type of gold stock typically attracts investors‘ attention later in the course of a new bull market in gold (when investors become comfortable to take more risk into account). This underperformance continues to create a major financing hurdle within the junior space“, Kitco stated.

And so those type of gold stocks are currently in the focus of (small and large) investors that can be brought into production within a few years, i.e. are “ready to go“. This is because the current mantra in the mining space must be “go big or go home“.

However, not only investors are looking for gold stocks with a path to production but also the seniors, a group of about 3 dozen gold producing companies each with a market capitalization exceeding $500 million. Especially at the beginning of a new gold bull, the seniors are hunting for their elixir of life: Fresh supply. Only new gold ounces can prolong (mine) life and inspire the stock market with growth prospects.

On the other hand, it‘s not only the 3 dozen seniors in search of replenishment but also another 3 dozen gold producing companies with a market capitalization of less than $500 million: The so-called junior gold producers.

With more than 72 hunters in the race, there could be a fierce battle for the highly limited gold projects that are believed to be brought into production within few years in politically stable and mining-friendly jurisdictions. And so, according to Kitco, M&A activity in the gold market is expected to increase. Mergers, takeovers, strategic alliances and joint ventures may become the order of the day from now on. The 6 dozen gold producers know only too well that the best deals are made at the beginning of a new bull market, precisely when valuations are felt to be (still) low. And since the global stock market crash is dragging down gold stocks as well, it should come as no surprise if some of the best deals are made now.

And because there are not many promising gold projects available in safe areas that could be brought into production within the next few years, the gold producers should now be quick with their outright takeovers or friendly interlocking partnerships, because the hunger for fresh gold ounces is great. The last bear market was quite long and demanding. It may even become precarious as the producers know all to well that in the hunt for new gold supply only the one will win who is faster.

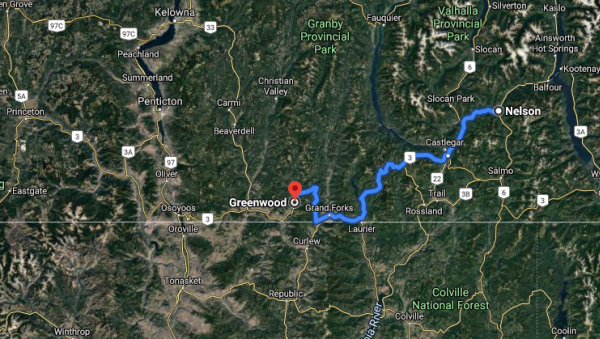

And it is also about competition with my favourite gold stock Ximen Mining Corp. as this prospective gold producer is already behaving like one who is hunting for growth early on. In recent weeks, Ximen made several announcements (see here, here, here and here) buying up properties including previously producing underground mines near the city of Nelson in southern British Columbia. Interestingly, the sellers obviously preferred Ximen stock as the main transaction currency (instead of mostly cash as being the case especially during bear markets).

At the same time, Ximen may also become a target candidate for the 6 dozen gold producers who are themselves looking for growth. In recent years, Ximen has considerably expanded its project portfolio in southern British Columbia and has become a top dog both in the Greenwood Mining District (in the very south of BC, near the city of Greenwood, bordering Washington State) and 150 km further north near the city of Nelson. Ximen aims at reviving both these historic mining districts.

Full size / Source: GoogleMaps

Just a few kilometers from the city of Nelson is the Kenville Gold Mine (100% Ximen; 0% royalties). As always, any “great“ gold deposit is not worth much if there is no processing plant available that can produce gold bars from the mined material. A processing plant can easily cost a 2-digit-million-dollar amount and can quickly swallow up 3 to 4-digit millions of dollars. This upfront capital must first be raised in order to be able to say that a production start is in the works.

Ximen could be all the luckier to use the modern, almost unused Greenwood Processing & Tailings Facility just 2 hours drive (on a highway) away from the Kenville Mine Property. Although this asset is owned by another company (Golden Dawn Minerals Inc.), the President and CEO of Ximen has also become the CEO of Golden Dawn Minerals, so the same interest potentially exists: Mining in Nelson and gold bar pouring in Greenwood.

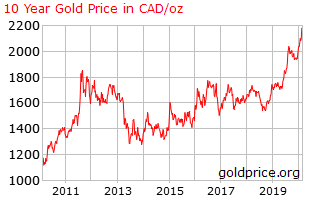

As the gold price in Canadian Dollar has already surpassed its 2011-high ($1,800 CAD/oz) and currently trades near $2,200 CAD/oz, the timing for Ximen could be perfect to advance towards near-term production in mining-friendly British Columbia.

Most importantly, the Ximen management has done its homework over the last years and can now get down to business. The many news in the last weeks are topped by today‘s press-release, as Ximen has now become a major land owner in the Nelson Mining District.

A month ago, the highly regarded Laurentian Bank Securities Inc. has become Ximen‘s strategic financial advisor to assist in sourcing capital and evaluating potential M&A opportunities (see here). Since then, Ximen is behaving like a big player, consolidating the entire Nelson Mining District and acquiring prospective properties including historic mines.

Full size / Above map from today’s news shows the Kenville Gold Mine Property (red; top) and the California Gold Mine Property acquired in late January (red; right), as well as the recently properties acquired from Klondike Gold Corp. (pink) and the properties acquired from Emgold Mining Corp. (orange). Today the large properties (yellow) from 49er Creek Gold Corp. were added.

The properties (highlighted in yellow in the above map) acquired today from 49er Creek Gold Corp. cover 4,276 hectares and include 4 previously producing mines that had a combined historic output of “only“ 641 ounces of gold, but did so from “only“ 45,546 tonnes of mined material. Additional gold ounces, some of which are historically enriched with silver and copper, could be present but need to be defined by drilling first.

Besides the Greenwood Camp, Ximen now also owns some of the largest gold-prospetive properties in the Nelson Mining District, adjacent to its flagship asset, the Kenville Gold Mine (100% Ximen; 0% royalties) targeted to be put into production first.

Technical Perspective

Link to updated chart (15 min. delayed): https://schrts.co/PxRvMIhK

Company Details

Ximen Mining Corp.

888 Dunsmuir Street – Suite 888

Vancouver, BC, Canada V6C 3K4

Phone: +1 604 488 3900

Email: office@ximenminingcorp.com

www.ximenminingcorp.com

Shares Issued & Outstanding: 49,828,102

Chart

Canadian Symbol (TSX.V): XIM

Current Price: $0.45 CAD (02/27/2020)

Market Capitalization: $22 Million CAD

Chart

German Symbol / WKN (Tradegate): 1XMA / A2JBKL

Current Price: €0.296 EUR (02/27/2020)

Market Capitalization: €15 Million EUR

Previous Coverage

Report #18: "Shallow and deep drilling at Gold Drop produce highly promising results and findings"

Report #17: "Shallow and deep drilling at Gold Drop produce highly promising results and findings"

Report #16: "The Drill is Turning to Uncover the Stargate II Anomaly: A Large Gold Pipe?"

Report #15: "Ximen targets first gold bar pour this year from bulk sampling at Kenville"

Report #14: "All Eyes on Gold Drop and Stargate II: Deep drilling to test for a large gold deposit near Greenwood in British Columbia"

Report #13: "Ximen is pressing ahead aggressively with its goal of becoming a gold producer: Mining plan now revealed"

Report #12: "Ximen frees Kenville Gold Mine from royalty burden, making it more attractive for development"

Report #11: "The Beauty of High-Grade Gold (and Silver!): Ximen Cuts to the Chase, Expands Work Efforts on Multiple Properties in Southern British Columbia"

Report #10: “Ximen Mining: Paving the road(s) to success“

Report #9: “Ximen takes a shot at history, focuses on acquiring the Kenville Gold Mine“

Report #8: “Industry inquiries persuade Ximen‘s partner to re-assay drill core for tellurium“

Report #7: “Ximen Hires B.C. Mining Expert Dr. Mathew Ball“

Report #6: “Location is Key for Ximen‘s Treasure Mountain Project in Southern British Columbia“

Report #5: “The Unprecedented Gold-Silver-Tellurium Strikes in the Historic Greenwood Mining Camp Continue“

Report #4: “Record-Breaking Gold Hit in Southern British Columbia“

Report #3: “Strong drill results and appreciating precious metals prices may herald golden times for Ximen Mining“

Report #2: “Ximen Mining reveals striking drill core observations ahead of assays“

Report #1: “Ximen Mining: Hunting for Multi-Million Ounces in British Columbia“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Ximen Mining Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Ximen Mining Corp.´s and Zimtu Capital Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Ximen Mining Corp.´s and Zimtu Capital Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Ximen Mining Corp., Golden Dawn Minerals Inc. and Zimtu Capital Corp. and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital also holds a long position in Ximen Mining Corp. Note that Ximen Mining Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. The cover picture has been obtained from Graphic_studio, das the picture "Go Big, or Go Home" comes from Quotefancy and the picture with the chess figures has been obtained from Monster Ztudio.