Maurice Jackson: Today we highlight a preeminent uranium and thorium explorer in Canada's Athabasca Basin. Joining us for conversation is Jordan Trimble of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB).

Always a pleasure to have you on our program, sir. You have some exciting updates for us regarding drilling. But before we begin, Mr. Trimble, please introduce Skyharbour Resources and the opportunity the company presents to the market.

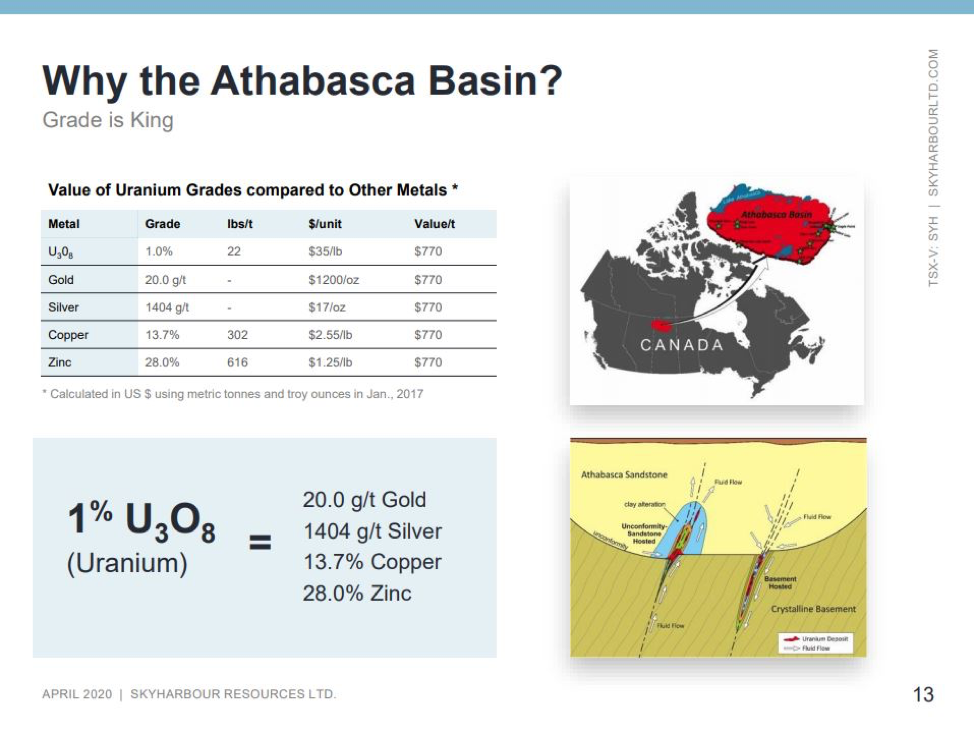

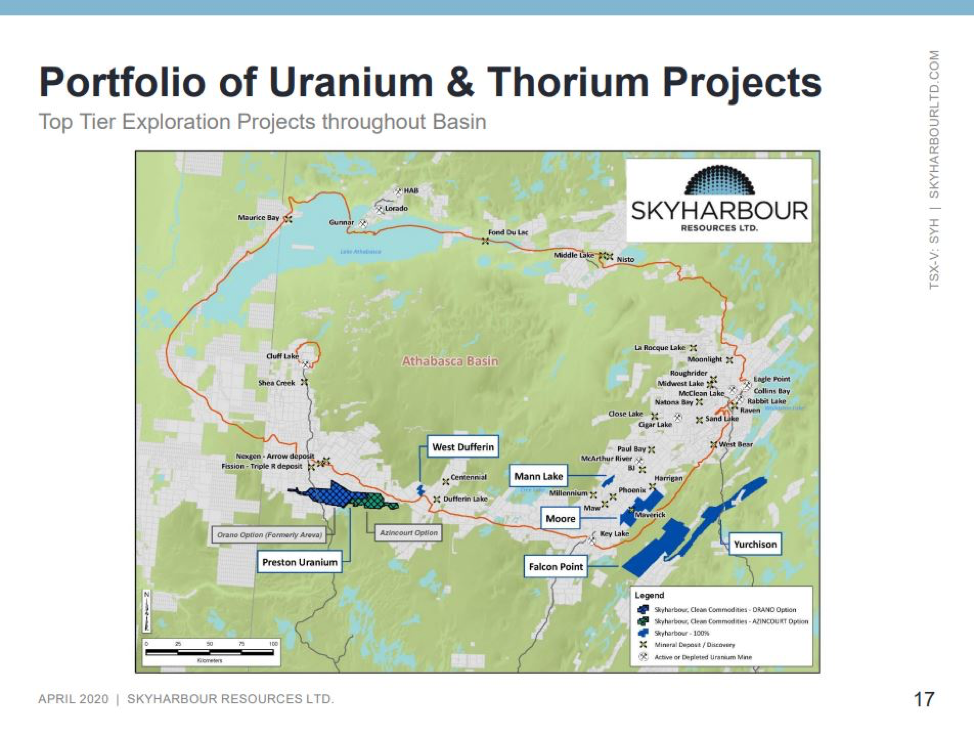

Jordan Trimble: Skyharbour Resources is a high-grade uranium exploration and early-stage development company. We have six projects in the Athabasca basin, which is in northern Saskatchewan in Canada. It's the highest grade depository of uranium in the world. It's one of the top ranked mining jurisdictions in the world, as ranked by the Fraser Institute—the Saudi Arabia, if you will, of uranium.

We have spent the last seven years building up a project portfolio. And we've done a good job being opportunistic in a bear uranium market. It has been a depressed market for an extended period of time, since Fukushima, that's created and presented the opportunity to acquire the asset base that we put together. The projects host a couple of uranium deposits—high-grade mineralization at various stages of exploration and development, ranging from earlier stage, more grassroots projects to more advanced-stage exploration.

Skyhabour has been able to amass its portfolio by spending just under CA$5 million, a good chunk of that being paid in stock and in exploration expenditures. And to shed some light on the potential rerating for this asset base as we come into a better uranium market, there's been about $90 million spent in historical exploration, invested into the projects. And, at one point, two of the projects were in a company that was valued at over $300 million in the last uranium bull market we saw, in 2006–2007.

At the current spot prices, these are significant discounted valuations. Skyhabour is excited to have this project portfolio, which we're now advancing both with programs and exploration, and with drilling that we're carrying out and funding at our flagship project, but as well with partner companies—strategic partners that we brought in to help advance some of our secondary projects.

We do have two strategic partners, one of which is Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT). They're our largest strategic shareholder. They're listed on the New York stock exchange and on the TSX, a larger uranium development company. The president and CEO, David Cates, is on our board.

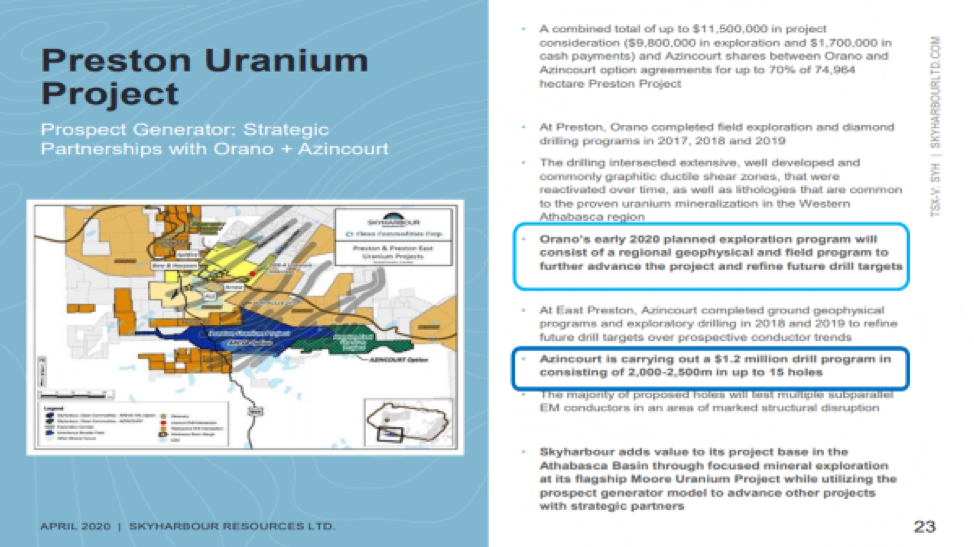

And secondly, we have a partner in Orano SA, which is France's largest uranium mining and nuclear company, headquartered in Paris. They're partners with us at our Preston Project, whereby they're earning in up to 70% of the project by spending $8 million over a six-year period. I will just note, as well: We're one of the few remaining active uranium junior mining companies out there.

We've seen a major contraction in both the number of uranium companies and their equity valuations. Uranium is a niche market, which is not followed as well as other larger market metals, but it does present a very unique opportunity with a very distinct set of fundamentals.

Maurice Jackson: Can you provide us with an example?

Jordan Trimble: For example, in the [past] two weeks, we've started to see the price of the uranium move almost 20% off its lows. And I think there's good reason to believe that will continue, despite what's happening in the broader market. And again, as one of the few remaining companies in the sector, we do offer investors exposure to that rise in uranium price, as we will highlight later in our discussion.

Maurice Jackson: Jordan, how does Skyharbour's dual-prong strategy as a high-grade uranium exploration company, as well as a prospect generator, place shareholders in a competitive advantage among your peers?

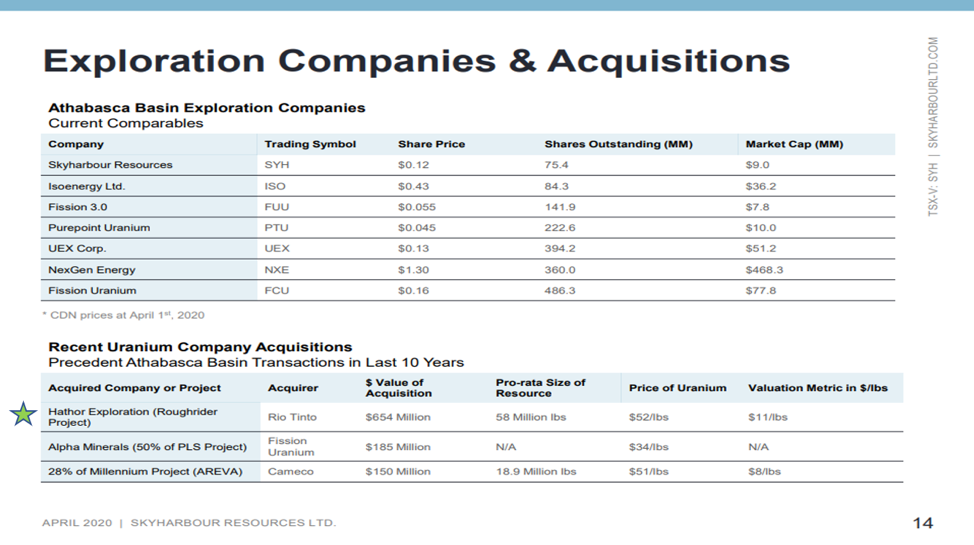

Jordan Trimble: First and foremost, we are an exploration and discovery story. And there's some notable recent high-grade uranium discoveries that have been made in our neck of the woods in the Athabasca Basin—within the last, call it, 12 years. You look at Hathor back in 2008–2009; it was ultimately acquired in a bidding war between Cameco Corp. (CCO:TSX; CCJ:NYSE) and Rio, and was bought by Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) in 2012 for over $600 million. And that discovery, which became the Rough Rider deposit, was a highly accretive transaction, and generously rewarded early investors in that story.

Recently in the Athabasca, we've seen new discoveries made by NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), Fission Uranium Corp. (FCU:TSX; FCUUF:OTCQX; 2FU:FSE) and Denison. And these are all perfect examples of what high-grade uranium discoveries offer investors. It's really unprecedented value creation in short periods of time. We are attempting to emulate the successes for our shareholders.

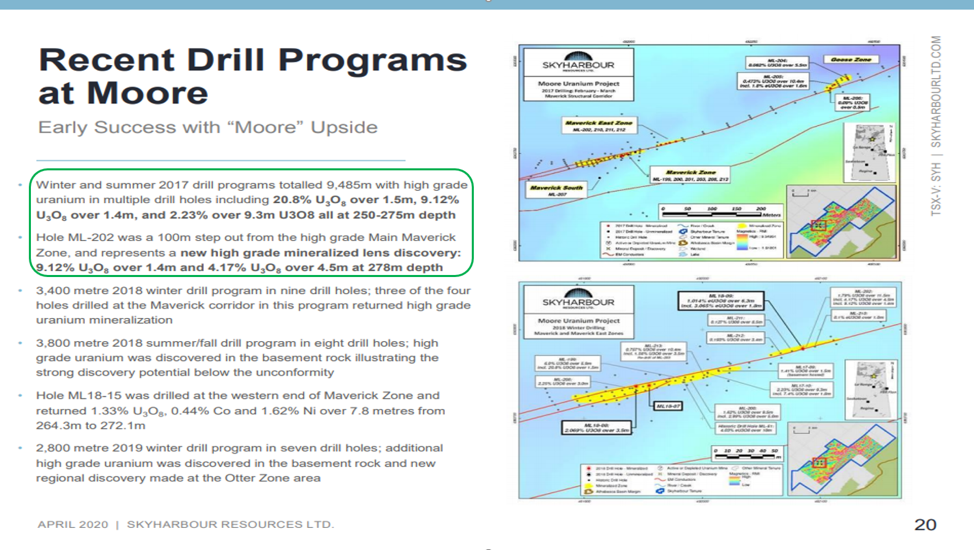

Skyharbour is currently conducting drilling at our100%-owned flagship Moore Project. It's an interesting asset that we acquired back in 2016, and has a fair bit of historical drilling and exploration, along with high-grade uranium mineralization that was discovered there in the early 2000s.

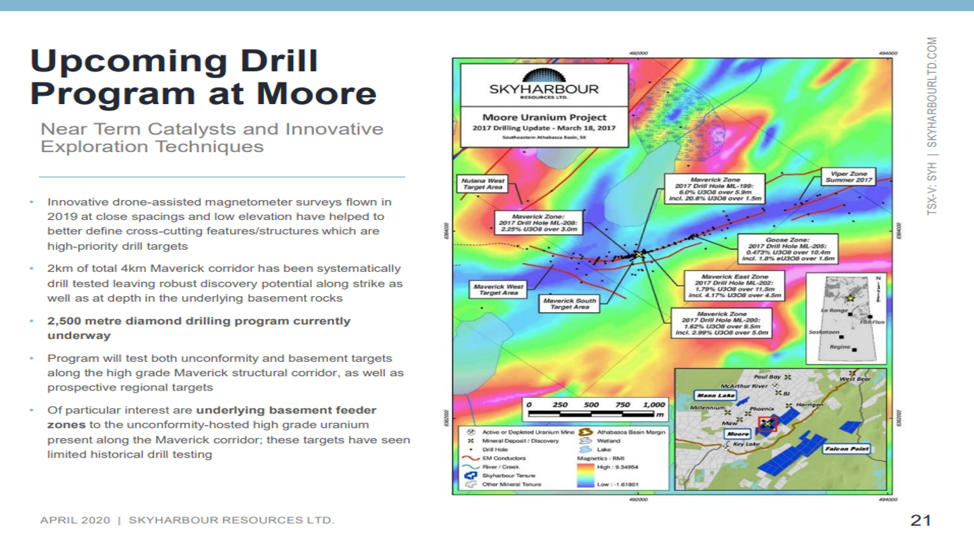

Interesting to note [that] most of the historical work was focused in one or two geological settings in the Athabasca sandstone, which overlies the underlying basement rocks. And the contact between the sandstone and the underlying basement rocks is called the unconformity. Most of the high-grade mineralization that was discovered historically was either in the sandstone or at the unconformity, with very little drilling being done into the underlying basement rocks. More recently, the notable and major discoveries. . .have been made in the underlying basement rocks. This is truly exciting for us right now, because we're now testing these underlying basement rocks with recent drill programs and upcoming planned drill programs. We think there's much more uranium to be found in these basement rocks, in the feeder zones where the uranium comes up.

Allow me to share with readers that in a previous program we intersected a zone of 21% U3O8 uranium over about a meter and a half. We've had other zones of multi-percent over good widths, and that's high-value rock on a dollar-per-ton basis at some of the most valuable ore out there.

Skyharbour has proven there is high-grade in the sandstone and the unconformity. But again, most of the historical work, and the work that we've done to date, has not been focused on testing the underlying basement rocks. It's really been some new geophysical techniques and methodologies, as well as a better understanding of the geology—some new geological modeling that we've carried out over the last year—that has refined these basement-hosted targets. Our current winter program, which is just wrapping up, was predominantly focused on drill testing basement-hosted targets and feeder zones.

We actually followed up on a discovery hole that we had last year, whereby we intersected high-grade uranium mineralization in an exploratory drill hole we drilled into the basement rocks. And so we've gone and followed up on that. We're very happy with the program and we will have results to follow in the next month or two. So keep an eye out for news flow there.

The second part of our overall strategy is being a prospect generator. What we do with our other projects, outside of our flagship, is we look to bring in partner companies that can fund and advance the projects. We can, in turn, also get some cash and stocks from these partner companies as they earn in, typically a majority stake in the property. We've consummated two deals thus far. One is with strategic partner Orano, as I mentioned earlier, whereby they have to spend upward of $8 million to earn in 70% of the Preston Project.

And another company, called Azincourt Uranium Inc. (AAZ:TSX.V), is nearing completion of their earn-in at our East Preston Project. There's still a $200,000 task payment that needs to be made to us. But they've funded several million dollars in exploration expenditures and have issued shares, and have made cash payments, and they can earn 70% at our East Preston Project.

So those are perfect examples of the prospect generator model, whereby, again, we package our properties up and look to bring in partner companies that will then fund the exploration, and we get cash and stock as well as they earn in. We'd be ultimately become a joint venture partner, while retaining the upside with any success in the exploration and development work, but we don't have to continuously raise money in the market and dilute. We can look to monetize the projects versus further dilution, and it's a good complement to our main focus, which is making a new high grade or additional high-grade discovery at the flagship Moore Project.

Maurice Jackson: It's a great, great business model. Skyharbour is currently conducting three active drill programs on the Preston, East Preston and Moore Lake Projects respectively. Can you provide us on an update on each of those sir?

Jordan Trimble: Beginning with our flagship Moore Project (press release), we announced earlier in the year we had commenced a 2,500-meter drill program testing predominantly basement targets. These are new targets that we've refined and identified in the underlying basement rocks. We think there's a larger deposit to be found in the underlying basement rocks given that we have high-grade mineralization at the unconformity and in the sandstone. As I mentioned, we have assays pending. And, in all likelihood, we will be following up with additional programs later this year and in 2021.

At our other projects, which are partner-funded, Azincourt has been spending money at our East Preston Project (press release). They just completed an approximately 2,000-meter drill program and relatively shallow drilling following up on a reconnaissance drill program they carried out last year, where they had some notable indicator minerals, and alteration and graphitic conductors in which they drill some into a few exploratory holes. The assays are also pending on that program. That'll augment news flow from our main drill program at our flagship Moore Project.

And then, last but not least, Orano has commenced, and is carrying out a field program at our Preston Project as a part of their $8 million earn-in at that project (press release). Orano is currently conducting a direct-current (DC) resistivity geophysical program, which is designed to refine drill targets for upcoming drill programs at the property. Their work will be wrapping up soon, and we expect to have some news flow as results come in from that program.

So, the bottom line is there's multiple irons in the fire, multiple opportunities for new discoveries and more uranium mineralization to be discovered at several different projects, and the bulk of it is being funded by partner companies. So that's an important point to note as well.

Maurice Jackson: Realizing there may be some supply chain constraints in reference to the assays, when should shareholders expect to get the first news results on those?

Jordan Trimble: We haven't heard of any disruptions yet at the labs, but given that these programs just recently wrapped up, I would expect to see results here, probably, in the next month or two. And we'll have a pretty steady flow of news between the various programs over that period of time taking us into the summer months.

Maurice Jackson: I see that Skyharbour has added a new member to the board of directors. Please share who was added, and provide a summary of the skill sets that he brings into Skyharbour Resources.

Jordan Trimble: Absolutely. We are proud to announce Joe Gallucci as the newest member to our board of directors. Joe's the head mining investment banker at Laurentian Bank in Montreal. He has an extensive history in the mining space as a banker and as an analyst, previously worked at BMO Capital Markets, GMP Securities, Dundee, and was a founding principal at Eight Capital. He led their mining investment banking team before he moved over to Laurentian. He's worked with many, many companies, he's raised a lot of money from mining companies through his career.

And specifically for us, he has a history in the uranium sector. He has worked extensively with a number of uranium companies and I see him being an integral part to the team going forward.

One of the things I will note is, ultimately, what we are looking to do with Skyharbour, on the back of exploration success and value creation in the field and with our strategic partners—and again, hopefully, in a much better uranium market—we would ultimately like to sell the company, to be the target of an acquisition by a larger company. And I think Joe will be a valuable resource to have as a director when that time comes.

In addition to Joe—he's the most recent addition to the board—we do have, I'd say, a top-tier management and technical team. Myself and our chairman, Jim Pettit, are based here in Vancouver. Jim previously ran a gold company that I worked for called Bayfield Ventures, which was ultimately acquired by New Gold Inc. (NGD:TSX; NGD:NYSE.MKT). That's when I started Skyharbour, in and around the time that Bayfield was acquired.

And my technical team is based in Saskatoon. My head geologist, Rick Kusmirski, who's a 40-year veteran in the sector, brings focused expertise on uranium exploration and discovery in the Athabasca Basin. He was the exploration manager at the world's largest uranium company, Cameco, for many years before starting his own uranium junior company, called JNR, which ultimately he sold to Denison Mines. And that's when he joined our team, when we started Skyharbour.

A couple of other people on the advisory board include Paul Matysek, who is well known in our industry, having built and sold a handful of mining companies over the last 12 years. And his biggest win was the uranium company called Energy Metals Corp., which he sold for $1.8 billion in 2007.

So, we have a very well-rounded team with management and capital markets expertise, as well as a focused expertise in the Athabasca Basin, uranium exploration and development in Saskatchewan.

Maurice Jackson: There've been some recent notable developments in the uranium sector, including the suspension of operations at Cigar Lake in response to the coronavirus. Can you give us your thoughts on these recent developments?

Jordan Trimble: As I pointed out earlier, we have seen the price of the metal move. Recently we've seen almost a 20% increase in the spot price, on the back of the recent announcement of suspension of operations and production at Cigar Lake, and the McClean Lake mill that processes the ore from Cigar Lake. Cigar Lake accounts for just over 13% of global primary mine supply. It is a massive mine, and it's the highest-grade operating uranium mine in the world. It's Cameco that is the majority owner and operator.

Cameco guided that it's going to be an initial four-week suspension due to health concerns surrounding COVID-19. . . .However, my gut is telling me that could be longer. We could see an extended suspension. I believe that you're going to see a restart of operation of that mine based not on the underlying health concern—the reason that they took it offline—but for the look at the economic and commercial factors of restarting the mine.

As we know, they shut down their other large operation and mine in the basin a couple of years back, McArthur River. It's been offline for a little while now, and they shut that down because of the low uranium price environment. As a result of that, they've had to buy a fair bit of material over the last little while in the spot market. Just before coronavirus caused a number of these operational shutdowns, Cameco recently came out with quarterlies that stated that they would have to buy between 20–22 million pounds of uranium.

They'd have to acquire that from somewhere in order to meet their contract delivery. They have. . .pre-negotiated contracts with utility companies and purchasing managers—field buyers—that they are required to deliver into. Now, that hasn't changed with everything that's going on; they're still required to make those deliveries. So with the McArthur River Mine having been shut down, they've been forced to buy material—a good chunk of material in the spot market—and/or draw down inventories.

They've drawn down inventories well below their guidance—minimal thresholds. So they don't have that as an option anymore. They have to acquire that material either by purchasing it in the market and/or finding it from some other secondary supply source. These secondary supply sources—their inventories are drying up. That's looking like it's becoming a less viable option for them. And in fact, they stated in those recent quarterlies and earnings that they would likely be having to buy most of that 20–22 million pounds in the spot market.

Well, that was a couple months ago. Fast forward to now, with the other large mine that they've shut down at Cigar Lake. That number has just increased dramatically from the 20–22 million pounds. With Cigar Lake shutdown—if it is shut down for any further extended period of time, more than the month that they've initially guided—that means they'll have to, again, find that material from somewhere else. That likely will have to be in the spot market. And we've already seen in the last week the spot price pick up from about $24.50 to almost $28, actually.

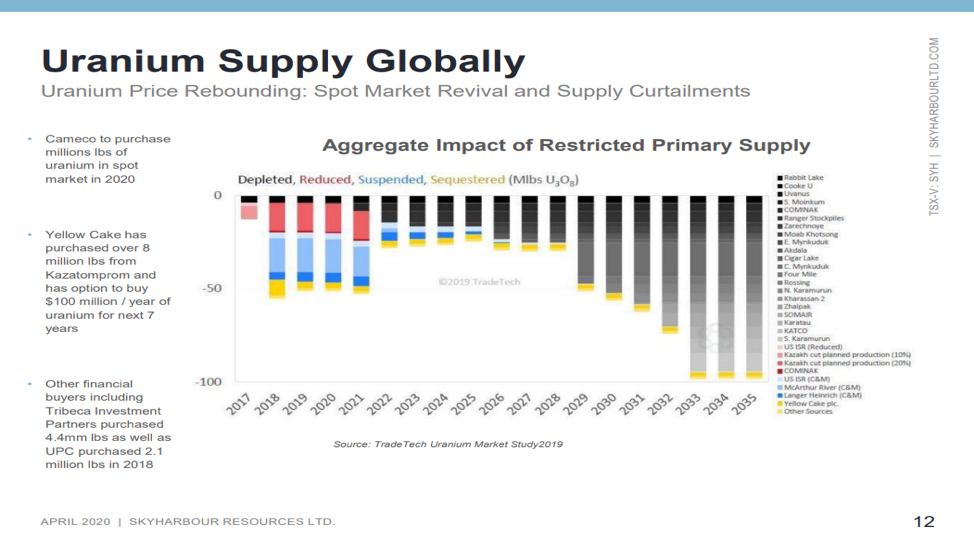

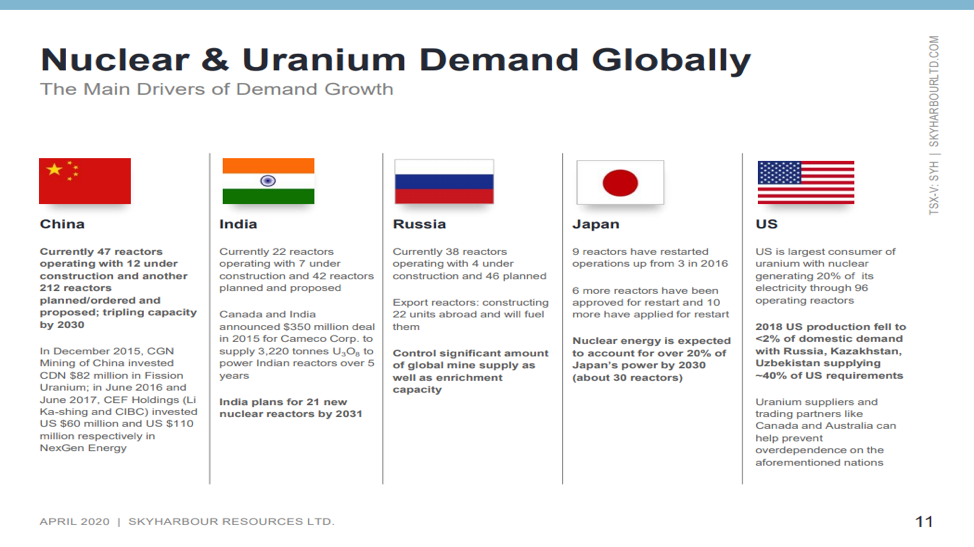

I think a chunk of that has been coming from the market obviously tightening up, with producers having to curtail production. And I think also we're going to see utilities likely start buying in the spot market to shore up supply. Just to kind of give some stats here, seven mines account for over two-thirds of global supply with this metal. So it's highly concentrated among just a handful of mines in a couple of jurisdictions.

Some other notable areas and mines to look out for in terms of the response to the virus is Namibia. It accounts for about 10% of global primary mine supply. They've already started shutting down their uranium mines, suspending production there. And then the big one will be Kazakhstan. Kazakhstan accounts for 40% of the global supply. And it'll be interesting to see, over the coming weeks, if there's any supply disruption there—in addition to a couple of mines in Australia, including Olympic Dam, where uranium is a byproduct, but it nonetheless accounts for about 4% to 5% of the global supply.

The uranium sector is experiencing major supply disruptions because of the virus. I think you could see more of that on the horizon. Again, if there's any extended production curtailment at any one of these mines, that's going to have a positive impact on the price.

Maurice Jackson: What are you seeing on the demand side?

Jordan Trimble: On the demand side, the demand for this metal is predominantly in nuclear reactors. It's relatively sticky demand. Nuclear reactors aren't easy to turn on and off, so you're not going to see much in the way of a demand shock or a demand disruption.

I think that it's relatively insulated from what's happening globally. You'll see intermittent sources of electricity, like wind, solar, that likely go off first if there isn't the electricity demand and consumption that we normally see. But nuclear reactors, they're big, big operating plants. And again, they're not easy to just simply turn on and off. I think you see a relatively insulated and sticky demand side in the backdrop of major supply disruptions, in addition to the supply disruptions and curtailment that we've seen already over the last couple of years.

Maurice Jackson: Well, you're looking at a multitude of catalysts for the uranium price, which has actually bucked the general market trend recently and is moving higher. Do you see this as a trend continuing?

Jordan Trimble: I do. We went over some of the reasons why it's moving higher right now, but I do see this being a trend that continues. It's important to note that uranium has a very unique and distinct set of fundamentals and drivers. It's a relatively uncorrelated to the broader market. And what you're seeing right now in this market is a prolonged bear market coming to an end. You're seeing a recovery take place. And it's right now being supply driven, with these recent supply cuts.

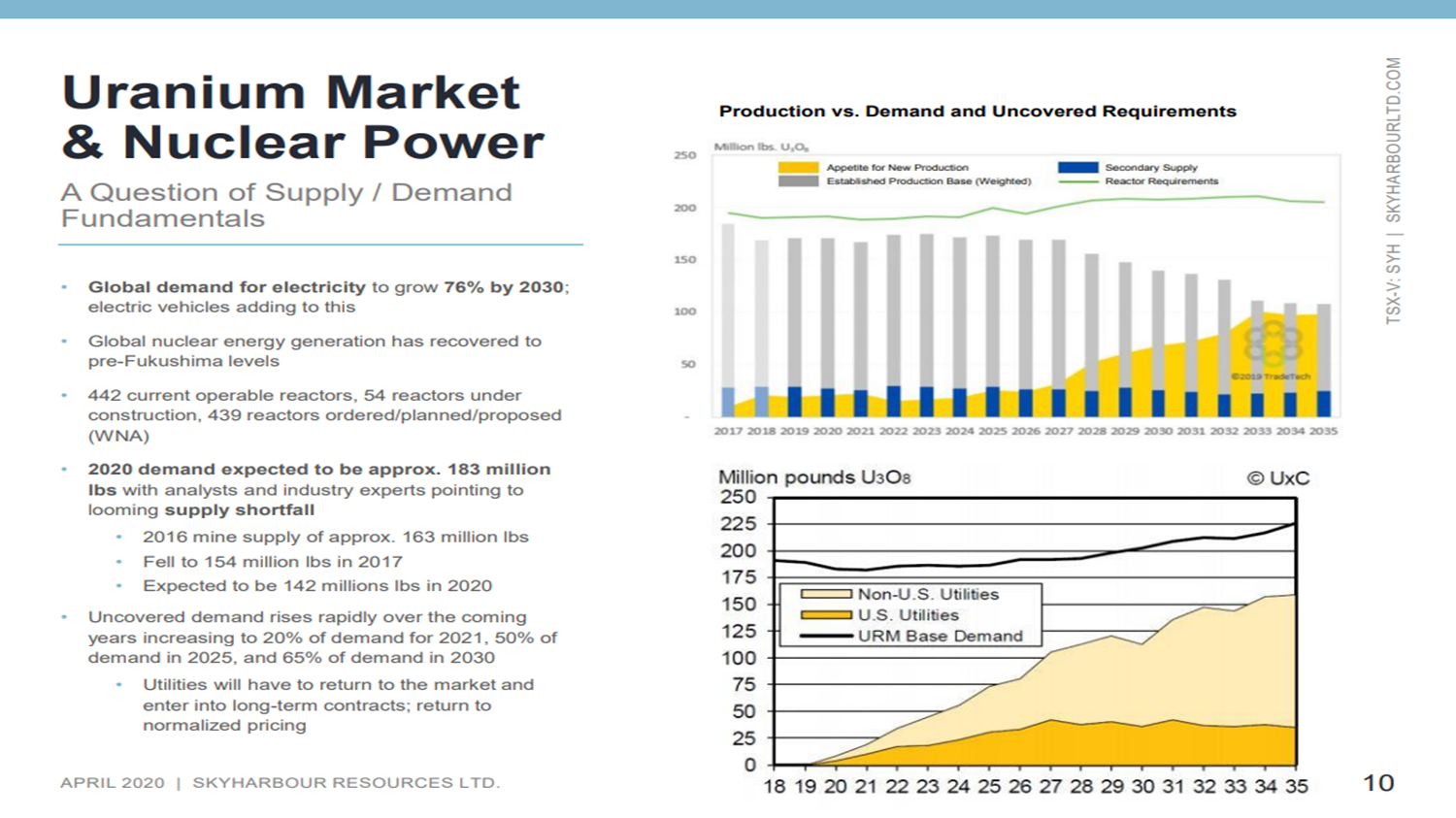

The supply/demand fundamentals and picture for this commodity are as compelling as any commodity out there right now from a buyer standpoint. You're looking at the supply side. We've seen supply now decrease. This was before the recent announcements in production suspensions.

But we've seen supply decrease from about 163 million pounds in 2016 down to an estimated 140 million pounds in this year. And that's in the backdrop of growing demand—demand that is estimated this year to be between 185–190 million pounds. So pretty notable and significant supply deficit that's having to be met by secondary supplies.

And we're seeing these markets tighten up, and I think we'll see that continue, especially with the supply disruptions that are occurring, including Cigar Lake and other mines that have shut down or been suspended recently. When you have that kind of a supply deficit and you have highly concentrated supply—primary mine supply globally just in a few operating mines—that really does set the stage for a serious price move, as we're starting to see.

And again, in this sector, it's not like we're coming out of eight- or nine-year bull market, like we've seen in many other asset classes and sectors. This has been, unfortunately for the last eight or nine years, a very difficult sector to be in. And I think that we're seeing. . .the cycle turn, we're seeing a reversal. And again, it's being driven by very specific fundamentals for the metal.

Another thing I think worth noting. . .is that one of the biggest drivers for the uranium price historically has been utility contracting, right? We discussed that uranium and most material is being bought and sold and being acquired by nuclear utility companies through contracts that they have with the miners and with the supplier as well.

We know that over 50% of these existing contracts expire by 2025 and you have to actually factor in about a year to two years where you have to fabricate and enrich the fuel. So you move that back about a year to two years. We are inching closer and closer to when the majority of these contracts have the risk of expiring. And so there's a lot of uncovered requirements five to six years out, and these utility companies and purchasing managers are now going to have to come back and are going to be forced to negotiate with the mining companies.

And we know that for the mining companies, the current low spot prices, $26–27 a pound, are well below the average global cost of production. We know that they're not going to settle for those prices, and sell material over a multiyear periods at those prices, and there has been an impasse as a result of that. I think that ultimately the fuel buyers are going to have to pay more. They're going to have to buy the material at what we would deem to be somewhat normal prices, in that $40–60 range.

The forecast price from analysts that cover the sector range from $45–60 a pound, which is a significant move. I'd call it almost a doubling from the current spot price. I foresee a new contracting cycle happening in short order that'll be expedited, with everything that's happening right now. And then another big thing more recently, and certainly with a focus in the United States, has been the security of supply—and whether it's in the U.S. It's a national security concern on where the U.S. sources its uranium.

The United States only produces about 1% of the uranium that it consumes annually. It's still the largest consumer of uranium for its nuclear reactor fleet, yet production has dwindled next to nothing. It has to import the vast majority of its fuel, a good chunk of that coming from places like Kazakhstan, Russia and Uzbekistan. So I'm sure readers are familiar with, over the last a couple of years, this Section 232 investigation that ended up leading to a decision in July of last year, which ultimately went against, I think, what most market participants were expecting and that President Trump and the administration decided against any trade auction.

And we did see, subsequent to that, a nuclear fuel working group set up, which is still there to further investigate and look at the situation. We're waiting to get some resolutions from that. That has created quite a bit of uncertainty and an overhang, if you will, and it has, I think, led to some price weakness in the equities over the last year. The uncertainty around Section 232 in the Nuclear Fuel Working Group has forced certain U.S. nuclear utilities to the sidelines. And when the largest buyer and consumer of uranium globally isn't in the market as actively as they would be because of that, that's obviously going to have a detriment. It's going to be a detriment to the price and to share prices.

We did see, earlier this year, the announcement of the proposed $150 million-a-year budget for a domestic reserve. Investors are still waiting to see details on what that exactly looks like, and what that entails. But again, I think it'll go a long way in just providing some visibility and clarity on what utilities in the U.S. have to do in terms of where they have to buy from. And I think that that will bring them back to the market, and that will go a long way.

There are just a wide multitude of factors specific to the sector that are driving higher prices right now, and I think will continue to drive higher uranium prices going forward.

Maurice Jackson: We've covered the uranium price. Please provide us with the current share price and capital structure for Skyharbour resources.

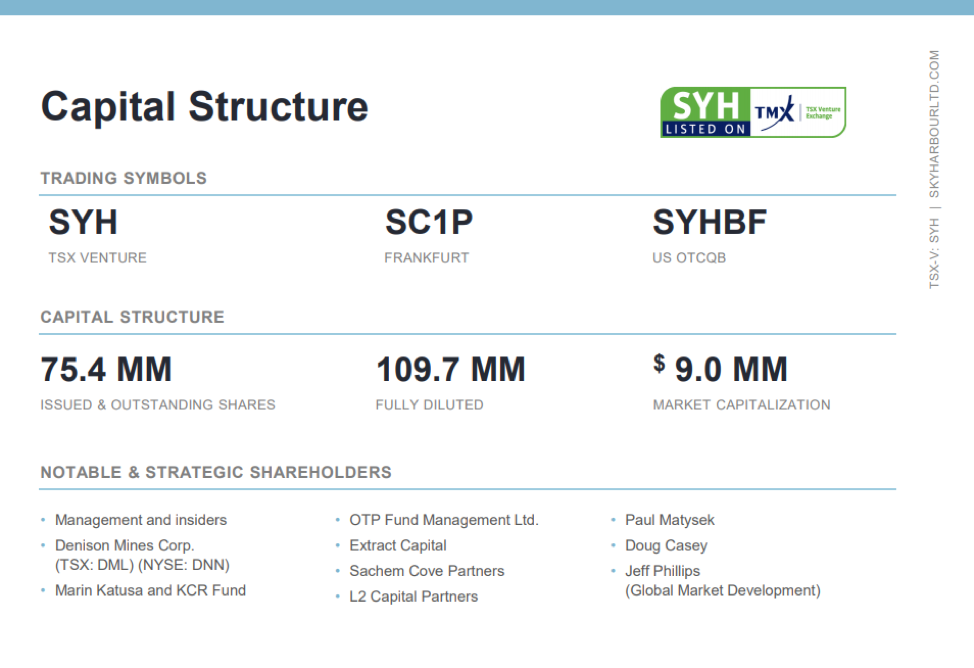

Jordan Trimble: Skyharbour has 75 million shares issued and outstanding, and trades at almost $10 million valuation market cap, so relatively low. And you can see that I've been buying a fair bit of stock in the market recently. I see the current price in valuation as one of the best value propositions that this company has ever offered, given what we have going on in the field, with results coming out on several programs, high-grade discovery potential at our projects in the Athabasca basin, strategic partnerships.

And I think investors are going to be looking for asset classes and sectors that they may not have looked at over the last several years and they're going to be looking at what is going to outperform, what is going to provide returns in a tough market. Given that this sector is relatively uncorrelated with the broader market, there's a good case to be made that you're going to see a higher commodity price over the next little while. I think a little bit of investor interest will go a long way, when the total combined market capitalization of all publicly traded uranium companies is now less than $7 billion.

Just to put that in perspective, nuclear energy globally accounts for about 11% of electricity output. Here you have the companies that looked for and mine the fuel for 11% of global or electricity generation. The total combined market caps and valuations are only $7 billion. So a little bit of investor interest will go a long way. And importantly for us, as a small-cap company, we will see those dollars flow down to small-cap names like Skyharbour relatively quickly.

There aren't a whole bunch of large-cap mining companies or exchange-traded funds, and you can't buy physical uranium. So again, it's a unique opportunity in that it offers leverage and torque on a rising uranium price. But you don't have to see a lot of money captured with larger-cap names and other means of getting investment exposure. You'll see investor dollars trickle down relatively quickly to the mid-cap and small-cap names in the space.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

Jordan Trimble: Well, I think, like everyone else right now, watching how this virus and pandemic plays out. It's created obviously a panic selloff in the broader markets. And unfortunately, when you see days where the Dow's down 1,000, 2,000 points, you get to a liquidity event and everything gets sold off.

Given everything that's happening from a health standpoint, loss the life and the collateral damage, if you will, financial markets and selling off, it's unprecedented times and you just hope that things can get back to normal and that we start seeing some more positive headlines out there. Unfortunately, it's out of our control, obviously. And we want to make sure that everyone's safe and healthy, and we will get through this. We're excited about our prospects for Skyharbour. I think we do have a lot to offer and a unique value proposition here, especially at the current valuation.

Maurice Jackson: Last question. What did I forget to ask?

Jordan Trimble: I think that covers it all. We went through quite a bit. Keep an eye out for news flow over the next several months. We've been quite active and we're going to have a number of key near-term catalysts, including drill results.

Readers should also keep an eye out for further news in the uranium sector, additional potential supply disruptions and cuts. A big one will occur in a few weeks. So, whether we see that could be Cigar Lake mine restart or if we see an extended shutdown at the mine. And then also whether we see mines in Kazakhstan and other mines globally shut down. And so despite everything that's happening, specifically for Skyharbour, we do have a lot to look forward to, and I do believe that we're very well positioned to benefit from a rising uranium price.

Maurice Jackson: Mr. Trimble, for someone listening that wants to get more information on Skyharbour Resources, please share the contact details.

Jordan Trimble: The website address is www.skyharbourltd.com. There's a wealth of information there and all of our contact information is on the website.

Maurice Jackson: Skyharbour Resources trades on the TSX.V: SYH, OTCQB: SYHBF. Skyharbour Resources is a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed in today's message.

Before you make your next bullion purchase, make sure you call me. I'm a licensed representative for Miles Franklin Precious Metals Investments where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs and private blockchain distributed ledger technology. Call me directly at (855) 505-1900 or you may e-mail maurice@milesfranklin.com.

Finally, please subscribe to www.provenandprobable.com for mining insights and bullion sales.

Jordan Trimble of Skyharbour Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.