It’s a stark new reality. And investors need to listen up or lose out.

Truth be told, it is no longer only the size and grade of each new mineral discovery that determines whether it can become a mine. Now, all exploration/development projects also need to earn a social licence to safeguard their prospects of getting commercialized.

To achieve this societal buy-in, exploration companies can significantly boost their odds of success by strategically acquiring projects that exist in optimal settings. For instance, a new mine is far more likely to get a governmental green light if it is situated in a pre-existing, highly regulated mining camp.

A good example can be found in southern British Columbia’s copper district, which has been the backbone of the regional economy for decades. Accordingly, the regulatory route to commercializing a large deposit in this expansive “mining camp” is well-established, well-respected worldwide, and highly regarded for its emphasis on mandating robust environmental standards.

Conversely, new projects in fragile ecosystems that have no history of extensive mining, such as the massive Pebble copper-gold deposit in Alaska, tend to face major political opposition and equally challenging regulatory hurdles. In other words, if a project cannot clearly demonstrate its future sustainability and minimal impact on the environment, it is unlikely to pass muster with regulators anywhere in the western world.

With this in mind,

Kodiak Copper Corp.(TSX-V: KDK, OTC: KDKCF, Forum) is most assuredly in the right place and at the right time. Let me explain.

Good Timing and Chris Taylor’s Midas Touch

Good Timing and Chris Taylor’s Midas Touch

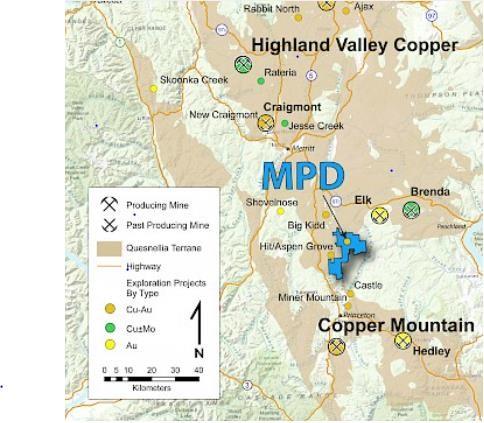

Kodiak is developing its expansive MPD Project in copper-rich southern British Columbia (BC). Of particular significance, it is surrounded by copper-gold giants that have a well-established history of operating lucratively, while also establishing themselves as conscientious corporate citizens.

Already, MPD is exhibiting comparably impressive grades and similarly large tonnage size potential to these proximal producers. By the estimation of one Canadian mining analyst, Stefan Ioannou of Cormark Securities, this translates into a “Big Picture potential” of 700 million tonnes of copper-gold mineralization, at grades potentially higher than MPD’s regional rivals.

The company’s good timing during an emerging super-cycle for industrial copper prices is no accident. It is largely thanks to the prescience and hands-on involvement of its Chairman of the Board, Chris Taylor. He is truly the “man of the moment” in the mining industry these days thanks to his role as founder and CEO of

Great Bear Resources (TSX.V: GBR), which is in the process of being snapped-up by Kinross Gold for the princely sum of US $1.4 billion.

Taylor’s leadership has been integral to Great Bear’s Cinderella-like success story, which has made it one of the largest and most envied high-grade gold finds in North America in decades.

Now he is looking to hit the ball out of the park once again – but this time with Kodiak Copper.

If the odds in favour of two home runs within a short span of several years may seem especially daunting or even unlikely, it’s worth considering that Taylor is best-known for his geological sleuthing prowess in the development of world-class copper finds. This is where he earned accolades long before he took the reins of Great Bear and guided it from pennies a share to a buyout valuation of nearly CDN $30 a share.

Great Bear Resources’ president and CEO Chris Taylor examines core at the US $1.4 billion Dixie gold project in Red Lake, Ontario. He is also Kodiak Copper’s founder and Chairman of the Board.

Continued Success via the Drill Bit

Great Bear Resources’ president and CEO Chris Taylor examines core at the US $1.4 billion Dixie gold project in Red Lake, Ontario. He is also Kodiak Copper’s founder and Chairman of the Board.

Continued Success via the Drill Bit

Let me briefly recap what has happened to date at MPD. In 2020, the company made what appears to be a world-class discovery at the Gate Zone of its MPD Project at the heart of a rich copper-gold belt in mining-friendly southern BC.

To date, this has been where most of the drilling has been focussed, thereby revealing that the Gate zone – alone – exhibits the size potential to host a large-tonnage mineral inventory.

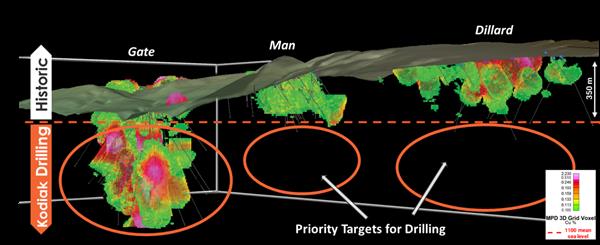

However, historic drilling and geological groundwork has shown that several other large targets offer comparable potential. They may yet reveal MPD to be a sprawling mineral asset with multiple high-grade porphyry centres. Keep in mind the fact that some of North America’s biggest and best porphyry deposits host over a billion tonnes of copper ore.

More specifically, drilling into the Gate Zone has revealed a central high-grade copper-gold zone within a significantly enriched, much wider mineralized envelope. Keep this in mind that most porphyries have high grade centres surrounded by a larger envelope of lower grades. It is the combination of these two dynamics that typically makes for a viable deposit.

All told, significant mineralization has been encountered over substantial widths and to depths of 850 metres and along a length of nearly one kilometre, as well as over widths of more than 350 metres.

Some of the best intercepts encountered so far consisted of 535 m of 0.49 % Cu and 0.29 g/t Au including 282 m of 0.70% Cu and 0.49 g/t Au, including 45.7 m of 1.41% Cu and 1.46 g/t Au.

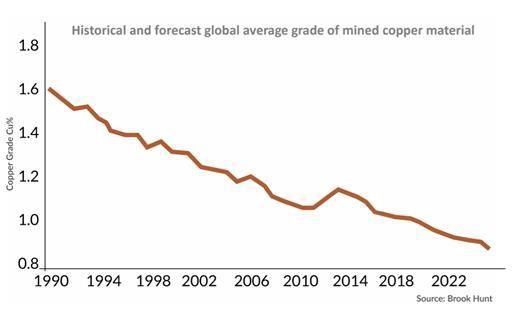

Take note that these grades compare very favourably with nearby Copper Mountain (currently mining with reserve grades at 0.24% Cu). This is similarly the case with Mount Milligan (at 0.23% Cu), Highland Valley (at 0.31% Cu), Mt. Polley (at 0.34% Cu), and Red Chris (at 0.36% Cu).

Collectively, these Canadian copper-gold mines average 0.35% Cu, while copper mines in the USA average a very comparable grade of 0.33% Cu. Yet, in spite of their relatively modest grades, some of BC’s copper mines rank as world-class operations due to their large tonnage and operational efficiencies.

Why Location Matters More than Ever

The MPD Project benefits from being situated in one of one the most well-established, and well-managed mining jurisdictions in the world. Canada also benefits from being one of the planet’s most politically stable nations. Notably, southern BC is where the industry has thrived for many decades and continues to play an important role in the regional and national economy.

It bears reiterating that it is home to one of North America’s most prolific copper belts, which is home to several big-league copper and gold mines, namely Highland Valley, Copper Mountain and New Afton.

This favourable mining environment also offers the risk-mitigating benefit of excellent infrastructure. This includes a network of highways and roads that offer easy access to the MPD Project area. Also, this very active mining camp provides the assurance of plenty of robust regional infrastructure, a skilled labour force, and mining-friendly communities. All of this bodes well for the economics of any new mine in the area.

Additionally, there are other key geopolitical factors at play that are making “home-grown” supplies of copper strategically critical to North America’s green energy needs.

For example, as North America embraces a transition to a carbon-neutral future, there has become a heightened imperative to secure stable, long-term supplies of key battery metals – none more so than copper. Hence, its spot price has more than doubled since 2016, heralding the arrival of a new copper super-cycle.

The heightened need for local supplies of copper to power North America’s green energy revolution has been exacerbated by increasing tensions with communist China. Again, this presages the need to bring new copper supplies on-stream that are domestically sourced.

Allocating a “Scarcity Value” Premium

Allocating a “Scarcity Value” Premium

The “scarcity value” of Kodiak’s domestic North American copper-gold discovery at MPD gives it a value-added premium that is not yet reflected in the company’s share price. It bears repeating that it is located at the heart of one of the continent’s most prolific copper belts.

In stark contrast, the world’s largest producer of copper, Latin America, is fast losing its allure. This is because the socialist governments in both Chile and Peru are talking about taking a much bigger share of the mining industry’s profits by way of imposing punitively high taxes and other penalties.

Plus, the situation is not likely to get better any time soon. This is because of the rise of resource nationalism. As nation states try to grapple with their treasuries being depleted after dealing with the COVID-19 pandemic, some are trying to get the mining industry to help make up the shortfall with the threat of corporate taxes being jacked up as high as 80%.

This promises to be a major deterrent to the development of new copper discoveries and the expansion of existing large-scale mines in this part of the world.

On another key note, the mammoth copper deposits in Chile and Peru are falling out of favour due to their huge carbon footprints, especially their over-reliance on increasingly scarce water supplies.

In contrast, the relatively smaller deposits in southern BC can run at a much smaller scale while relying on a bountiful supply of hydro power, thereby significantly limiting their environmental impact.

Moreover, comparatively high-grade deposits have become especially rare. In fact, only four world-class copper deposits – consisting of over one billion tonnes grading 1% copper or better – have been found since the turn of the new millennium.

By way of a little perspective, the pipeline of new copper projects is now the lowest in a century, according to Mining.com. Yet the paradox is that more copper will be required in the next 25 years than was consumed in the last 500 years, according to industry experts.

As an illustration of the monetary appeal of much-covered greenfield North American deposits, Australian miner Newcrest paid an eye-catching US $840 million in 2019 to acquire a 70% interest in the Red Chris copper/gold mine in northern BC.

More recently, Newmont Corporation acquired the small Canadian explorer GT Gold – a transaction that valued GT Gold at US $360 million. This follows GT’s development of the Saddle North deposit in northern BC, which hosts a copper-gold porphyry deposit in a well-established mining camp.

Investment Summary

The Gate Zone discovery alone is shaping up to be a large tonnage discovery with a large footprint and rich mineralization that runs deep (at least 850 metres). Other highly prospective targets at MPD – such as Dillard and Man -- may yet prove up considerably more mineralization.

A planned 25,000 metres of drilling this year should help to thoroughly probe these targets for more mineral riches. In a best-case scenario, Kodiak may therefore end up with the best of both worlds – a massive discovery in one of the world’s best mining jurisdictions.

Additionally, it cannot be overstated that companies are far more likely to succeed in politically stable mining jurisdictions where there is a reliable, well-established regulatory framework for extracting minerals – one that respects the environment, as well as the surrounding communities that are impacted by mining. Kodiak is ideally positioned in this regard.

From a miner’s perspective, the key to the appeal of MPD is the revelation of high-grade drill results over wide intercepts. This speaks to the prospect of a world-class discovery taking shape. This is why Teck Corp. decided to buy a 9.9% stake in Kodiak’s bright future at MPD. It is no coincidence that Teck owns the nearby Highland Valley mine and no doubt sees considerable potential in MPD to emulate the kind of success that this flagship asset has enjoyed.

On a technical note, the company maintains a tight share structure consisting of 49.6 million shares outstanding (53.6 million fully diluted). When matched with a steady flow of upbeat news, such a scenario typically acts as a powerful catalyst to higher share price valuations. Accordingly, Kodiak is well funded with $9 million in the treasury to finance its ambitious drilling activities this year. Investors should therefore not be surprised to see plenty of positive news updates in the coming months.

Hence, the stage appears set for Kodiak’s share price to enjoy a sustained upward trajectory in 2022 – and beyond.

ABOUT THE AUTHOR: Marc Davis has a deep background in the capital markets spanning 30 years, having mostly worked as an analyst and stock market commentator. He is also a longstanding financial journalist. Over the years, his articles have appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, The Times (UK), Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post, AOL, City A.M. (London), Bloomberg, WallStreetOnline.de (Germany) and the Independent (UK). He has also appeared in business interviews on the BBC, CBC, and SKY TV. An enthusiastic shareholder of Kodiak Copper, his opinions are therefore biased and should not be relied upon for making investment decisions.

FULL DISCLOSURE: Kodiak Copper Corp. is a client of Stockhouse Publishing.