The Stockhouse audience has already been introduced to junior Canadian copper (and cobalt) exploration company, Midnight Sun Mining Corp. (TSX: V.MMA, OTCQB: MDNGF, Forum). In a full-length feature article from January 17, 2018, investors learned the following:

The Stockhouse audience has already been introduced to junior Canadian copper (and cobalt) exploration company, Midnight Sun Mining Corp. (TSX: V.MMA, OTCQB: MDNGF, Forum). In a full-length feature article from January 17, 2018, investors learned the following:

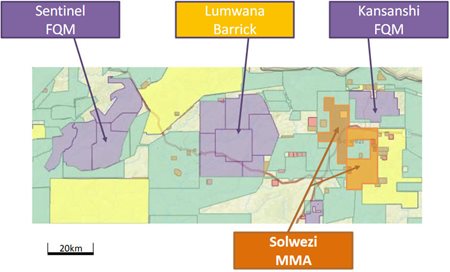

a) MMA is holding a huge land package (two licenses comprising 506 square kilometers);

b) These Solwezi licenses are located in one of the world's premier copper mining jurisdictions – Zambia;

c) Midnight Sun's holdings are sandwiched in the middle of the copper mining operations of several of the world's largest mining companies;

d) There are already some very exciting high-grade copper intercepts that have been recorded here;

e) Much of this copper mineralization includes robust readings of cobalt, which would significantly improve the economics of any potential mining operation.

(click to enlarge)

Investors wanting to hear more about the potential for cobalt credits in these two, huge licenses can tune-in to a Stockhouse podcast with the Company's President and CEO, Brett Richards from February 20, 2018. Now Midnight Sun is sending in the drills for further exploration of these highly prospective copper licenses. MMA will be looking to build upon previous drilling results that include (true widths):

-- 11.6 meters 0f 3.44% Cu, 4.23% Cu equivalent (Mitu)

-- 8.0 meters of 1.22% Cu and 14.0 meters of 1.02% copper (Mitu)

-- 21.0 meters of 3.26% Cu (22 Zone)

-- 11.3 meters of 5.71% Cu (22 Zone)

-- 6.4 meters of 5.08% Cu (22 Zone)

-- 4.5 meters of 6.27% Cu (22 Zone)

Stockhouse was fortunate to be able to connect again with CEO Richards. We asked him to provide more details on MMA's 2018 copper exploration program on its Solwezi licenses as well updating investors on general operations.

For investors who haven't had a chance to read the full-length feature on Midnight Sun, please discuss your ownership status on the Solwezi licenses.

We are currently finalizing the sale and purchase agreement with our partner Kam Chuen. It has taken longer than expected, given the various jurisdictions (China, Canada, Zambia), and the translation involved – in addition to explaining the concept which otherwise gets lost in translation. So in the end, we will have rights to own the full 100% of the Zambian High Light Mining Investment Limited entity (we own 60% currently), and the purchase agreement will dictate the final terms of our acquisition of the remaining 40%. Our partner in Kam Chuen has been very cooperative in structuring this agreement so that we are never stressed by the payments we need to make over the next 4 years, and we have been given generously wide parameters to make the payments. When we sign the purchase agreement, we will update the market accordingly.

Please outline MMA's 2018 drilling program.

We intend to drill up to 20,000m of diamond drilling in the 2018 – subject to results, and subject to the market seeing the value. We have our first diamond drill on site, and I was on site this week (w/o May 19, 2018) and watched it churning away. We have a second rig mobilized, but we are waiting to deploy it after we get the results in from the Versatile Time domain Electro Magnetic survey (“VTEM”) – so as we have good correlated drill targets with respect to all of the geo-chemical data, ground geophysics and drill data performed to date. As well, we are re-soiling (geochemical soil analysis) the entire 17km strike of Mitu so as we can demonstrate the size and scale of the first target on our licences (with 5 other equally as prospective other targets). So in addition to the one diamond rig, we have an air core rig tracking the strike at Mitu as well.

Investors can see the big numbers that have already been produced in past drilling on Mitu and 22 Zone. Why is management also planning on some drilling in the Dumbwa Zones of this land package?

It is quite simple – we have 6 targets on our two licences, that have the potential of being exceptional deposits in their own right, and combined could form the basis of a large mining complex / region, under the control of one company – I see that as a potential world-class Copper and Cobalt discovery. Dumbwa was re-soiled (geochemical soil analysis) last year, with a 14 km strike identified with what appears to be a lateral sedimentary deposit, which is assaying at higher grades at surface than 80% of the worlds copper mines are mining today. A colleague of Midnight Sun who has worked in the Zambian Copperbelt for over 20 years called it: “the best soil anomalies I have ever seen in the copperbelt in Zambia - ever”. So that is why we are excited about Dumbwa (Central and North), and it is why (after the VTEM survey), we may well run some holes across the structure.

For investors who are especially interested in the cobalt credits on these licenses, where has cobalt mineralization already been encountered?

We are seeing cobalt mineralization being picked up in the carbonaceous shales specifically at Mitu, and we fully expect to pick it up at Kafubwe and Khaziba; however we have not seen cobalt mineralization at 22 Zone and Dumbwa, as they are completely different geological formations.

How many drill rigs are currently active on your properties?

We have a diamond rig and an air core rig, and we expect to put a second diamond rig to work after the VTEM survey results in late June / early July. It is too early to speculate how we could ramp up from there.

When is drilling expected to be completed and when is your best estimate on when investors will begin to see assay results from this drilling?

Our drilling program (caveated with good results and a market that continues to fund the great potential of the story) will not stop until we have completed a feasibility study. That may be a tongue in cheek response, but the reality is that we have now started and I don’t want to stop for the next three years – as we prove up targets; infill targets; define a resource; develop a resource and expand the resource. This project really has the ability to do 200,000 – 300,000m of drilling over the next three years (at 12124-HQ-LEL) and over the next 6 years at (21509-HQ-LEL). We are not trolling for feedstock – we are hunting for elephants !!

The market can expect first results in July 2018 of our drilling program, and from our VTEM survey.

As was mentioned previously, the Company has some very large neighbours. Please mention a few of the mining companies who might be watching your drilling results with keen interest.

I guess most of the majors will be interested to see the size and scale of what may be defined through our program in 2018. There are many major copper producers in Zambia with First Quantum’s Kansanshi Mining Complex c.10 km away from our targets, and it is the largest copper mining and smelting complex in Africa. However, there are others in the region: Vedanta, ZCCM, Glencore and Barrick (Lumwana), with Rio Tinto / MMG and First Quantum’s project / licences contacting ours up in Solwezi.

Investors will be very interested in these upcoming drill results too, but they will also be looking farther down the road. Which of these highly prospective Zones on the Solwezi licenses will be targeted for your maiden resource estimate?

We are focused on the most advanced target, and that is Mitu. We will be doing other work later in the year on other targets – but Mitu will be our focus for creating and adding value as we move forward.

Can you put any timetable on when this resource estimate will be compiled, or is that still a little further down the road?

I would love to have something cobbled together for Q1 2019, but this is not an exact science; these ore bodies are complicated; and it takes extreme brain power to make the most of the drilling / other programs you undertake in order to maximise drilling value per meter. I am not hung up on getting to an initial maiden resource on one of our targets, I am intent on demonstrating how big the entire land package / target may well deliver as a standalone mining complex itself one day – and that is what is substantiating our patient / methodical and professional approach to the programs. We need to act, perform and execute as if we were a major mining company, and with that longer term / higher value view, we will maximize the potential of Midnight Sun. We are not a “pump and dump” TSXV junior specialist – we have something very real here.

For investors looking for a big-picture summary of this Project, please sum up Midnight Sun Mining in a paragraph or two.

I think I have illustrated the story pretty well above, but I will say this: “We have spent countless hours debating how best to maximize the value for Midnight Sun shareholders, and coming from a large mining background, this has all of the signs of something unique and probably larger than Midnight Sun is capable of fully exploring. We are as patient as we are anxious, but we are doing things right – with the right people. I am the second largest shareholder in this company, and have not drawn any cash in the form of a paycheque since I joined a year ago, and in fact have invested an additional $750,000 in a story I truly believe will develop into something very special and very substantial. The “Sun” has just arisen, and Midnight Sun is not going to be setting any time soon. Watch this space very carefully!!”

Brett A. Richards, CET, MBA

Chief Executive Officer

Midnight Sun Mining Corp.

www.midnightsunmining.com

FULL DISCLOSURE: Midnight Sun Mining Corp is a paid client of Stockhouse Publishing.