92 Resources Corp (TSX: V.NTY, OTCQB: RGDCF, Forum) is a Canadian junior lithium exploration company with a portfolio of six properties and a current market cap of approximately $4.5 million. Previously, NTY’s Hidden Lake Property (Northwest Territories) was the Company’s flagship asset. Acquired with Hidden Lake was the Corvette Lithium Property, located in northern Quebec.

92 Resources Corp (TSX: V.NTY, OTCQB: RGDCF, Forum) is a Canadian junior lithium exploration company with a portfolio of six properties and a current market cap of approximately $4.5 million. Previously, NTY’s Hidden Lake Property (Northwest Territories) was the Company’s flagship asset. Acquired with Hidden Lake was the Corvette Lithium Property, located in northern Quebec.

The Corvette Property was regarded as “a complimentary asset” to Hidden Lake. However, all of this has changed with a recently announced JV with Osisko Mining Inc. (TSX: OSK). On September 4, 2018; NTY reported an agreement with OSK to acquire up to a 75% interest in that company’s FCI Property, comprised of 28 claims in the James Bay Region of Quebec.

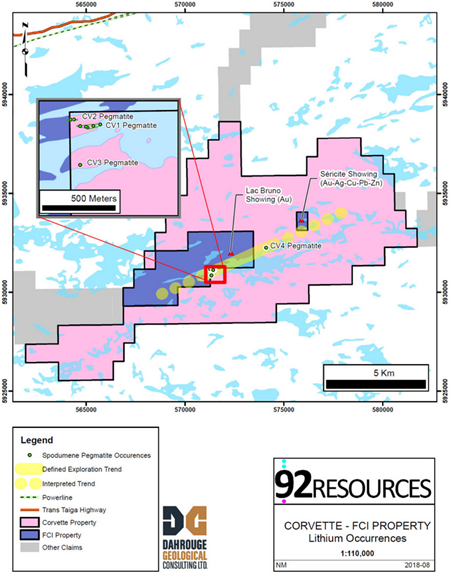

The significance of this is that the FCI Property adjoins NTY’s Corvette Property, where the Company holds a 100% interest. In past exploration, 92 Resources has already identified 3 kilometers of strike length at Corvette. The combined FCI/Corvette land package potentially quintuples this strike length, up to 15 kilometers.

The new Corvette-FCI Property now encompasses the entire spodumene-bearing pegmatite trend, a total land package of 5,325 hectares, comprised of 104 mining claims. Of equal interest to investors, this lithium project is within 10 kilometers of important infrastructure – both power and highway access.

Fleshing out the potential still further here is even more recent news. On September 11, 2018; NTY announced new channel sampling by 92 Resources on the Corvette property. Highlights include 2.28% Li2O over 6 meters and 1.54% Li2O over 8 meters.

As a bonus, previous field exploration work has already identified a “gold showing”, with one boulder assaying at 38.1 g/t Au. An additional grab sample has identified both silver and base metals mineralization. Stockhouse recently asked NTY’s President and CEO, Adrian Lamoureux, to frame this news for investors.

V.NTY

V.NTY

(click to enlarge)

1) Please introduce 92 Resources Corp to new investors.

We are a a modern energy solution company, focused on acquiring and advancing strategic and prospective modern energy related projects. NTY takes great pride in identifying potential projects and moving them forward -with an abundance of success to date. We strive to unlock optimal shareholder value through our initiatives.

2) NTY’s Hidden Lake Property was the Company’s previous operational focus. What was the principal motivation in reaching out to Osisko to consolidate the Corvette/FCI land package?

The initial success we had with Hidden Lake provided us an opportunity to monetize it and put focus to our Quebec assets, Corvette in particular. Also, keeping in mind that Quebec is one of the most mining friendly and geo-politically stable jurisdictions in the world, cost-effective to explore and offering very attractive financial, and tax credit incentives. Us reaching out to Osisko had everything to do with the Geology and overall strike trend. Previously, in 2017 we sent a geological team to do some initial ground reconnaissance work; this small program yielded very encouraging results. More importantly, it led to a vision of sizable concept, so we made it priority number one to acquire additional and adjacent ground, held by Osisko.

3) Please outline the terms of the joint venture with OSK.

NTY can acquire up to a 75-per-cent interest in 28 claims directly adjoining the company's 100-per-cent-owned Corvette property. Consideration is two million common shares and $2.25-million in work expenditures over three years to earn a 50-per-cent interest. A further 25-per-cent interest may be earned by forming a joint venture corporation and financing an additional $2-million in exploration expenditures.

4) The earn-in agreement is somewhat different in terms of the clause on the project Operator. Please explain this part of the deal to investors.

This is because of an underlying agreement that Osisko has for the FCI portion of project that preceded our agreement. A steering committee will be formed between our two companies, in which NTY will have the casting vote.

5) While the agreement stipulates a maximum earn-in of 75%, this can be increased still further under certain circumstances. What would allow 92 Resources to increase its ownership in the project beyond 75%?

Osisko's remaining 25-per-cent interest may be further reduced through dilution if it elects to not finance its portion of subsequent exploration/development. If their ownership falls below 10 per cent, Osisko will have the right to convert this remaining interest into a 1-per-cent net smelter royalty (NSR), of which the company retains the right to buy for $5-million cash, and thereby would obtain a 100-per-cent undivided interest in the FCI property.

6) Please summarize exploration workfrom your 2017 and 2018 field exploration programs.

We have completed fieldwork during the last two summer seasons.

2017’s short program consisted of targeted prospecting and sampling, which outlined two spodumene pegmatites both in close proximity, and confirmed significant grades of lithium were present.

2018 was a program much greater in scope with focus on channel sampling. The two pegmatites demonstrated strong grades of lithium, of 40 individual channels from the CV1 pegmatite having averaged 1.35 per cent Li2O over its entire cut length, and individual samples yielded greater than 2 per cent Li2O. The CV2 pegmatite returned its strongest mineralization to date. Collectively, this is a strong indication of continuity of mineralization over the known strike length of the pegmatite. In addition to the strong grades of lithium, unexpectedly, high grades of tantalum were also returned from both the CV1 and CV2 pegmatites.

7) What are NTY’s near-term plans for development of Corvette-FCI?

Recent work has uncovered a discovery of four additional spodumene pegmatites -we need to conduct more surface work and sampling here. Permitting is also well under way for a maiden drill program.

8) Does the Company have a tentative timetable to begin drilling on this project?

Yes, sooner the better. We are taking all the steps necessary to make this happen as soon as possible. Ideally this would happen before the snow hits, but if this is not possible we will look at the options of winter drilling.

9) Is NTY planning on continuing exploration work at Hidden Lake as well, or is the entire focus on Corvette-FCI at the present time?

We won’t be putting further resources into Hidden Lake, as this project is currently under option. NTY has a significant interest in Hidden Lake, we hope for its continued success.

Our current focus moving forward will be Corvette-FCI. Additionally, we will also put further emphasis to our other projects.

10) Over the long term, please outline your vision of 92 Resources Corp for investors.

NTY will always have our shareholders interest at heart, and look to increase shareholder value. We feel the best way to move the company forward is through identifying projects of opportunity and advancing them as rapidly as possible. We have monetized one and believe we have something special with Corvette. In addition to project development, we will work hard to expose our company to the investment community, putting NTY solidly on the map.

92resources.com

FULL DISCLOSURE: 92 Resources Corp is a paid client of Stockhouse Publishing.