Few others in the mining investment space have the experience, know-how and clout of Eric Sprott. The billionaire global investment guru is, pardon the pun, the ‘gold standard’ when it comes to picking winners in the metals & mining sector. And he obviously likes what he sees in an intriguing Argentine and Chilean silver and gold explorer – to the tune of nearly $13 million worth or 16% of the Company.

AbraPlata Resource Corp. (ABRA) (

TSX-V.ABRA,

OTCMKTS: ABBRF,

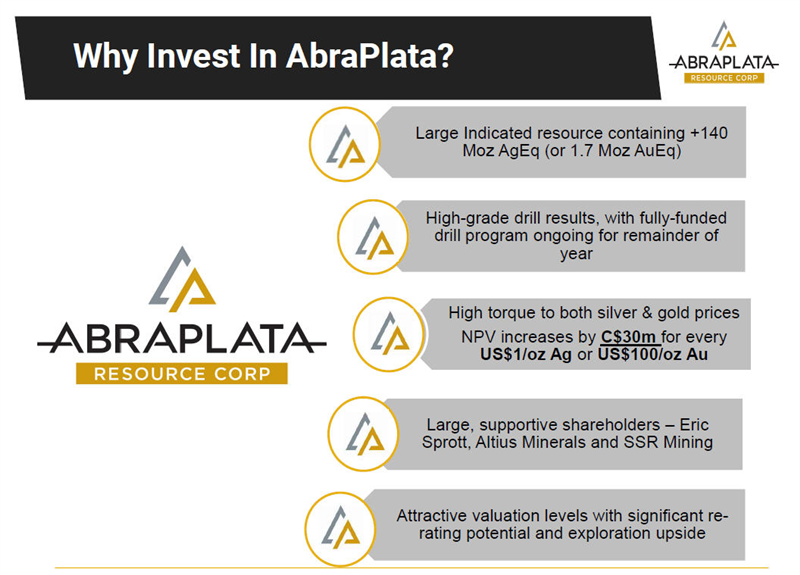

Forum) is a Toronto-based, multi-asset mineral exploration company that is offering investors exposure to silver, gold, and copper through projects at various stages of exploration…from drill-ready to the PEA stage. The Company provides excellent leverage to silver and gold through its 100% interest in the Diablillos project, which has an M&I resource base of over 140 million ounces of silver-equivalent, in the mining-friendly Salta province in Argentina. Its other key projects include the Arcas Copper / Gold Project in Chile, which is partnered with Rio Tinto, and the La Coipita Project located in one of the world’s most endowed copper-gold belts in Argentina.

Recently, Stockhouse Editorial sat down with Company President and CEO, John Miniotis – an industry veteran with over 15 years of experience in the mining industry focused primarily on mergers & acquisitions, equity capital markets, investor relations and corporate finance – to talk about their bevy of projects in some of South America’s most historically-productive and prolific mining regions.

SH: To start off, John, can you update our investor audience and your AbraPlata shareholders on any new company developments, especially in the wake of the COVID-19 pandemic?

JM: This has certainly been a transformational year for AbraPlata. Over the course of the summer, we raised a total of $25 million and as a result we’re now fully-funded to aggressively advance the Diablillos project forward. At site, we’ve significantly expanded and accelerated our exploration program, from 3,000 metres to 13,000 metres, as our initial results have yielded some very high-grade intercepts of silver, gold and copper.

Overall the Company is now very well positioned, with a strong balance sheet, a proven management team, and a large silver-gold resource base with exciting upside potential.

SH: For Stockhouse metals & mining investors that may be learning about AbraPlata for the first time, can tell us a bit about the history of the Company and its South American-first project focus?

JM: AbraPlata was formed in 2016 when it acquired the Diablillos project from Silver Standard Resources, which is now SSR Mining. In December 2019, AbraPlata merged with Aethon Minerals which is when my team and I joined, as we saw tremendous upside potential in this undervalued asset.

The Diablilllos project is an advanced-stage exploration project, with over US$40 million spent on exploration throughout the years, resulting in over 90,000 metres of drilling on the property. In 2018, a Preliminary Economic Assessment (PEA) was completed, which showed very high rates of return for the project, and at current silver and gold prices we believe the project has an NPV5% of over C$700 million, and an after-tax rate of return of over 50%.

Our current exploration program is focused on expanding the resource base further, so we believe the project has significantly more upside potential to be unlocked!

SH: The Company just announced some amazing results from three diamond drill holes at your Diablillos Project in Salta Province Argentina, including a 10.20 g/t Au Eq over 2 metres. That’s big news! Can you update our investor audience on the project and the most recent drill and assay results?

JM: Overall, we’re continuing to consistently intersect very high gold and silver grades which are outside of the current resource base, and so have the potential to expand our large existing oxide resource base. In addition, we’ve recently commenced drilling with a second rig on site, which will enable us to also test for the continuity of underlying copper-gold sulphide mineralisation which may be linked to a porphyry intrusive that would have been the source of mineralising fluids. Importantly, the sulphide mineralization has never been targeted in the past, so this represents a new significant exploration target for the project.

As we look forward, we expect to have a consistent stream of news flow providing investors with updates on our drilling campaign every few weeks.

SH: According to your investor deck, “the Diablillos project has a very large existing Indicated Resource base of 81 million ounces of silver and 732,000 ounces of gold.” What kind of value indicators should investors be looking for in a project of this kind of this scope and scale?

JM: The 2018 PEA study, envisioned an open pit project with average annual production of approximately 10Moz silver-equivalent. Following the completion of our current exploration program, we plan on releasing an updated resource estimate early next year, followed by an updated PEA study by mid-2021.

We believe the scope, scale and upside potential of Diablillos makes it a very appealing project which offers excellent upside leverage to both silver and gold prices.

SH: AbraPlata Resources Corp. boasts three key projects which have proven mineralization and offer exciting potential. Can you walk us through the highlights of the projects and some of the main target zones?

JM: While our focus remains on advancing and unlocking additional value from Diablillos, we also have two other projects which we believe offer great upside potential.

In Chile, we have partnered with Rio Tinto on our Arcas project. The agreement allows Rio Tinto to acquire up to a 75% stake in Arcas, by incurring up to US$25 million in exploration expenditures. The project totals over 51,000 hectares in the Antofagasta Region, which hosts a number of the largest coppery porphyry deposits in the world.

In addition, we have an option to acquire a 100%-stake in the La Coipita copper-gold project in San Juan, Argentina. La Coipita is also comprised of over 51,000 hectares in the prolific Miocene porphyry-epithermal belt, and historical drilling on the property has intersected over 40m grading 1.08% Cu and 0.35 g/t Au. The Company’s goal is to attract a major partner to help advance the La Coipita project.

SH: It would be remiss of us not to follow up on the introduction to the article and the investment made by Eric Sprott into the Company. That’s quite the financial commitment and endorsement…

JM: Yes, we are extremely pleased to have welcomed Mr. Sprott as the largest shareholder in AbraPlata. His investment is a strong endorsement of our substantial silver-gold resource base and allowed AbraPlata to raise sufficient capital to aggressively pursue our exploration plans at Diablillos.

SH: Clearly investors have taken note of AbraPlata. You’ve seen a more than 700% increase in shareholder value since mid-March and a steadily increasing market cap. Now, institutional and retail investors are really getting on board. How so?

JM: The share price appreciation is a clear reflection of our excellent leverage to gold and silver prices. Despite the nice gain in our share price to date, the Company is still only trading at a fraction of the net present value (NPV) of our project, so we believe that tremendous upside potential still exists.

At the moment, we feel that we are most likely only in the second inning of a major bull market in precious metals, and so we’re extremely excited for what’s yet to come.

(365 day TSX-V: ABRA stock chart Oct. 2019 – Oct. 2020. Click image to link to chart)

SH: SH: Can you talk a little bit about your corporate management team, along with the experience and innovative ideas they bring to the mining sector?

JM: We are very fortunate to have a proven management team and Board at AbraPlata with a wealth of corporate finance and exploration backgrounds. Our team has quite an extensive track record of adding value through exploration and corporate development across many different companies.

SH: And finally, John, if there’s anything else that I’ve overlooked and you’d like to add, please feel free to elaborate.

JM: We are very excited to continue to advance AbraPlata forward. We believe silver and gold are both poised to do very well over the next several years, and AbraPlata shareholders could stand to benefit tremendously as we execute on our plan and look to unlock additional value.

(365 day TSX-V: ABRA stock chart Oct. 2019 – Oct. 2020. Click image to link to chart)

SH: SH: Can you talk a little bit about your corporate management team, along with the experience and innovative ideas they bring to the mining sector?

JM: We are very fortunate to have a proven management team and Board at AbraPlata with a wealth of corporate finance and exploration backgrounds. Our team has quite an extensive track record of adding value through exploration and corporate development across many different companies.

SH: And finally, John, if there’s anything else that I’ve overlooked and you’d like to add, please feel free to elaborate.

JM: We are very excited to continue to advance AbraPlata forward. We believe silver and gold are both poised to do very well over the next several years, and AbraPlata shareholders could stand to benefit tremendously as we execute on our plan and look to unlock additional value.

(Click image to enlarge)

(Click image to enlarge)

For more information, visit

www.abraplata.com

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.