Back in June

Back in June, we introduced our Stockhouse investor audience to an emerging FinTech giant and took a deep dive into how this Canadian company is on the forefront of developing artificial intelligence (AI) that transforms data into knowledge.

Toronto ON-based

AnalytixInsight Inc. (ALY) (

TSX-V.ALY,

OTC:ATIXF,

Forum) is an advanced FinTech and AI company that “transforms big data into actionable insights.” The Company’s online portal,

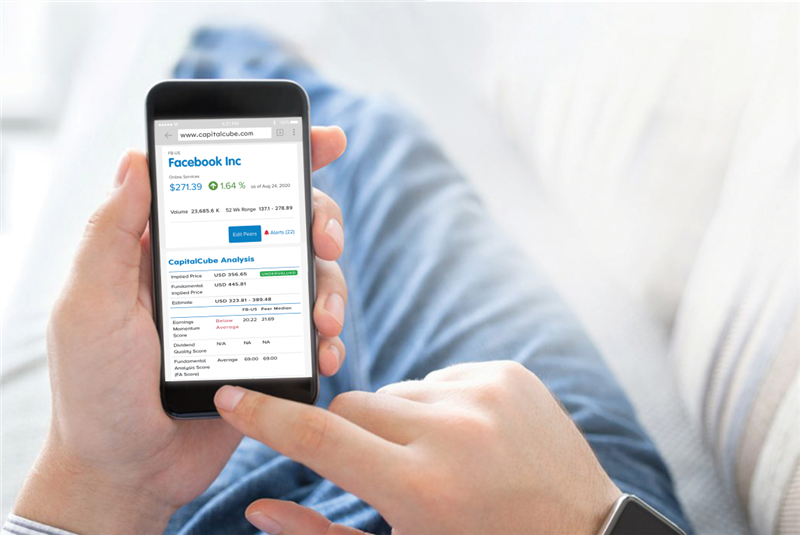

CapitalCube.com, algorithmically and instantaneously analyzes market price data and regulatory filings to create narratives and reports for global stocks and Exchange Traded Funds (ETFs) for investors, finance portals, and media outlets. ALY also holds a 49% interest in MarketWall, a FinTech digital solutions provider for major financial services firms, in partnership with Italian mobile banking giant, Intesa Sanpaolo.

Stockhouse Editorial recently touched base with Company CEO & Chairman of the Board, Prakash Hariharan, to discuss a variety of topics about the Company’s suite of cutting-edge products, what investors can expect from ALY moving forward, and his overall ‘insight’ into AnalytixInsight.

SH: Mr. Hariharan, can we start off with a little background history about yourself and the history of AnalytixInsight?

PH: Prior to AnalytixInsight, I was a portfolio manager at Front Street Capital specializing in technology and growth-related investments. I saw a shift coming in the industry towards do-it-yourself investing & research, and the opportunity that AI and financial analytics might have on the industry. I came to know of AnalytixInsight who had built an AI & Machine Learning platform that was performing analysis on the financial fundamentals of worldwide stocks, and I joined the team in this effort.

SH: AnalytixInsight created CapitalCube to provide investors a fundamental financial analysis tool that makes researching global companies fast and easy – as opposed to digging into SEDAR filings. Can you give us some more details on what makes CapitalCube unique?

PH: We provide machine-created financial content on mostly all global stocks and North American ETFs. CapitalCube transforms raw financial data into simple narrative reports that are valuable for both novice and experienced investors. We compare a company to its industry peers to measure its strengths and weaknesses, which is an investment thesis that I used as a portfolio manager. If you can find the strongest company within a basket of companies, then that creates the formula for a winning trade.

SH: CapitalCube focuses more heavily on financial fundamentals for analyzing and evaluating stocks as opposed to technical analysis. Why does the Company feel this is important?

SH: Mr. Hariharan, can we start off with a little background history about yourself and the history of AnalytixInsight?

PH: Prior to AnalytixInsight, I was a portfolio manager at Front Street Capital specializing in technology and growth-related investments. I saw a shift coming in the industry towards do-it-yourself investing & research, and the opportunity that AI and financial analytics might have on the industry. I came to know of AnalytixInsight who had built an AI & Machine Learning platform that was performing analysis on the financial fundamentals of worldwide stocks, and I joined the team in this effort.

SH: AnalytixInsight created CapitalCube to provide investors a fundamental financial analysis tool that makes researching global companies fast and easy – as opposed to digging into SEDAR filings. Can you give us some more details on what makes CapitalCube unique?

PH: We provide machine-created financial content on mostly all global stocks and North American ETFs. CapitalCube transforms raw financial data into simple narrative reports that are valuable for both novice and experienced investors. We compare a company to its industry peers to measure its strengths and weaknesses, which is an investment thesis that I used as a portfolio manager. If you can find the strongest company within a basket of companies, then that creates the formula for a winning trade.

SH: CapitalCube focuses more heavily on financial fundamentals for analyzing and evaluating stocks as opposed to technical analysis. Why does the Company feel this is important?

PH: We believe in the value of strong financial fundamentals when analyzing a business. Many investors don’t have the time or the skill to evaluate the strength of a company by diving into their financial filings on SEDAR, so we do it for them – at scale and with a level of additional intelligence as to provide true insights for investors. There are many stock chart & technical analysis tools - but that represents only one piece of the investment puzzle. Successful investing also requires a knowledge of how the business is performing, not just the stock.

SH: Can you tell us a bit about your partnership with financial market data and infrastructure provider Refinitiv, and how it has validated the desire for fundamental research on global companies?

PH: Refinitiv is a world-leading data provider for the financial markets and we are proud to be one of their content partners. We are distributing our CapitalCube reports on their trading terminals that are used by 40,000 institutions worldwide. Currently we are publishing reports on approximately 3,000 companies and growing. When you think about that number, it would require many analysts to achieve the same goal. We automate this process with machine-created content, and we have the scale capacity to do it for 50,000 publicly traded companies worldwide.

SH: And how has this relationship with Refinitiv evolved?

PH: It started with awareness by Refinitiv of the computational capabilities of our platform and our ability to take raw data and turn it into meaningful insights. Refinitiv has an increasing thirst for financial content and our ability to provide some level of research, especially in the small to mid cap market, was of particular interest.

We started with providing only our Pre-Revenue Analysis reports and we have since added Dividend and Earnings Analysis reports for companies around the world.

PH: We believe in the value of strong financial fundamentals when analyzing a business. Many investors don’t have the time or the skill to evaluate the strength of a company by diving into their financial filings on SEDAR, so we do it for them – at scale and with a level of additional intelligence as to provide true insights for investors. There are many stock chart & technical analysis tools - but that represents only one piece of the investment puzzle. Successful investing also requires a knowledge of how the business is performing, not just the stock.

SH: Can you tell us a bit about your partnership with financial market data and infrastructure provider Refinitiv, and how it has validated the desire for fundamental research on global companies?

PH: Refinitiv is a world-leading data provider for the financial markets and we are proud to be one of their content partners. We are distributing our CapitalCube reports on their trading terminals that are used by 40,000 institutions worldwide. Currently we are publishing reports on approximately 3,000 companies and growing. When you think about that number, it would require many analysts to achieve the same goal. We automate this process with machine-created content, and we have the scale capacity to do it for 50,000 publicly traded companies worldwide.

SH: And how has this relationship with Refinitiv evolved?

PH: It started with awareness by Refinitiv of the computational capabilities of our platform and our ability to take raw data and turn it into meaningful insights. Refinitiv has an increasing thirst for financial content and our ability to provide some level of research, especially in the small to mid cap market, was of particular interest.

We started with providing only our Pre-Revenue Analysis reports and we have since added Dividend and Earnings Analysis reports for companies around the world.

SH: Can you now tell us about your JV initiative, MarketWall?

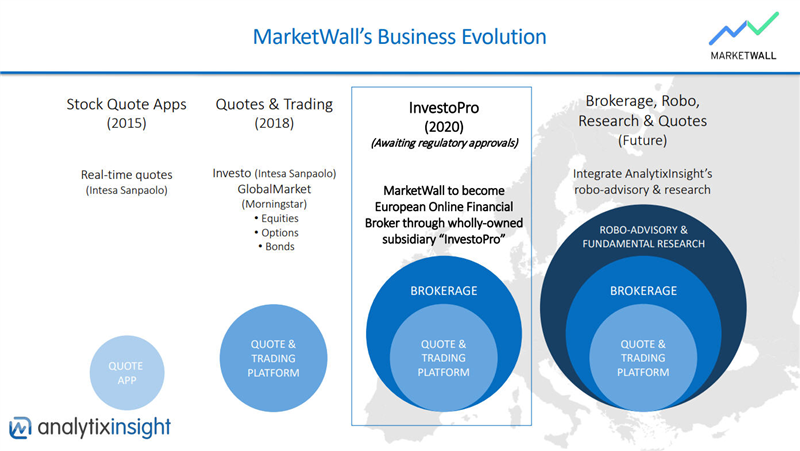

PH: Yes, this is an initiative that has become strategically important for our company. It is a JV with Intesa Sanpaolo, a leading European bank that is aggressive in digitization. It started as a FinTech initiative which has since evolved into a stock trading platform and is now becoming an online brokerage. We own 49% of MarketWall and the bank owns 33%.

SH: Online brokerages have become big news recently! How is your initiative progressing?

PH: Yes, very much so. We began this initiative a little over a year ago and have worked extensively to build a cutting-edge online trading platform that would meet the scale criteria of a world-leading bank. We have recently branded the initiative as “InvestoPro” and appointed a seven-member board of directors which includes three representatives by Intesa Sanpaolo.

InvestoPro will be an online stock, options & derivatives trading platform that will also provide research content and financial education. InvestoPro will be available for multi-device use (e.g., mobile, wearables, smart-TV) and will offer discounted stock trading commissions to give individual investors greater control over their investments and trading. We are awaiting final regulatory approvals for InvestoPro.

SH: Will North American users be able to use MarketWall’s InvestoPro and if so, how will they buy and sell stocks?

PH: InvestoPro will be offered initially in Italy with intentions to expand to other European countries, using Intesa Sanpaolo as its execution broker. We are exploring strategies for a North American version which would then allow North American investors to use the trading and education platform.

SH: What sets the Company apart from other FinTech companies in this space and what makes your business model attractive to investors?

PH: MarketWall has a strategic partnership with a world-leading bank, it has already built and successfully deployed stock trading applications for leading financial institutions and has turned profitable.

SH: Prakash, is there a plan to integrate CapitalCube and MarketWall?

SH: Can you now tell us about your JV initiative, MarketWall?

PH: Yes, this is an initiative that has become strategically important for our company. It is a JV with Intesa Sanpaolo, a leading European bank that is aggressive in digitization. It started as a FinTech initiative which has since evolved into a stock trading platform and is now becoming an online brokerage. We own 49% of MarketWall and the bank owns 33%.

SH: Online brokerages have become big news recently! How is your initiative progressing?

PH: Yes, very much so. We began this initiative a little over a year ago and have worked extensively to build a cutting-edge online trading platform that would meet the scale criteria of a world-leading bank. We have recently branded the initiative as “InvestoPro” and appointed a seven-member board of directors which includes three representatives by Intesa Sanpaolo.

InvestoPro will be an online stock, options & derivatives trading platform that will also provide research content and financial education. InvestoPro will be available for multi-device use (e.g., mobile, wearables, smart-TV) and will offer discounted stock trading commissions to give individual investors greater control over their investments and trading. We are awaiting final regulatory approvals for InvestoPro.

SH: Will North American users be able to use MarketWall’s InvestoPro and if so, how will they buy and sell stocks?

PH: InvestoPro will be offered initially in Italy with intentions to expand to other European countries, using Intesa Sanpaolo as its execution broker. We are exploring strategies for a North American version which would then allow North American investors to use the trading and education platform.

SH: What sets the Company apart from other FinTech companies in this space and what makes your business model attractive to investors?

PH: MarketWall has a strategic partnership with a world-leading bank, it has already built and successfully deployed stock trading applications for leading financial institutions and has turned profitable.

SH: Prakash, is there a plan to integrate CapitalCube and MarketWall?

(Click image to enlarge)

PH: CapitalCube is our AI and Machine Learning platform that provides financial analytics, whereas MarketWall is focused on trade execution and content delivery. So, there is an obvious intersection point between the two initiatives which is in our strategic plans. Our vision is for do-it-yourself investors to be able to research stocks, gain financial education and trade stocks with ease – all from one platform. Moreover, CapitalCube has developed a robo-advisor that will further enable our vision of the future of investing.

SH: You are a tech company with a relatively low market capitalization, yet you have partnerships with major industry giants. What can ALY shareholders expect in the near future?

PH: Yes, each of our company’s major strategic initiatives are supported by a major industry partner and we have been very focused on building shareholder value within our initiatives. It’s rare to find a micro-cap company with strategic industry partners, which in this discussion includes Refinitiv, Intesa Sanpaolo, and Samsung Europe.

As MarketWall launches its European online broker, we will be able to better demonstrate to our shareholders the proper valuation of this important initiative. MarketWall is currently a private company and we are considering spinout alternatives such as an IPO, which would demonstrate the proper valuation of our 49%-holding of this asset. We feel this will help reflect the appropriate value of our collective initiatives to our ALY shareholders.

SH: And lastly, Prakash, if there’s anything else that we’ve overlooked and you’d like to add to the article, please feel free to elaborate.

PH: Sure, while our ALY shareholders have been anxiously awaiting completion of the brokerage in Europe, MarketWall has been busy engaging its future users and now has over 3 million user impressions per month across its digital channels. This is further amplified by our Samsung relationship where the MarketWall apps are pre-loaded on certain Samsung devices. These initiatives are very important customer engagement points as we prepare to roll out our online broker in Europe.

(Click image to enlarge)

PH: CapitalCube is our AI and Machine Learning platform that provides financial analytics, whereas MarketWall is focused on trade execution and content delivery. So, there is an obvious intersection point between the two initiatives which is in our strategic plans. Our vision is for do-it-yourself investors to be able to research stocks, gain financial education and trade stocks with ease – all from one platform. Moreover, CapitalCube has developed a robo-advisor that will further enable our vision of the future of investing.

SH: You are a tech company with a relatively low market capitalization, yet you have partnerships with major industry giants. What can ALY shareholders expect in the near future?

PH: Yes, each of our company’s major strategic initiatives are supported by a major industry partner and we have been very focused on building shareholder value within our initiatives. It’s rare to find a micro-cap company with strategic industry partners, which in this discussion includes Refinitiv, Intesa Sanpaolo, and Samsung Europe.

As MarketWall launches its European online broker, we will be able to better demonstrate to our shareholders the proper valuation of this important initiative. MarketWall is currently a private company and we are considering spinout alternatives such as an IPO, which would demonstrate the proper valuation of our 49%-holding of this asset. We feel this will help reflect the appropriate value of our collective initiatives to our ALY shareholders.

SH: And lastly, Prakash, if there’s anything else that we’ve overlooked and you’d like to add to the article, please feel free to elaborate.

PH: Sure, while our ALY shareholders have been anxiously awaiting completion of the brokerage in Europe, MarketWall has been busy engaging its future users and now has over 3 million user impressions per month across its digital channels. This is further amplified by our Samsung relationship where the MarketWall apps are pre-loaded on certain Samsung devices. These initiatives are very important customer engagement points as we prepare to roll out our online broker in Europe.

For more information visit

analytixinsight.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.