Goldman Sachs decided Friday night was a good time to tell the world how bearish they are ahead of the Q1 2016 earnings season.

In lieu of comments read from the perch of the Benzinga Pro news desk, we determined it would be of value to all our readers for us to highlight some of the recent notable comments from analysts regarding Q1 earnings expectations along with some focus point comments on Financials and Credit markets.

To lead off, we'll continue with David Kostin's view on Q1 earnings.

The three reasons Kostin is bearish:

- Consensus expectations for flat Y/Y EPS growth looks to be the best case. Kostin expects EPS growth to decline 9 percent, led by Financials (NYSE: XLF) and Energy (NYSE: XLE).

- Historically, companies lower EPS guidance for the subsequent quarter which drives down revisions to FY EPS guidance, meaning stock prices have to be revised lower to account for the weaker performance guidance.

- The only demand source for shares is corporate buybacks. Kostin notes more than 75 percent of S&P 500 constituents are unable to execute discretionary buybacks until early May.

Equity Market, Where Are We Now?

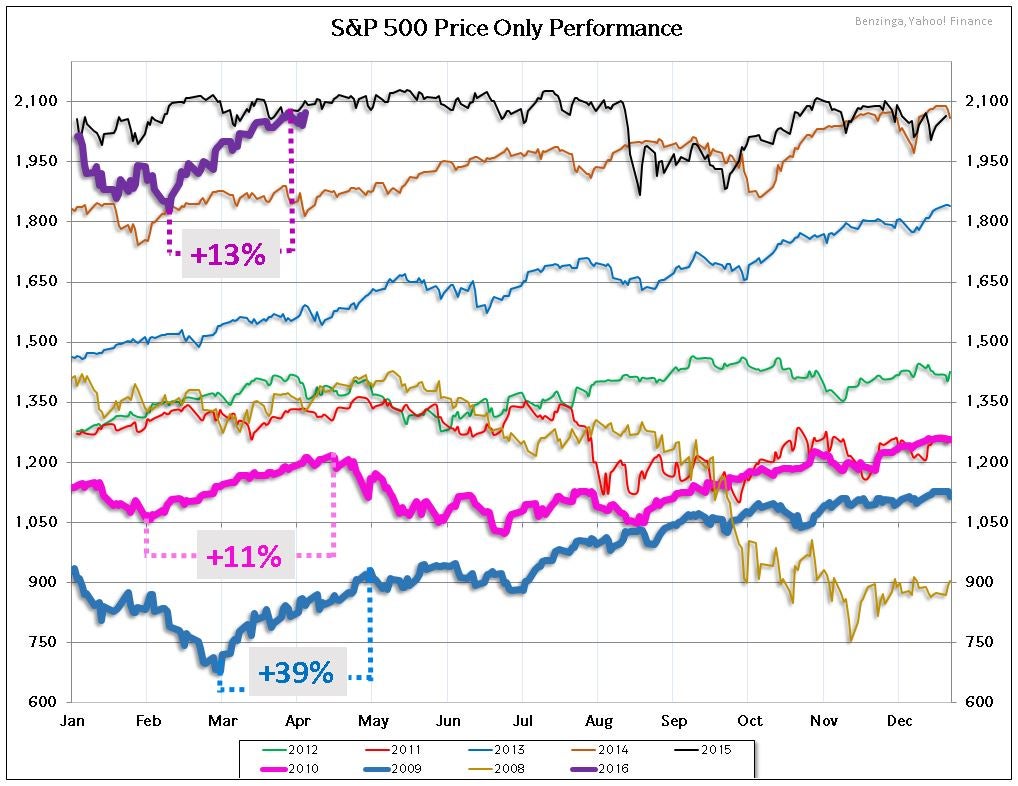

It's certainly not 2009 but the post-January rebound we've seen in the S&P has analogues in recent history:

Going back to Kostin, he shares a chart pointing to an increasing short-interest as a percent of the median market capitalization of S&P 500 companies:

It's relatively easy to get bearish in the near-term. US equity fund flows continue to bleed out according to Goldman Sachs analyst Peter Callahan:

Jefferies' Daniel Fannon called attention ...

/www.benzinga.com/analyst-ratings/analyst-color/16/04/7822782/goldman-sachs-acknowledges-the-only-source-of-demand-for alt=Goldman Sachs Acknowledges The Only Source Of Demand For Equities Comes From Corporate Buybacks>Full story available on Benzinga.com

More...

More...