Quite honestly I am struggling to present “anything” as an attractive speculation right now as it seems like the phrase “catching a falling fridge” would be a gross understatement. However, for those with a few shekels lying around to invest, BOE may be worth bottom-fishing during tax loss season.

BOE is one of the companies from our Ticker Trax list of cash-rich microcap stocks that I have been focused on for almost three years now. That list has dwindled dramatically (from 80 stocks to < 20) as companies burned through cash, rose in value (making the cash discount far less attractive) or they participated in a merger or acquisition.

For the most part, some great capital gains were generated from that list since 2013. Americas Petrogas remained on our list and they also happen to have the largest bank account.

_______________________________________________

Americas Petrogas (BOE: TSXV, Stock Forum) (19 cents)

www.americaspetrogas.com

BOE is not only cash-rich, but the market is valuing their Argentina and Peru assets at zero (because the stock trades well below their net cash value).

November 2nd was an important turning point for them - the CEO was replaced with a very successful businessman from Calgary and a promising business plan was laid out for 2016.

The company is a rare breed in the world of Canadian microcap stocks:

· Very well funded (working capital in the range of $60 million with no debt – worth about 26 cents/share).

· Access to management & potential financing from one of the world’s largest hedge funds

· Valuable phosphate assets valued at ZERO by the market

· Oil and Gas exploration assets also valued at ZERO by the market

The share price of BOE was depressed because of this weak market and (primarily) because shareholders and potential investors had little to no faith in the ability of former President and CEO Barclay Hambrook to rebuild shareholder value.

However, November 2nd it was announced that Carlos Lau would step down as Executive Chairman and he would be replaced by Mr. Abdel Badwi as both executive chairman and interim CEO. Barclay Hambrook resigned as director, President and CEO effective October 30, 2015.

Not only was this critically important to rebuilding shareholder value, but it re-affirmed that Ken Geren would remain on the board and would be instrumental in guiding BOE (I have explained the importance of this below).

The appointment of Abdel F. (Abby) Badwi as executive chairman of the board of directors and interim Chief Executive Officer was a huge coupe for BOE. Mr. Badwi also invested $1/2 million at 25 cents per share in a private placement so that he has a vested interest in the success of BOE.

Mr. Badwi is an international energy executive and a Professional Geologist with more than 40 years of experience in the exploration, development and production of oil and gas fields in Canada, Latin America, Europe, Asia and the Middle East. He is current Vice-Chairman of Calgary based Bankers Petroleum – a very successful oil and gas company that is one of the largest producers and employers in Albania.

He was also the President and CEO of Rally Energy from 2005 to 2007. In September 2007, NOPC acquired Rally Energy for US$ 868 million.

Behind Mr. Badwi is critically important board member Ken Geren – a BOE shareholder and portfolio manager for Point72 (who owns a large position in BOE). Point72 Asset Management (formerly S.A.C. Capital Advisors), is a group of hedge funds founded by Steven A. Cohen- one of the most successful hedge fund managers on the planet - with an estimated net worth of $11 Billion.

BOE ASSETS

The company’s November 2nd corporate presentation shows them with $60 Million in working capital (primarily cash) and no debt. With 232 million shares outstanding, that cash is worth 26 cents per share. This means ZERO value is being assigned by investors to the following:

> ARGENTINA

· Five Non-Conventional shale gas and oil blocks

· Two conventional gas & oil blocks

· Total net acres: 801,000

> PERU

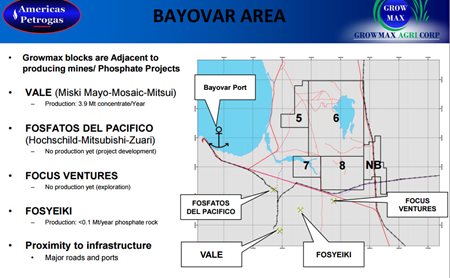

· Phosphate, Potash and Other Minerals exploration blocks near existing mining operations totalling 147,800 net acres (held 89% by subsidiary GrowMax)

· The 11% partner in GrowMax is the Indian Farmers Fertiliser Cooperative (IFFCO) - the world’s

· Largest fertilizer co-op with 40,000 cooperatives and more than US$4 Billion in annual revenue.

· IFFCO also owns 13.5% of the BOE shares.

· According to the November 2nd BOE press release, the company is “initiating negotiations for an Off take agreement with IFFCO”

SHIFT IN STRATEGY

> PERU

• 2016 Primary focus will be on the Company’s Phosphate blocks in Bayovar to

fully assess the upside potential of these assets

• Delineation drilling to commence in Q1-2016

• Begin feasibility study with the objective to start commercial mine

construction in 2017, subject to obtaining permits and licenses

• The size of the prize is significant with a low expected capital requirement

> ARGENTINA

• Small capital program in 2016 on the Company’s low risk conventional oil and

gas exploration blocks (Rinconada Norte and Vaca Mahuida*)

• Examine funding options for non-conventional shale blocks

>SUCCESSFUL COST REDUCTION MEASURES

• Eliminated all outstanding Debts ($3 Million)

• Incorporated significant G&A reductions in Argentina

THE PERU PHOSPHATE PROJECT

This project holds significant unrecognized value.

- large acreage with significant drilling to date

- high quality phosphate that is near surface and easier / lower cost to mine

- close to infrastructure resulting in lower capex

- partner is one of India’s largest agriculture companies

China accounts for a large percentage of the world’s phosphate production but they are also one of the largest consumers next to India and Brazil. Morocco is a very large exporter because of its high grade phosphate but Peru has the potential to become a significant export player.

The Bayovar Area of Peru (shown above) has only been producing since 2010 (Vale) and produces a high quality, price competitive product. Focus is the only other junior in the area but they do not have the financial backing that BOE (Growmax) has.

While world market prices have been low the past several years, there has been a lot of merger and acquisition activity – in particular for the blending of specialized phosphate products / nutrients. In late 2014, ICL of Israel invested $1/2 Billion for 50% ownership of a large phosphate project in China. ICL is an International conglomerate that sees strong phosphate demand originating from China and India.

BOE has a big advantage out of the gate by being partnered with IFFCO and having them as a common shareholder. If one of Steven Cohen’s hedge funds is also willing to back this phosphate project, then that means there should be “substantial” value hidden within BOE from the low 0.20’s.

For additional information about the Company, an updated corporate presentation is now available:

www.americaspetrogas.com.

_____________________________________________________________________

Throughout the week you can follow Misc market information I post on Social Media

https://www.twitter.com/microcap_com or www.facebook.com/microcap

LinkedIn: www.linkedin.com/in/dannydeadlock

_____________________________________________________________________

To ensure email delivery and prevent blocking - Please be sure to add the following as an email contact

mailbox@newsletter.stockhouse.com

_____________________________________________________________________

Disclosure (shares always purchased in the open market):

Danny Deadlock owns 150,000 shares of BOE.

_____________________________________________________________________