Friday, March 4, 2016 | www.tickertrax.com | |

Help 9 Cent GEN.T Save Lives with Cancer Screening

By Danny Deadlock, TickerTrax |

Note: I have been working on this report all day (since GEN issued news early Friday morning) and what started out at 5 cents has now resulted in GEN closing at 9 cents on VERY strong volume. While I believe this current price range is still attractive, it is impossible to know until such time as we see what their next round of financing will be (share price and total dollar amount). This is expected to close by the end of March.

I really like this company and the fact they are doing something great to help people (cancer screening), so even in light of today’s big gain, I am still putting this report out – just

be careful until such time as terms of an upcoming financing are announced.

__________________________________________

GeneNews (TSX: GEN, Stock Forum) (9 cents)

(52wk High $1.80 Low 1 cent)

https://www.genenews.com/

Shares outstanding: 56 million

GeneNews is focused on developing and commercializing proprietary molecular diagnostic tests for the early detection of diseases and personalized health management, with a primary focus on cancer-related indications.

The Company's lead product, ColonSentry®, is the world's first blood test to assess an individual's current risk for colorectal cancer (CRC).

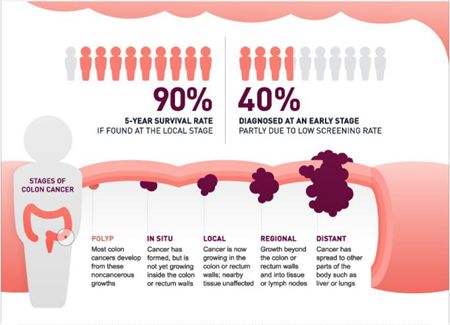

In the United States alone, CRC kills more than 50,000 people every year. CRC is the most preventable and treatable cancer when detected early, yet people often delay or avoid being tested until symptoms appear. The expense or discomfort associated with a colonoscopy or stool test is keeping people from getting screened – and early screening is critical to saving lives.

THE GENENEWS INVESTMENT THESIS

THE GENENEWS INVESTMENT THESIS:

With a

market cap of only $5 million (versus $90 million in Q4/14), GeneNews has very attractive capital gain potential (if) they can successfully restructure their U.S. diagnostic lab & sales team OR partner with someone larger.

Genetic screening for health problems is still a new industry with hurdles and financial risks, but as the GeneNews valuation in 2014 showed, investors in a healthy life sciences sector are willing to pay big money for growth potential – and going forward,

the investment demand for health sciences stocks should remain strong.

What also makes GEN appealing is the management and directors. They have very strong business and scientific backgrounds:

https://www.genenews.com/management-team.html

https://www.genenews.com/board-of-directors.html

SENTINEL PRINCIPLE

GeneNews developed a powerful approach to identifying unique RNA-based biomarkers from blood. They called this proprietary platform technology the

Sentinel Principle®,

and it has the ability to detect virtually any disease or medical condition from a simple blood sample. The Sentinel Principle® technology is protected by pioneering foundational patents.

According to the principle:

As blood circulates, communication occurs between cells in blood and tissue. Subtle changes that occur in cells due to injury or disease trigger detectable, specific changes in blood cell gene expression. Profiling these changes generates unique molecular signatures reflecting disease activity. These molecular signatures can be used to identify disease-specific blood biomarkers.

These biomarkers are the foundation for GeneNews' highly sensitive and specific molecular diagnostic assays. One of the strengths of the Sentinel Principle is its flexibility. Applying it to different disease areas enables GeneNews' Scientists to generate specific combinations of biomarkers for numerous applications - theoretically virtually any medical condition. This enables GeneNews to focus on the clinical questions and diseases with the greatest unmet need and largest commercial opportunities.

Among the utilities of the Sentinel Principle are:

· early diagnosis

· determining stage of disease

· identifying responders/non-responders to a specific therapy

· monitoring progression/recurrence of disease

· monitoring the effects of treatment

· monitoring treatment compliance

GeneNews has demonstrated the power of the method in over a dozen diseases and is developing molecular diagnostic tests to address specific clinical needs with a near term focus on cancer.

The science behind the Sentinel Principle® led to the development of their flagship product, ColonSentry®, a blood-based test for assessing an individual's current risk of having colorectal cancer.

In 2014 ColonSentry® was ordered by more than 65,000 physicians.

Sales of ColonSentry at IDL grew rapidly during both the first and second quarters of 2014, driven primarily by the expansion of the IDL sales force. During the second half of 2014 and continuing in the first quarter of 2015, HDL's business challenges necessitated shifting the primary focus at IDL to the refinement of its organizational structure. This shift in focus negatively affected sales of ColonSentry and other tests at IDL.

CORPORATE RESTRUCTURING BACKGROUND

Through 2014 GEN traded well above $1 and heading into 2015 it was comfortable near $1.80 with a market cap of $90 million! In 2014 the biotech sector was strong and Health Sciences was a "hot" investment theme. In Q1/15 the stock started its decline and bottomed mid November 2015 with restructuring news and tax loss selling.

GeneNews was partnered with another company (

Cobalt Healthcare Consultants) on a diagnostic lab

(IDL) in the United States - but it became a money pit following their association with

HDL (see below). Genetic testing (screening) while a popular theme, is also a complicated business when it comes to billing through medical insurance companies. I don't know all the details behind the problems that GeneNews encountered with HDL, but it had something to do with billing and how (or if) the insurance companies would cover the costs of the testing.

Also... In the midst of their 2014 ramp-up, HDL (an initial 1/3 partner in their lab), came under investigation by the US Department of Justice - I believe something to do with billing to insurance companies (I am unsure of the specifics). Eventually GeneNews and Cobalt Healthcare became 50/50 partners but their association with HDL caused nothing but problems for them.

Over the remainder of 2015, the GEN share price collapsed and by November, GeneNews was forced to restructure as their lab partnership with Cobalt was not working out (admin costs too high and the sales force not strong enough). Essentially, partners were killing GeneNews.

December 2015 at IDL (the diagnostic lab), GeneNews initiated a 30% staff reduction to 34 people including its sales force. This would continue to make their suite of advanced cancer assays available across the United States (with a focus on ColonSentry).

Friday March 4thit was announced that GeneNews had entered into a Purchase Agreement to acquire Cobalt’s 50% interest in the Innovative Diagnostic Laboratory, LLP (“IDL”) joint-venture.

Giving GeneNews full ownership of IDL. They would acquire this interest by assuming Cobalt’s $US 1 million Promissory Note payable May 2017. The Purchasing Agreement is subject to GeneNews completing a strategic financing during March 2016.

“In recent months, we have taken a number of important steps to get the Company on a more solid footing to support an orderly restructuring of its operations,” said GeneNews’ Executive Chairman, James Howard-Tripp. “With a number of difficult decisions behind us, and this Purchasing Agreement in place, we are now much better prepared to pursue the working capital we need to restore IDL’s corporate viability and re-establish its growth trajectory.”

ABOUT IDL

Virginia-based IDL is a national clinical reference lab specializing in personalized blood-based testing to help find, understand, and address cancer risk in patient populations.

IDL’s mission is to provide a comprehensive menu of traditional and advanced clinical evidence-based blood tests that aid in early cancer detection. Currently IDL offers risk assessment blood tests for the three most prevalent cancer types including lung, colon and prostate. IDL is actively in-licensing and commercializing an array of DNA, RNA, protein and autoantibody blood-based cancer diagnostic tests to address early detection of all major types of cancer.

https://www.myinnovativelab.com/

LIMITED COMPETITION

There are few companies in this space and even fewer that are public. The highest profile would be

Foundation Medicine (FMI: NASDAQ $17.44) -www.foundationmedicine.com

This was a November 2015 analyst research note on FMI but the industry comments would be applicable to GeneNews.

"Clearly the market is early and we expect continued noise, particularly around reimbursement and competitive dynamics in the near term; certainly these results seem to help the bear case that the incremental clinical utility of Foundation One above more simplistic hotspot assays is uncertain. However, we also know

sequencing is becoming increasingly integrated in patient treatment and becoming more frequently administered in oncology, that the addressable market is large, and that some payers recognize the value of comprehensive genomic profiling. Ultimately, we believe that data is going to be a key asset; likely the players that succeed in this market will be those that are well funded to build out the appropriate scale to support a national operation and complete clinical trials to support the clinical utility of their tests (particularly in an environment of increased regulatory and payer scrutiny). Thus, we maintain our Outperform rating and recommend purchase for investors with long time horizons"

GENENEWS OUTLOOK

The company has strong (and unique) science BUT they need more "Boots on the Ground" (sales people). To accomplish this, they need to raise more capital (without horribly diluting at a low share price) OR a strong industry partner.

Management and Directors have the experience to pull this off in 2016, and the investment demand for healthcare stocks and life sciences, should remain strong through 2016 and 2017.

COMPANY CONTACT

James R. Howard-Tripp - Executive Chairman

Office: (905) 209-2030

jhoward-tripp@genenews.com

_____________________________________________________________________

Throughout the week you can follow Misc market information I post on Social Media

https://www.twitter.com/microcap_com or

www.facebook.com/microcap

LinkedIn:

www.linkedin.com/in/dannydeadlock

_____________________________________________________________________

Disclosure (shares always purchased in the open market):

Danny Deadlock owns 200,000 shares of GEN.

_____________________________________________________________________