Investor interest in Canadian uranium exploration picks up this week as shareholders get set to vote on a proposed merger of Fission Uranium Corp. (TSX: V.FCU, Stock Forum) and Alpha Minerals Inc. (TSX: V.AMW, Stock Forum), two of the leading players in the field.

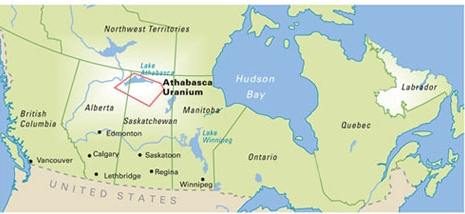

The two British Columbia companies leapt onto investor radar screens in November 2012, following the announcement of a high-grade uranium discovery in Saskatchewan’s Athabasca Basin, which is also home to Cameco Corp. (TSX: T.CCO, Stock Forum), the world’s leading uranium producer.

News of the find sparked a rush to stake ground through Saskatchewan’s on-line registry system that processed applications covering 458,000 hectares in a 27-hour period in March, 2013.

By joining forces under one surviving company, Alpha and Fission are widely seen to be creating more liquidity and gearing up for a potential takeover if results at their flagship Patterson Lake South project continue to live up to early expectations.

Shareholders of Fission and Alpha are set vote in Vancouver Thursday (November 28, 2013) as the global uranium sector tries to recover from the impact of the catastrophic meltdown of Japan’s Fukushima Diichi nuclear plant in March 2011.

One of the world’s worst nuclear disasters, it knocked the uranium mining sector on its back as Japan shut down more than half of its reactors and a number of countries decided to scale back on their nuclear programs.

Trading at $36 earlier this month, the spot price of U308 (Triuranium oxtoxide) has dropped from around $70 before the Fukushima meltdown, which marked the biggest warning about the potential dangers of nuclear power since the explosion at the Chernobyl nuclear power plant in the Ukraine in April 1986.

A report in Britain’s Guardian newspaper said 150,000 local residents have been forced to leave their homes, likely on a permanent basis, and the entire Fukushima facility is currently being decommissioned, a process that is expected to take 40 years.

Still, uranium industry officials point out that the need for nuclear power is unlikely to disappear, as indicated by the fact that more than 70 reactors are currently under construction, mainly in China, Russia and India that will need to be fed by uranium fuel.

“About 20% of North America’s electricity comes from nuclear, so it’s not going away very soon,’’ said Harrison Cookenboo, a consulting geologist with Adlrin Resource Corp. (TSX: V.ALN, Stock Forum), a Vancouver-based junior, which is engaged in uranium exploration in Saskatchewan.

He said the industry is also looking to the consequences of the imminent end of the infamous HEU agreement between Russia and the U.S.

Under the 20-year deal, 475.2 tonnes of Russian warhead grade HEU (high enriched uranium, equivalent to 19,008 nuclear warheads) were converted in Russia to 13,723 tonnes of LEW (low enriched uranium) and sold to the United States for use in American nuclear power plants.

But now that the arrangement is about to end next month, nuclear power plants will presumably need to look elsewhere for fuel.

Meanwhile, officials engaged in early stage exploration in Saskatchewan remain optimistic, even though high grade deposits in that province are notoriously small, deep and difficult to find.

Historically, the major Saskatchewan uranium discoveries have been found on the eastern rim of the Athabaska Basin, which covers about 100,000 square kilometers, and stretches from the Alberta border northeast of Fort McMurray across the province of Saskatchewan.

But advances in exploration technology and geophysics have more recently prompted new discoveries on the southwestern rim where, Fission, Alpha and a handful of other juniors are focusing their efforts.

Aside from Fission and Alpha, active players in the area include Adlrin, Azincourt Uranium Inc. (TSX: V.AAZ, Stock Forum), NexGen Energy Ltd. (TSX: V.NXE, Stock Forum), and Zadar Ventures Ltd. (TSX: V.ZAD, Stock Forum).

Aldrin is planning to spend up to $2 million on drilling, likely in February and March on the Triple M property, southwest of Patterson Lake South. “We have strong drill targets outlined,’’ said Aldrin’s Cookenboo, during an interview with Stockhouse.

Also gearing up for drilling is a uranium exploration syndicate comprised of Skyharbour Resources Ltd. (TSX: V.SYH, Stock Forum) Athabasca Nuclear Corp (TSX: V.ASC, Stock Forum) Noka Resources Inc. (TSX: V.NX, Stock Forum) and Lucky Strike Resources Ltd. (TSX: V.LKY, Stock Forum).

The Western Athabasca Syndicate is targeting the Preston Lake project -- adjacent to Patterson Lake South – and plans to spend around $6 million over the next two years.

Assuming the Fission and Alpha merger succeeds, the combined company will have a $12 million budget available for Patterson Lake South. However, in a telephone interview, Fission President and COO Ross McElroy said his company will need to drill up to 100 new holes before it is in a position to announce a resource estimate, possibly by the fall of 2014.

Meanwhile, Fission is moving on other fronts.

For example, it and partner Azincourt Uranium Inc. (TSX: V.AAZ, Stock Forum) have outlined 8-10 drill targets on the Patterson Lake North property which is about 6 kilometres north of the original high grade find. “We will be starting a drill program there early in the New Year,’’ McElroy said. The program is expected to consist of roughly 3,000 metres of drilling.

As well, Fission and joint venture partner Brades Resource Corp. (TSX: V.BRA, Stock Forum) plan to be active on the 11,835-hectare Clearwater West project, which is located immediately south of Patterson Lake South. Brades has the option to earn a 50% stake in Clearwater by spending $5 million.

As he prepared to fly to Vancouver from San Francisco for the shareholder meetings on Thursday, McElroy said he could see no reason why the merger won’t proceed. “I think there is great support for the deal,’’ he said.

Under the agreement, the merged company will continue to focus on Patterson Lake South, leaving Fission and Alpha to spin out their other assets into new companies. Each company will receive $3 million in cash to fund future programs on other properties.

On Wednesday, Fission eased 2.6% to $1.13, leaving a market cap of $171 million, based on 151.7 million shares outstanding. The 52-week range is $1.48 and 52 cents.

Alpha was off 0.49% to $6.07, leaving a market cap of $166.7 million, based on 27.5 million shares outstanding. The 52-week range is $7.60 and $1.32.