Excelsior Financial Projections at $4.05/lb CuIt's been a while since I've posted any projections, but some folks have been asking for them. I've taken some liberties on the charts below.

FYI: I will be talking with Stephen Twyerould, CEO, today regarding operational challenges raised in the Crux article. He will - of course - not disclose any non-public information, but will hopefully place the ramp-up process in context. I will share notes from my conversation with him in a later post.

Here are the assumptions:

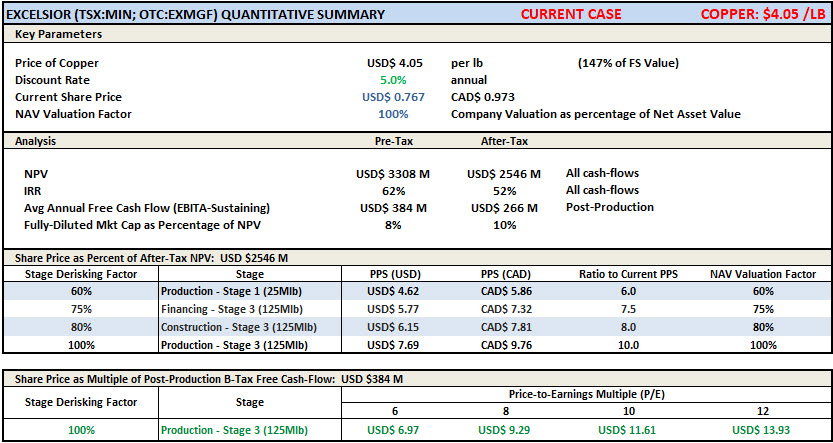

- Copper Price: Copper pricing is at $4.05/lb.

- Year 0 Production Levels: I've computed an estimate for Yr2021 production levels based on a linear progression from a starting point of 0 in Dec2020 to the equivalent of 25MLb/year in Dec2021. I've shown this computation in the first chart below. Unsurprisingly, that effectively comes out to an annual total for 2021 of 13.5MLb/yr, which is roughly half of the 25MLb/year nameplate capacity for Stage 1.

- Stage 3 moved forward 3 years: With copper pricing currently at 5 year highs, I think it is safe to assume that Excelsior management will pursue financing for Stage 3 earlier and skip Stage 2 entirely. The resulting Stage 3 production levels will be attained in the fifth year (Year4). I've attempted to reflect this in the Capex as well as cash flows. No guarantees my assumptions will match reality.

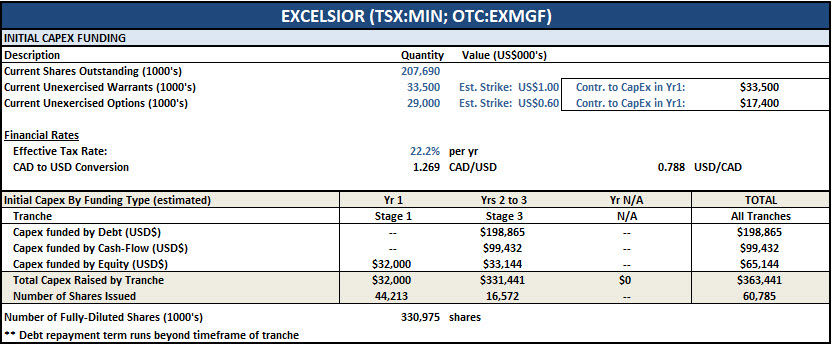

- Stage 3 Debt/Equity Financing: The Capex for Stage 3 is assumed to be met by a 60% Debt / 30% Cash-Flow / 10% Equity financing. Note: Income from Warrants and Options is used to offset capex requirements for Stage 3 expansion. Again, no guarantees the actual financing will be anywhere close to these assumptions.

- Discount Rate at 5%: Assuming the kinks are worked out in the ISR process, the cash-flows from the project will be very good. Excelsior will be among the lowest cost producers worldwide. for this reason, the Discount Rate is shown at 5% per annum, instead of the 7.5% used in the FS. Cash flow from a single year of 125MLb/yr operation will be sufficient to cover the Stage 3 Capex expansion.

PG