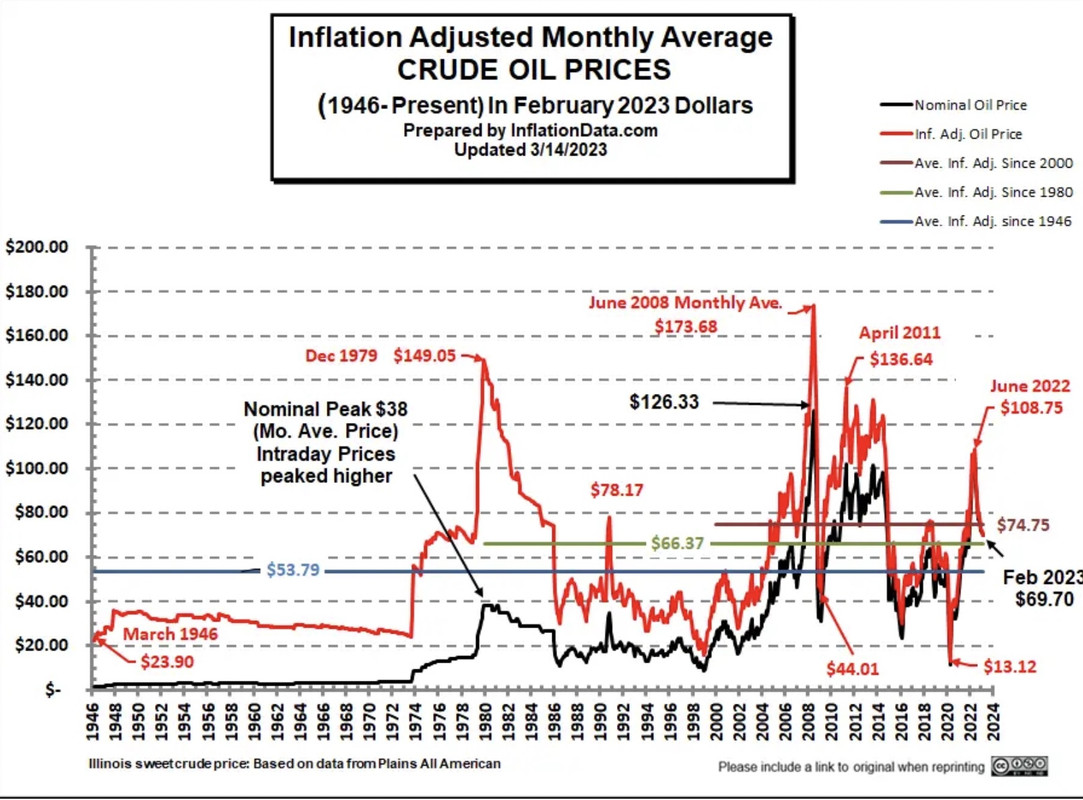

RE:Comparing prices in the past to todayThe oil inflation adjusted price chart:

Looking at an inflation adjusted oil price is indeed very relevant, especially when considering today's higher and increasing costs involved in producing it relelative to years ago. Only a handful of producers today can extract at lower costs, which include ones with the capital costs already sunk in. The rest are in a race to replace reserves in far more technically difficult, hostile, and higher cost environments with higher break evens as time goes on.

The inflation adjusted oil price chart does not imply that oil must go higher, it just illustrates that we have had far higher oil prices in the past, when indexed for inflation. Also, we can see on a comparative basis to past levels if we are currently paying a reasonable price for it or a high price.

Oil is also a commodity, and cannot easily and directly be compared with computers subject to Moore's Law, electricity, or technical advancement. It is what it is.

I get your point regarding the market costs of the portion of it that is used where it is able to be compared to a substitution like transportation, and I think that does apply to a point. However, the cost benefits of technical advancements to replace oil can only go only so far. It is not cost effective to produce rubber tires for cars or pave millions of miles of asphalt roads from a primeal feedstock of electrons and compressed hemp, nor the many things that are made from oil that we will continue to rely on and owe our modern existence to.

Some people say we will never have $100 oil. Yet it is simply a matter of time that inflation and the costs of producing it increase and it approaches that price point. We will always need oil, and it will one day be too precious of a resource to waste by burning it for transportation. Those days may be beyond our lifetimes, but it is indeed approaching.

Oil is a finite resource on this planet, a precious gift bestowed on us of which we have consumed over half of since the industrial revolution, and initially at a trickle of far lower consumption rates. Since the 60's till today, we have really burned it up. The second remaining half will become far more difficult to get to with smaller pools, deeper waters, and colder environments making it much harder and costly to extract. Each day we burn 100mm bbls more, and the clock is ticking.

Also relevant to the discussion is how many hours does one have to work for one Big Mac over the years? The first MacDonalds restaurants sold burgers for $0.15. Today they are a lot more. Probably one has to work the same amount of hours then as you do today for one. One day in the future, Big Macs will also be $100, but fortunately a long time after oil surpasses $100/bbl.

The world has changed. As things become scarce, the supply drops and the price goes up. I have a real hard time finding a good Panda burger lately. It now costs me a Rhino horn, and a 5 Tiger claws.

Experienced wrote: A number of people here have fallen into the trap of comparing say oil prices in the past to an inflation aadjusted price today and suggesting that the price of oil will go up. Such comparisons are useless and often lead to wrongheaded conclusions.

If we used the same argument for other things such as computer prices or in the energy field, electricity prices, you would conclude that these things are underpriced and prices are destined to go up a lot. In the case of electricity prices, the price of a KWH is about the same today as it was in 1910 (more than a 100 years ago....as my wife would kid me..."You would know you were there then"...lol). If we said that electricity prices should go to up to its inflation adjusted number, you would need to increase the price of electricity today by 32X.

The reason why such comnparisons are a best wrong or at worse silly is that the comparison does not take into technological advances which reduce the need for cost increases. When I was in university we had the second fastest scientific computer in the world for use in the science faculty. It has 64K of memory and its clock speed was .8 MIPS and cost millions of dollars. Check out the comparable stats for your phone and what you paid paid for it!!

What is more relevant is the future supply and demand for that thing or commodity and the forecasted relative price of that thing compared to a subsitute. So in the case of oil, the important thing to decide on its whether there will be more demand destruction due to EVs and other technological substitutes for oil or more supply destruction.

If you believe in the former than you should be invested elsewhere. if you believe in the latter then there is a case to be invested in oils. The relative price of oil to an inflation adjusted price doesn't enter into this decision making.