RE:RE:RE:RE:RE:Rig counts continue to drop, Shale growth stallsGood points Pablo, and Experienced.

I also held Crew for the same reasons mentioned, great potential and way more reserve rich land to develop than they have the cash. A great take out target in a few years. I am also bullish NG in the long run, but my thoughts are that oil producers have a lot of runway to move up first, then will be followed after by gas names.

Regarding NG used in oil sands, Alberta's gas is largely land locked thanks to the lack of export pipeline infrastructure and congeston, and as a result AECO prices are much lower than other markets. I recall a year ago it went negative, while in Europe it was trading at a $1000/bbl equivalent. How stupid is that...

When it comes to shale, I see so many red flags that indicate challenges to growth in shale oil production, let alone maintaining it, due to a maturing Permian basin.

In order to maintain current levels of shale oil production in the face of declining productivity, there would have to be a lot more activity in drilling and fracking. Many more rigs would have to be built, as well as frack fleets. This is not likely in this anti oil environment where the government gave you a warning that it wants you out of business in a few years. Rigs are being auctioned off at fractions of original costs.

Here is the problem:

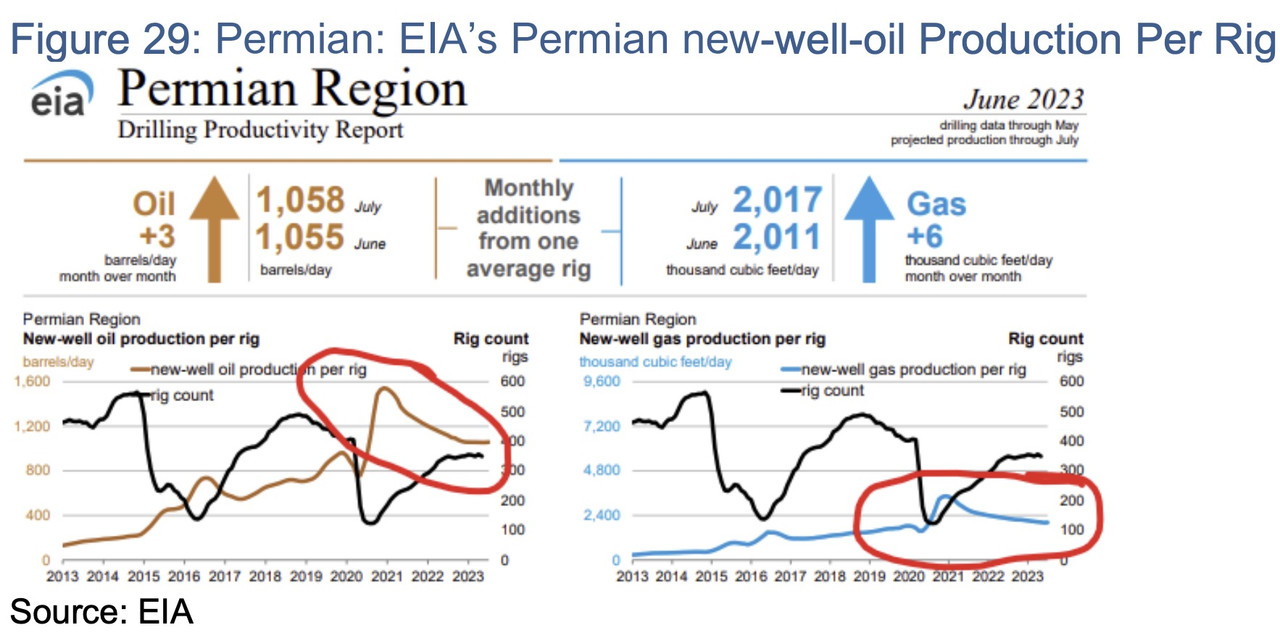

In 2020/21 industry drilled their best wells when cash flows were squeezed. So in 2021, new well productivity was great, about 1500 bpd, then as these were used up, it has dropped down to about 1050 bpd in 2023.

This chart shows just how fast productivity is dropping per well:

Yet overall production increased because they chewed through the DUC inventory, which is now down to very low levels.

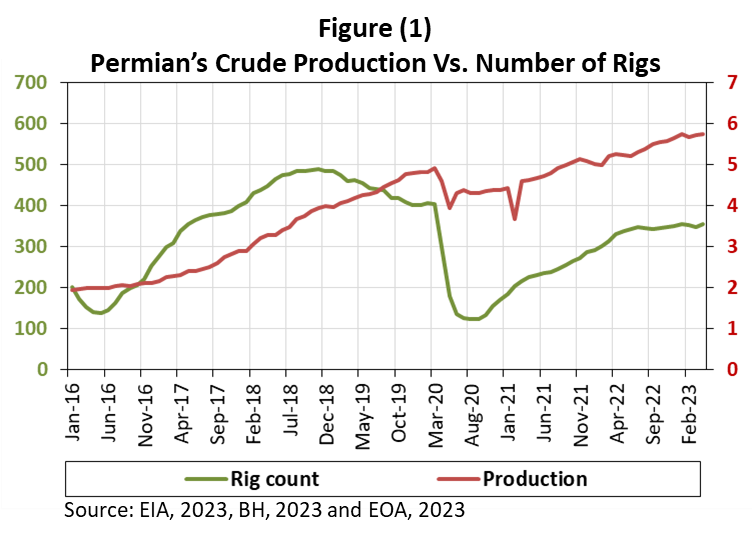

Here is the Permian rig count, which has not had such a violent rig count drop as other basins, but is flat:

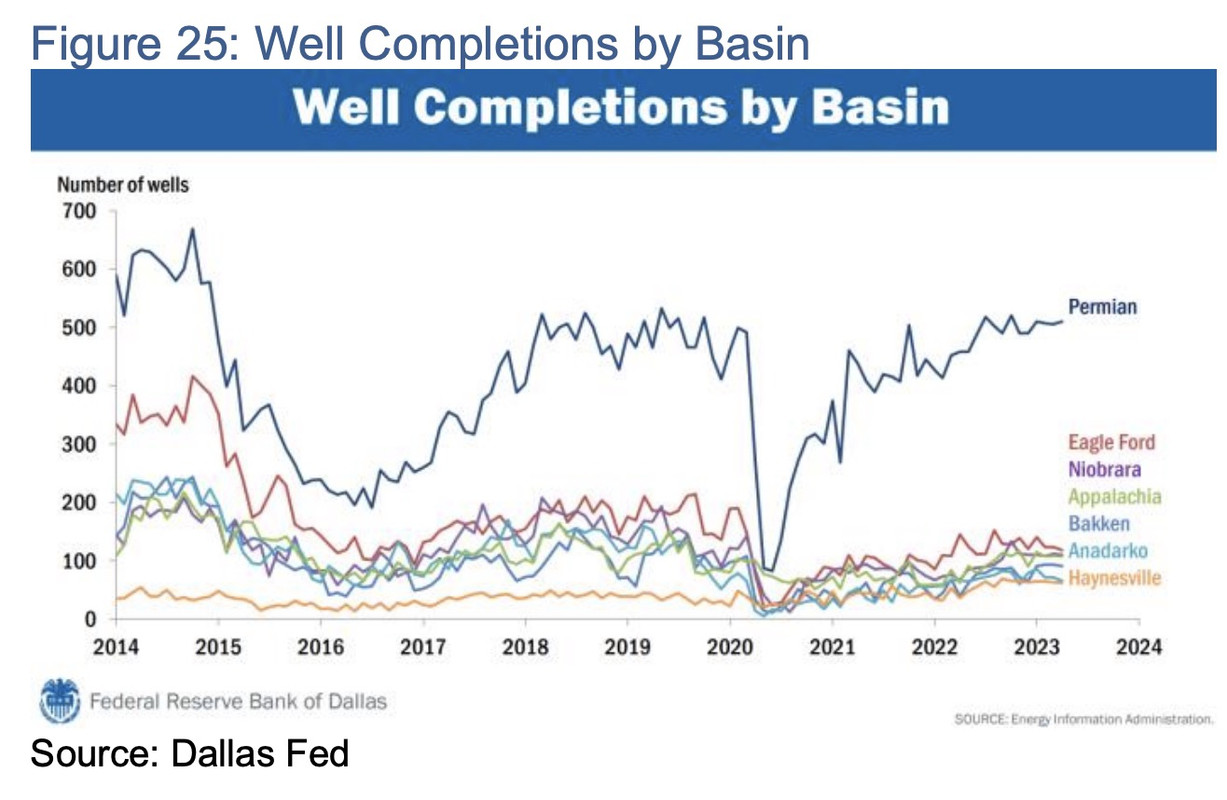

Here are the completions per basin. Permian has been high due to the completion of DUCs.

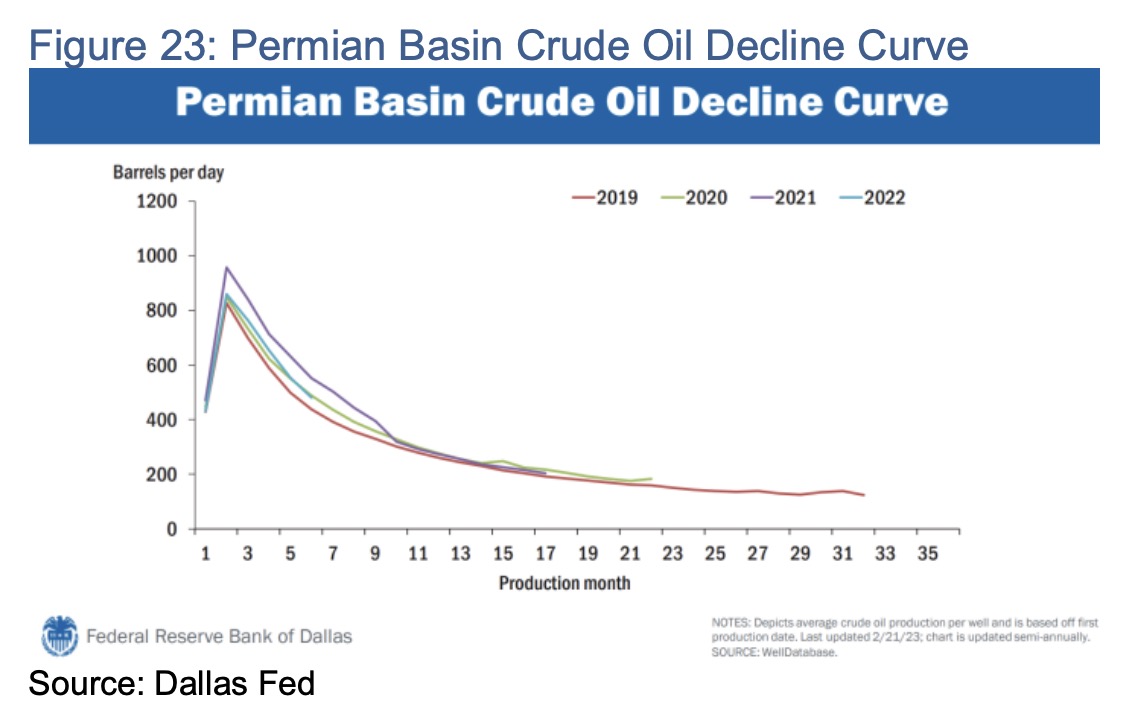

This chart shows the well decline rates,

PER MONTH on a year to year basis which gives a good indication of the amount of time it will take to see a drop in production from completion, in other words, the lag.

Now producers are left with second tier acerage, which for many wells is near break even at $60 to $70 ish oil. This is reflected in the reluctance seen in more drilling, and the drop in DUCs amid the rush to complete and recover the drilling investments made before drilling a new well.

Well productivity is dropping, and although perhaps technology will eventually improve to increase the ultimate extraction by refracking old wells for example, it comes with additional costs and uses the same fracking fleets which are currently at very high utilization rates. So much equipment was scrapped in the Covid oil plunge.

My takeaway from all this, is that the combination of dropping well productivity with second tier acerage, flat Permian rig counts, exhausted DUC inventory to fall back on which has kept production and completions high, and the inability to ramp up with more drilling and fracking, Permian production is headed down soon regardless of increases in oil price.

Experienced wrote: Nice analysis Pablo....

I agree with your thoughts on NG.

The future as I see it is that EVs will become the dominant and potentially replace all ICE cars and trucks over the next 15 years and this will provide a big dent in the demand for oil. In addition there are many new technologies emerging including such things as carbon capture which will reduce the need for oil based petrochemicals.

The shift to EV will dictate a need for increased production of electricity and the technologies to produce this electricity without expansion of the grid by way of major transmission lines. Solar and wind are not going to do the trick and there is already the beginnings of pushback against them from environmentalists concerned with their impact on the ecosystem. People still haven't gotten their heads around going back to nuclear and fusion is still a long way off IMHO.

So what does leave?

Natural gas and biofuels.

So if I was to put long term money into energy, I would be figuring out which natural gas producers I should be buying. People may still need oil for another 50 years (who knows?) but IMO it is not likely to be a growth industry where investors could realize above average returns. If you are nimble and knowledgeable like Migraine you can make money as a trader in oils. But frankly, that is a skill set that few people have IMO and to do it properly is essentially a full-time job, not a side line activity while one is holding down a day job.