Tilray Brands - Analysts are Upgrading Tilray BrandsAnalysts Are Upgrading Tilray Brands, Inc. (NASDAQ:TLRY) After Its Latest Results Simply Wall St Taking into account the latest results, the consensus forecast from Tilray Brands' eight analysts is for revenues of US$810.2m in 2024. This reflects a major 24% improvement in revenue compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 90% to US$0.19. Before this latest report, the consensus had been expecting revenues of US$717.3m and US$0.22 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Despite these upgrades,the analysts have not made any major changes to their price target of US$2.92, implying that their latest estimates don't have a long term impact on what they think the stock is worth. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Tilray Brands analyst has a price target of US$5.50 per share, while the most pessimistic values it at US$1.90. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

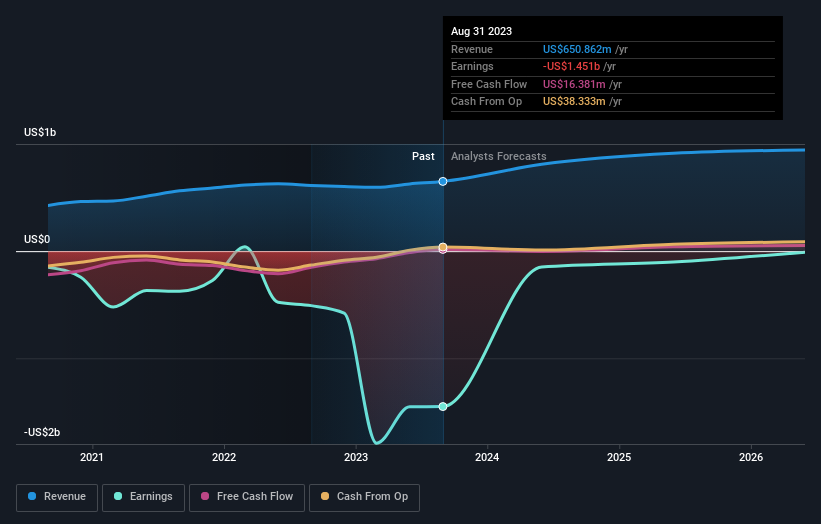

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 34% growth on an annualised basis. That is in line with its 29% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 7.2% annually. So although Tilray Brands is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. https://simplywall.st/stocks/us/pharmaceuticals-biotech/nasdaq-tlry/tilray-brands/news/analysts-are-upgrading-tilray-brands-inc-nasdaqtlry-after-it/amp