RE:Biggest joke of all Agreed, which is why I said before the costs need to be spread over a *** minimum *** of 12 years in a previous post (which you may be referring to). We've been hearing for years from the old timers that they believe there is more Cobalt to be had at the ICP.

Now, having said that. The scenario that scares everyone is the violent frenzied push to non-cobalt solutions, being accelerated even more by present sky high cobalt prices. Historically, these prices last only a few months to a year or so....fleeting.

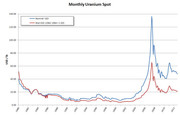

and remember how excited everyone felt when our Uranium was priced so high?

These high points do not last, nor will this one.

LFP is leading now (https://investingwhisperer.com/lfp-batteries-are-winning-the-ev-race-but-wheres-the-ex-china-supply/). LFP batteries are cheap, safe, and they last a long time. Additionally, you charge LFP 100%, but with Cobalt batteries, you are NOT supposed to do so. My Tesla is designed to charge only to 78% by default; you change that ONLY on long trips. LFP batteries are for cheaper electric cars. So you have to ask yourself, what is coming in the future, more expensive cars, or cheaper EV's for the masses? If you think cheaper, that is LFP. Solid State and 4860's will serve both markets.

Tesla Giga factory Berlin AND Austin are transitioning to 4860's now; in fact, Austin now has machinery in place. And now Tesla is backing a huge US LFP battery deal for the U.S as well. (https://insideevs.com/news/556099/tesla-domestic-lfp-battery-production/). Solid State is also around the corner, with Car manufactures already inking deals for 2025.

So, how many years will it be before the the inevitable happens?

I guarentee you that there will be a HUGE drop-off in demaind for Cobalt (like history has shown up), except this time it will be with a 50%+ drop in demand. My guess is that will happen in 3 to 6 years. That is the mine life of the ICP.