Bob Moriarty While gold and silver have fallen out of bed along with every other financial market, silver is starting to show signs of a potential turn around in price based on a DSI of 15 on July 6th. Anything below 10% is a signal of an approaching reversal. Gold on the other hand is stubbornly high at 50 on July 6th.

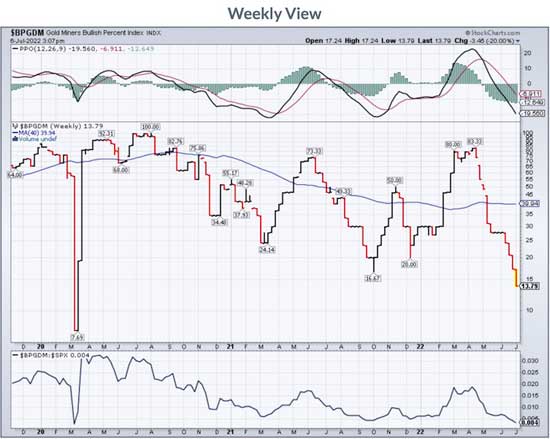

One of the important signals I use to guess when resource stocks will change direction is the Gold Miners Bullish Percent Index ($BPGDM) which gives pretty clear signals at both tops and bottoms. It is the lowest reading since the March of 2020 Covid plunge. It says the gold miners will turn shortly. If it goes down ever further from here, it will rebound like a stretched slingshot in the same way it did in early 2016 and March of 2020 climbing 202% and 189% in a few months.

(Click on image to enlarge)

There is only a loose relationship between the price of gold and resource stocks. Gold has plunged eleven out of the last twelve days and that rubber band is really stretched. But the gold DSI is not indicating a bottom or a turn at 50%. It is entirely possible for gold shares to anticipate the future and climb well before the price of gold wakes up. That happened in gold and gold stocks in 2000 and 2001 with the XAU bottoming in November of 2000 and jumping 36% by May of 2001. I called a bottom then. The GDXJ has dropped ten out of twelve days. That’s pretty stretched.

The only time small investors ever get a break when making a bet on stocks is when junior resource stocks make a major bottom. One of the key issues on identifying a bottom is looking at volume. Lately there hasn’t been any. So if a fund wants to come in and buy up a million shares of XYZ stock at a nickel, they are out of luck. But a small investor can and should put in a stink bid for 10,000 or 20,000 shares and get it filled on a regular basis. Someone wrote me a few days ago and asked what he should be picking up if we are at a bottom.

I told him to forget the fundaments and concentrate on just the price relative to the range of the last year. He should be picking up juniors with tiny market caps selling for less than $.10. Remember, in a bull market everything goes up and in a bear market everything goes down.