Colin13362/iStock Editorial via Getty Images

Introduction

Kraken Robotics Inc. (OTCQB:KRKNF) has had a fantastic year in terms of share price performance. I wanted to take a look at the company’s performance in more detail and give some comments on the upcoming quarter and what I think about the company in general. It is a very interesting company with products and services that are in high demand, which help it become profitable rather early and reward loyal shareholders handsomely. If Kraken Robotics continues this momentum, I expect it to become a much bigger company overall; however, I need to get additional information on the upcoming quarters, so I am initiating my coverage of the company with a hold rating.

Briefly on the Company

Kraken provides subsea sensors, batteries, and robotic systems worldwide, mainly through government contracts. The company’s high-resolution 3D imaging solutions help clients see in much more detail what our vast ocean floor holds. The company is a world-leading innovator of Synthetic Aperture Sonar technology, or SAS. It is headquartered in Canada and has offices in NA, SA, and Europe.

Briefly on the Performance

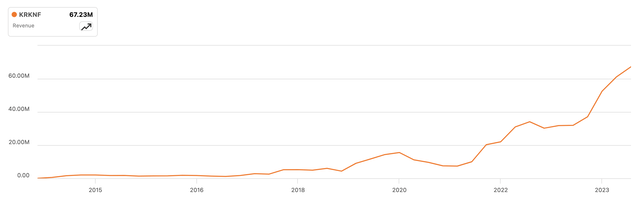

The company’s revenues saw quite a change of pace right before the pandemic hit, as we can see from the graph below. Then, the pandemic lockdowns took place, and demand softened. Thereafter, we can see an even larger change in the company’s revenues as in Q4 ’21; the company saw a massive boost from securing a contract from the Royal Danish Navy, Remontowa Shipbuilding, for the purchases of KATFISH system, the sale of subsea batteries, and SAS sensors. The company replicated the same excellent growth in the following years thanks to the company’s product portfolio and the acquisition of PanGeo SubSea Inc., which is now Kraken Robotics Services.

The latest year shows even further revenue growth than in previous years, with 83% growth in product revenue growth, which benefited from the continued delivery of SeaPower subsea batteries, Remote Minehunting and Disposal System to the Government of Canada, and KATFISH. We can see these peaks and troughs for the last few years, which is due to the timing of order deliveries. I expect this to continue, as that is the nature of the business.

Seeking Alpha

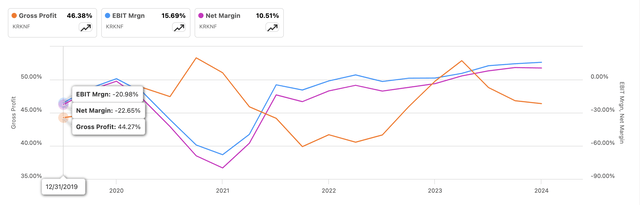

Looking at the company’s efficiency and profitability metrics, we can see that it has finally pushed into profitable territory over the last year. That is great news, especially with the company being rather young still, so to already push into profit speaks a lot about the company’s management and how valuable the company’s products and services are.

Seeking Alpha

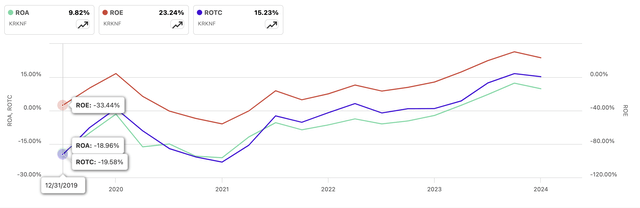

Unsurprisingly, the company’s other efficiency and profitability metrics turned positive, and by a decent margin. The company’s ROA and ROE are well above my minimums of 5% and 10%, respectively, which tells me the management is adept at utilizing the company’s assets and shareholder capital very efficiently, thus creating value. It is not an easy task to find a company of similar size as Kraken that engages in the same industry. Accordingly, I can’t compare its ROTC to its peers. However, as a standalone metric, it is well above my minimum of 10%, which means the management is doing an impressive job at allocating capital to profitable projects. This means management has good decision-making abilities and knows the company rather well.

Seeking Alpha

Regarding the company’s financial position, as of Q2 ’24, Kraken had around C$20.3m in cash and equivalents against around C$15m in long-term debt. This is not an issue, in my opinion. The company’s amazing growth made it very profitable and brought its EBIT to C$4m, which brings its interest coverage ratio to around 7.2x, well above what analysts consider healthy, which is 2x, and above my more stringent requirements of 5x. Just looking at the same time last year, the company interest coverage ratio was half that, so a marked improvement.

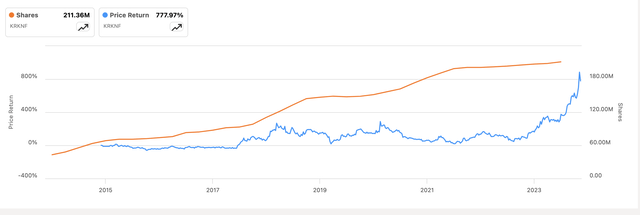

Overall, the company has progressed at a remarkable speed, growing its revenues from lows of C$2m to C$93m TTM is a fantastic achievement, and the recent share price performance shows it. In the last year, the company’s share price is up 350% and over 800% since inception.

Outlook on the Company-Upcoming Quarter

It looks like the company is firing on all cylinders. The products and services are all in high demand, and with high ROTC, it appears that it also has a decent competitive advantage. What I will be looking for in the next quarter (reported expected November 27th) is how the company’s top line progressed from a fantastic Q2 quarter. Given the nature of the business, with lags in deliveries and recognition of revenues, the upcoming quarter may show a rather subdued growth sequentially. Last year’s Q3 already showed a decent jump from Q3 ’22, so the comps will be tough. Nevertheless, the company has been busy winning contracts left and right, so if it can keep this momentum going forward, it will continue to thrive and be even more profitable.

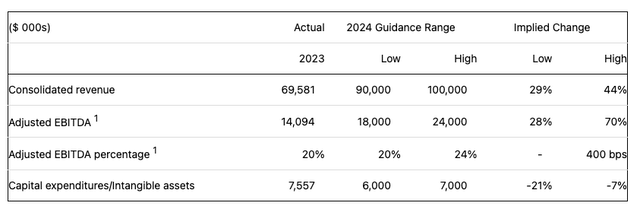

Speaking of profitability, I would like to see how the company’s margins performed since Q2. I want to see further profitability on the back of tremendous top-line performance. Back in Q2, the company reiterated its FY24 guidance. Will the company update us in the upcoming ER to the upside on the back of winning more contracts? Time will tell.

Seeking Alpha

Looking at the company’s outlook more broadly, government contracts have been known in the past to carry a rather low-profit margin for contractors. There is a lot of competition in the space, and with a company like Kraken, it’s got competition from many large companies in the space, which can easily take Kraken’s market share. However, we are not seeing this happening right now. This tells me that the company is leading the way in the products it manufactures. This is especially regarding the Synthetic Aperture Sonar technology, which it pioneered and seems to be in rather higher demand by looking at how the company’s top line progressed in the last few years. Army contracts are looking to be very lucrative, not just in the US but across the globe. With so much tension around the world from conflicts and other threats, it will bode well for the company if it persists, but not great for humanity overall.

The company has been issuing numerous shares over the last decade, with the latest offering closing back in October, which netted the company around $C50m. To be honest, for a young company like Kraken, share dilution is expected, and this capital is very welcome to help it grow further, which will most likely offset any share dilution that the shareholders are seeing. In the last decade, the shares outstanding increased by 390%, while at the same time, its share price sits at over 770%. So, as long as its share price continues to perform as well as it has, this shouldn’t be an issue.

Seeking Alpha

Closing Comments

Kraken Robotics Inc. seems to be a solid choice for the long run by the way it has been performing over the last few years. I am very impressed by the company’s ability to already turn a profit so early in its life cycle. However, I am going to sit on the sidelines for now and observe what is going to happen after the next quarterly report, which should come shortly. I would like to see how it has performed this past quarter and whether we will see an update to the rest of the year’s guidance. Furthermore, no matter the prospects, I don’t feel comfortable chasing the gains, especially after the company already gained 300% in one year without so much as a decent pullback.

I am putting this in my potential to own watchlist and will set a reminder to check out the numbers when the company reports before deciding, but I like what I see.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.