DailyFX.com -

Why and how do we use the SSI in trading? View our video and download the free indicator here

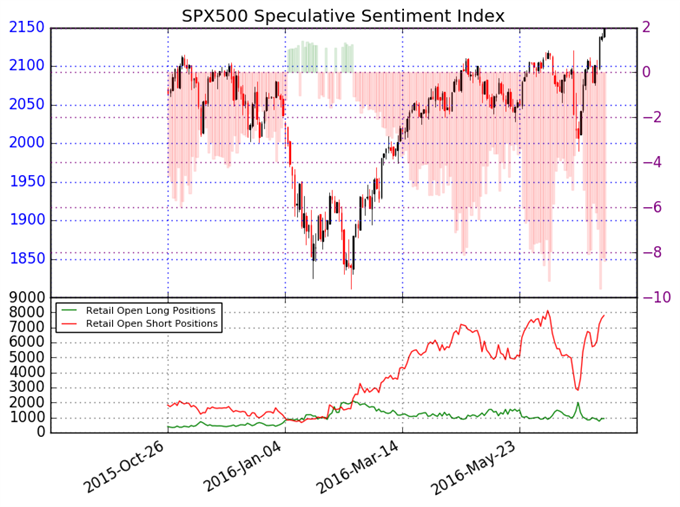

US S&P 500– Retail CFD traders recently hit a record net-short

position in the SPX500, which tracks the fair value of the US S&P 500, and a contrarian view of crowd sentiment warns further

gains remain likely. Indeed, our data shows there were a remarkable 10.2 retail short positions in SPX500 for every 1 long—a

whopping 91 percent of all open positions were short. This eclipsed the previous record set just one month ago as the index traded

to fresh yearly lows.

The clear caveat is straightforward—crowds are often their most net-short or net-long at key

market turning points, and such heavily one-sided sentiment suggests price momentum may be stretched. Yet by definition these

extremes are only clear in hindsight.

Until we see a substantial sentiment swing in the opposite direction, we see little reason to

call for a worthwhile reversal in the high-flying US S&P 500.

See next currency section: EURUSD - Euro Remains Weak, but Sentiment Warns this may not Last

--- Written by David Rodriguez, Senior Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via

e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX

original

source

DailyFX provides forex news and

technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.