The summer trading season is well underway following the July long weekends in Canada and the US. Even on days that the markets were closed, the Bullboards on Stockhouse were wide open and busy with lively discussions on some of the biggest (and smallest!) stocks that investors are tracking.

Every few weeks, we review the Stockhouse Community’s chatter with a Buzz on the Bullboards article.

Last time, we talked about each sector’s biggest talking points and how the conversations were trending, so this article we’re switching things up. Instead of looking at the most talked about companies, we’re highlighting stocks on the rise.

The spotlight is on how investors react when shares make big gains. Whether gains were part of a climbing pattern or a sudden and unexpected surge, Stockhouse users responded smartly: with equal parts hope and skepticism. Unfortunately, that sidelines the ever-popular cannabis Bullboards, as there weren’t many gains in the most talked about sector.

.jpg?width=600&height=315)

It’s not every day that we get to start in the technology sector, but Canadian software company

Martello Technologies Group Inc. (

V.MTLO,

DRKOF,

Forum) had one of the hottest Bullboards and stocks around. After a quiet and steady decline over the last six months, shares bottomed out on July 2 near a year low at $0.19. Four days later, they rocketed up to $0.78 on July 8,

a 310.5% jump.

(Click image to enlarge)

(Click image to enlarge)

What explains the MTLO share surge?

According to the Company’s announcement on the matter, it probably had to do with comments from Co-Chairman Bruce Linton, the former CEO of

Canopy Growth (

T.WEED,

CGC,

Forum).

Stockhouse Member

MNK3240 was one of many users on the same page. When you get a big name involved with proven expertise making small companies profitable, the result is a massive boost in confidence.

“It’s not pumping, just think about it, you got the best, world famous and brand-new billionaire entrepreneur CEO on your side. He was/is the best CEO now , who turned a small company to a multi billion dollar international company. He knows a thing or two…

…I think Martello is going to do something big in short term. Whatever Bruce can do is not important, it’s his presence will make whole bunch of things for Martello. It’s like Warren Buffet says hey I am going to invest in a small company to make it bigger, imagine the impact. It’s gonna be really fun...”

.jpg?width=600&height=315)

The biggest gainer on the metals and mining Bullboards may not have been the highest viewed, but it was probably the most praised. That’s because

Eldorado Gold Corp. (

T.ELD,

EGO,

Forum) is a case of long-term investors being rewarded. After hitting a year low in January at $3.36, ELD climbed back to $8.14 on July 8 by following through with solid operations, and early on July 10 managed to shoot past its year high to $8.77.

(Click image to enlarge)

(Click image to enlarge)

The gold company’s Bullboard discussions debated what the next move would be, and whether the climb would be able to continue. Eldorado Gold, for its part,

renewed its NCIB and

reported positive preliminary second quarter results. This may have fueled Stockhouse Member

stardust4’s recommendation that the Company will continue to trend upwards.

“Go Mitsotakis - Go Eldorado / Hellas Gold projects!

ELD MOVING ON THE FAST LANE. BUY.BUY.”

The healthcare Bullboards had a few companies generate noticeable buzz, but

StageZero Life Sciences Ltd. (

T.SZLS,

GNWSF,

Forum) in particular had an interesting few weeks. The company, formerly known as

GeneNews Ltd., changed its name on June 20.

Once trading commenced under its new trading symbol, investors responded positively, sending shares up from $0.14 to $0.20 on June 26.

(Click image to enlarge)

(Click image to enlarge)

Though SZLS has been climbing since June, the overall picture following a leap in February has been more tumultuous. Likewise, after the initial jump in shares towards the end of June, investors in July have been more muted on the Company’s potential.

Part of the reason, as Stockhouse Member

HornstGornkl points out on the Bullboard, is a lack of faith in the CEO.

“…What has Tripp done? He’s consistently over promised and under performed- actually zero performed in many cases. It’s been a broken record. Any promises made should be taken with a grain of salt or the whole Sifto plant.

Im holding this thing and will continue to do so. Face it. It’s upside is cheap. Will it happen? Sure hope so but I’m not holding my breath…”

It’s hard to stand out in the energy sector when the market is actively volatile, but

Inter Pipeline Ltd. (

T.IPL,

IPPLF,

Forum) has managed to gain in both share price and renown. After IPL shares closed at $20.67 on July 2, it climbed day after day, closing at $22.12 on July 9

for an increase of 7.01%.

(Click image to enlarge)

(Click image to enlarge)

The timing couldn’t be better for Inter Pipeline’s run, after lagging through the spring without much fanfare. Many investors on Stockhouse are bullish on IPL in the long-term, but discussion on the Bullboard showed that many didn’t know what caused the recent run.

Potentially, news got out ahead that

Inter Pipeline completed a major project. Another theory pinpointed the rise on analysts changing their tune on IPL after it cleared 50- and 200-day moving averages. Or, investors are simply getting around to appreciating the Company’s

high dividend yields. Stockhouse Member

hawk35 think that, regardless, the signs are pointing in the right direction.

“Another down day on North American markets and most pipe's are down but IPL is up on above average volume. I've been expecting consolidation as people take some profits but looks like the market feels IPL still has more room to run.”

Over on the industrials Bullboards, celebrations were abound for

dynaCERT Inc. (

V.DYA,

DYFSF,

Forum). DYA hadn’t been performing too well, with shares and trade volume alike had stagnated following a rally in January. By July 8, shares closed at a low $0.28. The next day, they were

up more than 50% to $0.43.

(Click image to enlarge)

(Click image to enlarge)

As with any sudden surge in price and volume, the DYA Bullboard was trying to make sense of the leap. Amidst the speculations and celebrations, the Company

announced that the Head Engineer of TUV Sud has been appointed to its European subsidiary.

The move was met with cheers, as investors are expecting dynaCERT’s carbon emission reduction technology to attain ABE certification. Many Stockhouse Members are expecting more good news to be released soon that would explain the shift in sentiment towards the company, and Member

rainorshine59 was already imagining DYA dominating headlines in the future.

“DYA is the Volume leader on the upside on TSXV...

soon to be the volume leader on [Insert EXCHANGE: ______]”

After not recapping the bitcoin Bullboards for a few months, we return just in time for a round of debate on blockchain tech company

CUV Ventures Corp. (

V.CUV,

MPSFF,

Forum). CUV had made massive strides in early June before quickly correcting (or falling) back down. After shares hit a trough at $0.24 on June 28, a week later they had climbed back up to $0.275.

(Click image to enlarge)

(Click image to enlarge)

Unfortunately, as the chart above shows, the story didn’t end there. Shares dropped once again on July 11, and the

latest corporate update more than a week ago sheds little light on the recent waves.

What does CUV’s Bullboard think? One speculative line of thinking from Stockhouse Member

Jimpro63 is that purchasing decisions behind-the-scenes might be influencing things.

“Who is going to be the lucky owners of them on the open Market ? This Ceo Anthony ( Stevie ) Marshall now has to come up with the money to buy that " significant" amount of those 15 Million cheap shares from Vesilen ; the ONLY major shareholder left holding the bag in this little Venture Company .

Does " Jaycee123" and gang pump-it-up for Stevie to sell ? then drop it down for the purchase of Vesilen's shares ??? Time will tell...”

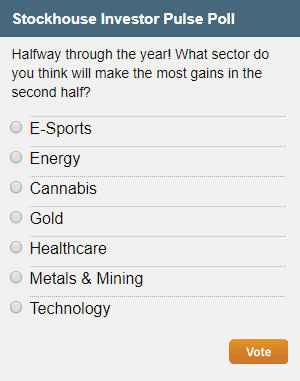

Given our focus on rising stocks, and the surprising lack of gains in the cannabis sector, our latest Investor Pulse Poll seems all the more relevant. We want to know what sector you think is the one to watch in the latter half of 2019, so head over to the

homepage to cast your vote.

(Click image to go to the poll)

(Click image to go to the poll)

On the next issue of Buzz on the Bullboards, we’ll examine the poll results and see if Stockhouse users think Cannabis will hold on to the top spot or if a new challenger is going to take the crown. Until then, the Stockhouse Bullboards remain one of the best places to make sense of the sudden gains (and inexplicable losses) made by the companies you’re invested in. For previous editions of Buzz on the Bullboards:

click here.