(Image via HEXO Corp.)

(Image via HEXO Corp.)

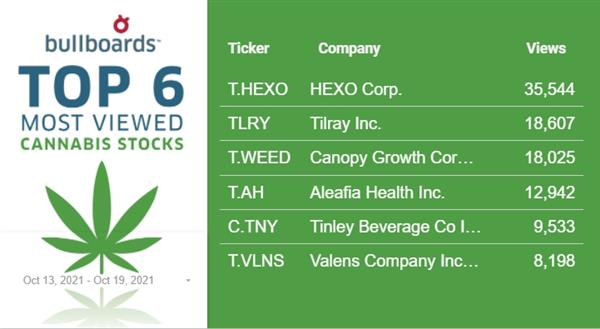

Canada’s largest financial portal for Canadian small-cap investors is right here at Stockhouse. It is where our Bullboards –

your Bullboards – are a leading forum to discuss these Canadian-listed small-cap businesses.

Want to hedge against market volatility by increasing your exposure to gold? Precious metals mining stocks are on sale.

Want to capitalize on the Electric Vehicle Revolution? Battery Metals stocks are on sale.

Cannabis is strong, cannabis has amazing growth potential. However, relative to these other sectors, cannabis stocks are closer to being fully valued.

Who mader news this week? We start with a licensed producer of innovative products for the global cannabis market -

HEXO Corp. (TSX: HEXO, Forum), who announced executive changes as it completes a strategic reorganization.

Sebastien St-Louis (pictured above), HEXO’s Co-Founder and CEO,

has departed the company effective immediately.

“Building HEXO from the ground-up to become number one in Canada has been the highlight of my career,” St-Louis said. “Without question, HEXO’s future is bright – I am so proud of the team we established, the brands we launched and the loyalty our customers have shown us. As a significant shareholder, I look forward to the company’s next exciting stage of growth.”

Dr. Michael Munzar, Chair of the Board, stated,

“On behalf of the entire organization, I would like to thank Sebastien for his tremendous impact on the Canadian cannabis industry. Through his years of dedication, he has helped build HEXO into a market leader in Canada.

The board has established a Special Committee for Succession to identify a new CEO with the experience to defend HEXO’s position as a market leader in Canada and secure our place as a top-three global cannabis company.”

The Special Committee is in advanced discussions with a preferred CEO candidate and expects to make an announcement in the coming days.

The company believes its new CEO will be well-positioned to integrate recent acquisitions and leverage HEXO’s lean production capabilities, brands and robust product offering to lead it through its next phase of strategic evolution. It was just last Thursday when he spoke at

MJBizCon.

HEXO also announced the resignation of its Chief Operating Officer, Donald Courtney, thanking him for his operational excellence by increasing scale and automation. He will remain as COO until a suitable replacement is identified.

Elsewhere in the market,

Tinley Beverage Company Inc. (CSE: TNY, Forum) recently closed its non-brokered private placement for gross proceeds of

$1,865,670.75.

The company issued 12,437,805 units priced at $0.15 per unit. Each unit consists of one common share and one purchase warrant. Each warrant is exercisable into one common share at a price of $0.20 (CAD) for a period of 24 months following the closure of the offering.

Richard Gillis, President and Chief Operating Officer of Tinley’s, subscribed for 1 million units.

“I made this investment to demonstrate my confidence in Tinley’s growth trajectory,” said Richard Gillis. “Our canning line nearing completion provides us with our third packaging production option, and our tunnel pasteurizer plus the additional upgrades we are now engineering allow us to offer a broad menu of paths to production to satisfy Q4 customer demand. I’m more excited than ever to see the Tinley vision becoming a reality.”

Advisory board member Andrew Stodart also participated in the offering.

“We are delighted to have key executives who lead our growth in both Canada and the USA participate in the Offering,” said Ted Zittell, member, Office of the CEO, and director of the company. “Our commitment to building value in both countries remains as strong as ever.”

Net proceeds from the offering will be used for working capital, capital expenditures, marketing, establishing new business lines and exploring potential mergers and acquisitions. The company issued an aggregate of 760,256 compensation options and paid aggregate cash commissions of $114,625 to eligible finders.

Tinley manufactures the Beckett’s Classics and Beckett’s 27 line of non-alcoholic, terpene-infused spirits and cocktails. Cannabis-infused versions of these products are offered under the Tinley brand in licensed dispensaries and home delivery services throughout California, with expansion to Canada underway.

Kelowna BC-based cannabis extraction outfit

The Valens Company Inc. (TSX-V: LNS, Forum) has announced an exclusive partnership with

Epsilon Healthcare Limited (ASX: EPN) (Epsilon – that it has executed a letter of intent with Société Québécoise du Cannabis for the distribution of its cannabis products into Québec.

This marks a significant milestone for Valens entering the third-largest cannabis market in Canada, representing approximately 15% of Canadian cannabis retail sales in the country and approximately 22% of the Canadian population.

Canadian mining company

Ivanhoe Mines Ltd. (TSX: IVN, Forum) will report its Q3 2021 financial results before market open on Monday, November 15, 2021. Management will host a conference call and webcast to discuss the results at 10:30AM Eastern Time the same day.

For details on how to listen in to the call, click

here.

New Found Gold (TSX-V: NFG, Forum) released assay results from 11 holes drilled at the Keats Zone, located along the Appleton Fault Zone. These holes were completed as part of the company’s ongoing 200,000 metre diamond drill program at its 100% owned Queensway Project, located on the Trans-Canada Highway 15 km west of Gander, Newfoundland.

For a deeper look at these results, click

here.

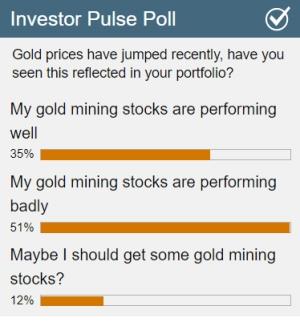

Speaking of gold, prices have jumped recently, but have you seen this reflected in your portfolio? Judging by the response to last week’s Investor Pulse Poll … the answer is a resounding “NO”.

That being said, there is more than one way to generate returns from your investments, one of those is diversity in your portfolio. This week we want to know, just how diverse is your portfolio? Let us know by clicking the image below to cast your vote.

(Click image to vote.)

(Click image to vote.)

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

In the tech segment,

PyroGenesis Canada Inc. (TSX-V.PYR, Forum) has secured a

$1.5 million government award for a phase 2 contract in developing a ceramic powder processing system.

PyroGenesis’s system utilizes a thermal plasma process to synthesize carbon nanotubes and deposit them on a ceramic powder within a single plasma reactor. Carbon nanotubes hold significant potential for mechanical reinforcement in composite materials like ceramic. The bundling of carbon nanotubes has prevented this potential from being realized, which the system intends to resolve.

The company is in the process of building an integrated and automated system to produce high-quality ceramic powder products in a safe, economical, and scalable manner. First it would optimize the process, then finalize the design and manufacturing of the system. Phase 2 follows a successful first phase as proof of concept.

Pierre Carabin, CTO and chief strategist of PyroGenesis cited the advantage of its solution is being able to process ceramic powder in the same reactor as the carbon nanotube synthesis.

“We believe this process will prove far more efficient and scalable than conventional technologies such as the chemical vapor deposition process,” he said.

“Additionally, we believe that our technology is capable of processing a variety of composite materials, which could lead to the development of new IP and product lines for other specialty powder production technologies.”

More news from the company this week, as its subsidiary,

Pyro Green-Gas, also received part of a $9.3 million contract with Tata Steel. Under the contract, Pyro Green-Gas will supply a coke oven gas purification and hydrogen production system that can extract high-quality hydrogen with significant environmental benefits.

The remaining contract balance, which is approximately $3 million, is expected to be received in full within the next nine months. In addition to the payment received today, Pyro Green-Gas has signed an additional contract for $267,000 with Tata Steel to provide supplementary engineering improvements to the dry coke oven gas desulfurization and hydrogen production process already under contract.

Pyro Green-Gas will supply filters that will further purify the remaining gas, removing condensed hydrocarbons, naphthalene, and dust from the coke oven gas infrastructure. This will allow the purified gas to be used as a fuel for galvanizing and annealing furnaces in steel processing.

P. Peter Pascali, CEO and Chair of PyroGenesis, commented,

“We are very happy to be announcing our expanding relationship with another multi-billion-dollar entity.” “It is clear,” he added, “that this acquisition is proving to be an exceptional addition to our offerings.”

PyroGenesis Canada is a leader in the design, development, manufacture and commercialization of advanced plasma processes and sustainable solutions. The company has created proprietary, patented, and advanced plasma technologies that are being vetted and adopted by multiple multibillion-dollar industry leaders in four massive markets: iron ore pelletization, aluminum, waste management, and additive manufacturing.

Operating from a position of strength as a result of its

strongest balance sheet to date, data intelligence company

Fobi AI Inc. (TSX-V: FOBI, Forum) released details on its agreement with

REVELXP, who will utilize the Fobi Wallet pass technology to engage fans at the company’s university football events.

Fobi’s platform will enable fans to easily navigate to their tailgate, access a field pass, participate in an exclusive meet-and-greet or unlock merchandise discounts. The deal will see Fobi receive an initial setup fee for each event, together with licensing revenue for each Wallet pass distributed to fans. An embedded messaging function will also enable the REVELXP staff to communicate with fans for schedule or location changes, as well as in the event of inclement weather.

Ray DeWeese, CEO, REVELXP commented on the partnership with FOBI.

“We are constantly seeking advanced solutions to make our premium hospitality experiences even more seamless for our fans. Fobi’s platform makes it easier for fans who purchase a tailgate or other experience to share event details with their guests and minimizes any logistical questions that often arise on a busy game day. We are excited to immediately make the technology available to fans this season.”

The Sports Event market is projected to reach $6.5 billion (USD) in 2021. This market is forecast to grow to $32 billion (USD) in 2025.

Rob Anson, Fobi CEO remarked,

“Fobi enables venue operators to provide their guests with a more personalized digital experience. The relationship with REVELXPwill provide Fobi with a great opportunity to showcase our technology with one of the premier organizations in collegiate and professional sports.”

REVELXP is focused on working with college athletic departments and professional teams to maximize fan engagement, identify new revenue streams and successfully welcome back fans in today’s post-pandemic environment. The company’s services span design and custom-builds, seating solutions, equipment needs, ticketing services, turnkey tailgates, event staffing and more.

Fobi is a cutting-edge data intelligence company that helps clients turn real-time data into actionable insights and personalized customer engagement to generate increased profits.

Finally,

BlackBerry Limited (TSX: BB, Forum) announced that it is joining forces with the likes of

Google (NASDAQ: GOOG, Forum) and Qualcomm Incorporated (NASDAQ: QCOM, Forum) to drive advancements in

next-generation automotive cockpits. This comes via the availability of a QNX Hypervisor and VIRTIO-based reference design to virtualize Android Automotive OS on the 3rd Generation Snapdragon Automotive Cockpit Platform, helping automakers to deliver the ultimate cockpit experience while accelerating time to market.

Mining, cannabis, or tech? Investors don’t have to choose. There are plenty of great small-cap investment opportunities in each of these sectors. For those investors with a clear preference for technology, the next couple of weeks on Stockhouse should be especially interesting as we cover CanTech and small-cap Canadian technology stocks.

For previous editions of Buzz on the Bullboards:

click here.