Source: Claudia Avalos of

The Energy Report (8/31/15)

https://www.theenergyreport.com/pub/na/can-tesla-make-winners-out-of-these-lithium-players

Tesla Motors Inc. (TSLA), long known for its ability to keep its buzz machine churning, gave lithium investors something to get excited about this weekend. On Friday,

Bacanora Minerals Ltd. (BCRMF)[BCN:TSX.V] and

Rare Earth Minerals Plc (RARMF)[REM:LSE], owners of the Sonora Lithium Project, announced that they had finalized a conditional, long-term lithium hydroxide supply agreement with the car and battery giant.

The Energy Report reviewed the commentary of leading lithium experts Simon Moores and Chris Berry to anticipate what the new agreement may mean for the sector.

Bacanora and Rare Earth Minerals saw their stock take a nice bump upward as the news was announced on Friday. According to the news release, Tesla will buy lithium hydroxide to feed the manufacturing of batteries at its Nevada Gigafactory on the condition that the Sonora project reaches certain milestones and passes product specification qualifications. Though the press release did not specify how much material will go to Tesla, Bacanora estimates the Sonora project will have an initial production capacity of 35,000 tonnes per annum (35 Ktpa) lithium compounds with the potential to scale up to 50 Ktpa.

Simon Moores, managing director of London-based Benchmark Mineral Intelligence, estimates Tesla could consume as much as 80% of total output. In a

recent interview with

The Gold Report, Simon Moores correctly predicted that Tesla would be focused on supply security in H2/15. "If Tesla wants to drive down the price of batteries by 30% or more," he said, "it is going to have to go all the way to the raw materials to cut costs. . .this is where the company must start."

Chris Berry, co-author of

The Disruptive Discoveries Journal, had this to say about the deal: "The agreement between the companies offers an interesting window into Tesla's supply chain strategy. What the company has done here has purchased an out-of-the-money call option on future lithium supply."

An Increasingly Lithium-Hungry World

For his part, Colin Orr-Ewing, chairman of Bacanora, is enthusiastic about what the deal means for his company and its partner: "This supply agreement with Tesla represents a vital and monumental step forwards in the commercialization of the large lithium resources that the company holds, together with its partner Rare Earth Minerals, in northern Mexico. We anticipate this contract to rapidly accelerate the development of the Sonora Lithium Project, which we expect will prove to be invaluable in an increasingly lithium-hungry world."

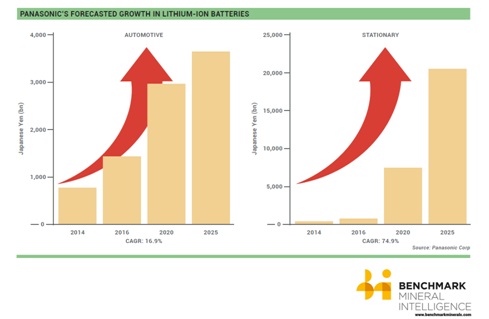

Leading battery manufacturer Panasonic Corp. is predicting powerful growth in emerging markets for lithium-ion batteries. The chart below shows Panasonic's expectations between 2014 and 2025.

Source: Benchmark Mineral Intelligence

Welcome Relief for Lithium Companies?

Source: Benchmark Mineral Intelligence

Welcome Relief for Lithium Companies?

Tesla's supply chain strategy could have a positive effect on a lithium industry that badly needs new investment. The deal has piqued investors' sometime-waning interest in the lithium sphere. But Simon Moores warns there are challenges: "The biggest hurdle to the agreement is Bacanora's need to secure significant financing through debt and/or equity, which Tesla may itself be involved in."

And though Chris Berry calls the deal "an encouraging first step," he remains cautious, noting "while it likely won't breathe new life into the mining space (if Friday's closing prices of the 34 lithium plays I track are any indication), it is a signal of companies anticipating future demand. I would expect to see Tesla and perhaps other battery manufacturers undertake additional 'out-of-the-money call option'-type deals as the lithium market tightens over the next two years. This is also likely to be true for cobalt and graphite."

The Takeaway

Simon Moores stresses to investors that thinking long term is crucial. "The timing appears good for Bacanora, with lithium prices at five-year highs intensifying the need for new supply. Lithium hydroxide has risen as much as 25% this year, while carbonate is up as much as 15% on 2014 levels. A lack of new supply in the face of steadily increasing battery demand has seen the lithium industry fall into a supply shortage."

Chris Berry had this takeaway: "Perhaps the most significant conclusion is that you're just starting to see these next-generation value chains come to life."

Want to read more

Energy Report interviews like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our

Interviews page.

Top of Form

Bottom of Form

Top of Form

Bottom of Form

DISCLOSURE:

1) Claudia Avalos compiled this article for Streetwise Reports LLC, publisher of

The Gold Report, The Energy Report and

The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: none.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: None. The companies mentioned in this interview were not involved in any aspect of the article preparation or editing. Streetwise Reports does not accept stock in exchange for its services.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise –

The Energy Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Energy Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

Email:

jluther@streetwisereports.com