As investors in stocks and commodities abandon long positions amid plunging world markets,

Brent Crude oil prices continue to slide south. Tehran’s Foreign Minister Mohammad Javad Zarif announced last week that the United States, European Union, and United Nations would lift sanctions against Iran, opening the commerce pipeline for the oil-producing country to add, to an already overflowing world supply, half a million more barrels of Iranian crude each day.

Many large crude producing countries, like the United States, Canada, Norway, Russia, China, and Mexico, have watched oil prices drop while their oil supplies test storage limits. According to

Finanssans, Norway could lose over 70 percent of it’s estimated oil wealth if the price remains at the current level. Even before the November of 2014 Organization of the Petroleum Exporting Countries (OPEC) announcement that the 13-country oil cartel would continue to flood an already oversupplied market, crude prices had begun to decline. The OPEC nations, Algeria, Angola, Ecuador, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates and Venezuela, in the meantime, continue to pump. OPEC nations, anticipate that declining oil prices will force non-OPEC producers, many with higher production costs, to scale down competing production. While some OPEC nations can produce oil around ten dollars a barrel, oil production in the Americas and Europe runs from three to four times this price, making it difficult for companies in the northern continents to compete with their OPEC rivals.

As non-OPEC countries scramble to sustain their marketability, the National Iranian Oil Company (NIOC) announced intentions to cut its light crude oil prices to north-western Europe, by $0.55 a barrel, while discounting Mediterranean deliveries by about a third of that price. While OPEC countries continue high volume production and price-cutting, non-OPEC European, North American, and Asian producers will undoubtedly feel the grip tighten even more around their already strained margins.

Iranian production will undoubtedly take some time … perhaps a year or more ... to reach the predicted half million mark, but crude prices continued to drop after the NIOC announcement. As the U.S.'s celebrated Martin Luther King's holiday, Monday, the 18

th of February, Brent Crude's price reached a 52 week low of $27.67, the lowest price since early May of 2015, down nearly 61% from the 52 week high of $73.21. The day saw trading volume below the previous week's volume, partly due to the holiday.

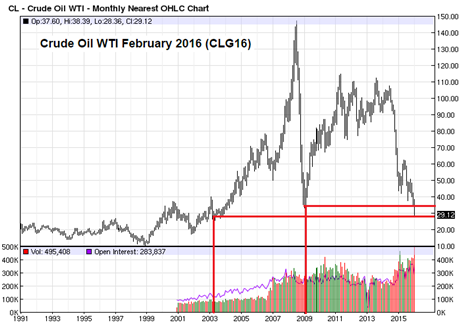

Not only have Brent crude prices tanked below the 12-month lows, but they continued downward, beyond prices from as far back as 2003. March crude contracts, on the Chicago Mercantile Exchange, traded as low as $28.40 this week, while J.P. Morgan, in a report from Monday, the 18

th of January of 2016, predicted average crude oil prices this year to fall to $31.50 a barrel, with Brent crude bottoming out near $31.25 a barrel.

The year's dropping crude prices coincide with overall bearish sentiment in other markets, as well. The S&P 500, likewise, hit a 52 week low of 1865 on Tuesday, 19 January 2016. Equity prices have taken a hit, like those of crude oil and metal commodities, after many investors, disappointed by a slump in Asia's new-found growth, pulled out of China, the number two oil consumer on the planet, and its rising satellites. Increased volatility has left the market to strategists prepared for strong movements to either direction.

Will someone catch the falling knife soon? OPEC as well as non-OPEC players have boosted their production since 2014, even as crude prices continue to plunge. The players, aware that the knife has almost reached the bottom of the oil tank, and busy holding their breath, might see a viscous drowning before coming up for air and diving back in to keep the blade from punching a hole in the whole tank.