Source: Bob Moriarty for

The Energy Report (8/15/16)

https://www.streetwisereports.com/pub/na/17067

Bob Moriarty discusses a tiny Canadian technology company based in Calgary with an award winning battery/power converter that is more powerful, more portable and easier to install than the Tesla equivalent.

Distributed Storage

Between 2014 and 2024 solar/wind power systems or

Distributed

Energy

Storage

Systems (DESS) are predicted to increase some sixty-fold from 200MW to greater than 12,000MW, according to research firm Navigant. That would put the market for DESS at $16.5 billion. Elon Musk plans on cashing in on the demand for this new technology with his Powerwall 2.0 home battery to be produced in his $5 billion "

Gigafactory" in Nevada spanning 135 acres for the building alone.

A tiny Canadian technology company based in Calgary has already skunked Tesla with an award winning battery/power converter that is more powerful, more portable and easier to install than the Tesla equivalent. The average home installation would need two of the Tesla Powerwall devices but

Eguana Technologies Inc. (EGT:TSX.V; EGTYF:OTCQB) can provide the same storage capacity with one unit.

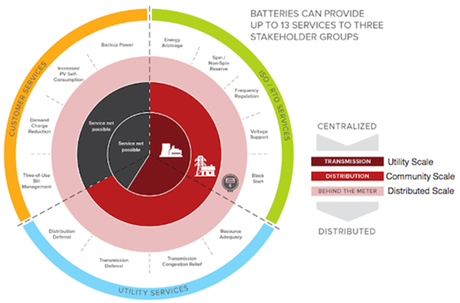

A DESS unit is composed of three different elements. You have a power source that can be solar, wind or even the grid itself during non-peak hours. You also have an inverter/power control unit that converts the input power for passing on either to the user or to a storage unit, some form of battery for later use. The power control unit also has to be able to pass higher voltage power back to the grid when necessary or desirable. The third part of the triangle is a battery or storage unit.

Ambrose Evans-Pritchard of

The Telegraphjust wrote an interesting article about the technology of batteries for DESS in the last week. In the piece he quotes another industry expert, the consulting group

McKinsey, as saying they estimate the total market as $90 billion by 2025.

Evans-Pritchard begins the article suggesting the next energy revolution is no more than five to ten years away. It will be led by battery technology as costs are decreasing far faster than either solar or wind power inputs.

Batteries for storage are literally the missing link but costs are plummeting. Between 2011 and 2014, prices for storage dropped 50%. Elon Musk believes he can lower

the cost of DESS to $100 per kWh by 2020 at which point solar becomes competitive with carbon-based power generation.

Storage for energy is the missing link, the holy grail of renewable energy. Solar cells and wind turbines have been around for yonks even if hardly economic. But the wind doesn't always blow and the sun doesn't always shine. An affordable way to store excess energy for use when it is most needed or to pass back into the grid makes renewable energy possible. At some price it even will surpass the value of carbon-based energy with all its attendant problems. An inexpensive battery/storage system makes the entire concept viable.

Eguana Tech is a fifteen-year-old company that is brand new. The company spent those years and $30 million developing the technology for the power control units that sandwich between the solar panels and the battery storage units. They simply have the best inverters/power control units in the market being 4–12% more efficient than the competition in power conversion.

The company has installed units in over 5,000 storage systems. It is a 3

rd generation platform with 35+ MW operational. They have a variety of patents protecting their technology with both a low-cost and high-performance advantage over other companies.

I said the company was fifteen years old but that it is brand new. With the decreased costs of both solar cells and battery/storage units, a year ago the company made the decision to transition from design to market penetration intending to ride the wave of commercialization as lower costs drive demand higher by 45% per year.

Eguana has cash flow now with revenue trending at a $6 million per year run rate. With the 18 design wins over the past twelve months in the US, Europe, Australia and Japan, it's time to convert design into sales on a massive scale. By my figures, with their penetration in the California, Hawaii, Australian and German market, the company could achieve sales of $60 million per year in the next 18 months. Gross margins should be in the 25% to 35% range.

Automobile manufacturers are starting to enter the residential DESS marketplace with Daimler and Nissan indicating an interest and participation. In

June of 2016 Eguana announced delivery to an unnamed German carmaker of their Power Control Solution (PCS) for integration in a European designed DESS.

Currently potential and actual customers are battery manufacturers, distributors of solar or wind power systems, and electric utilities. Eguana's competitive advantage is in their software technology that optimizes storage performance and power conversion both in and out of the storage unit with a 4–12% advantage over other manufacturers.

The race is not to the swift nor the battle to the brave but that is the way to bet. What the market is going to reward now will be the ability to pivot on a dime. The DESS market is fluid but giant in potential. It will be as important for a company to be able to change direction as to have a technological advantage. Every jurisdiction has different legal and technical requirements. Eguana is targeting the most attractive and economically potential markets first without betting the farm on any particular market.

Elon Musk is bringing a lot of attention to both the automobile and the battery storage market with his $5 billion dollar investment in the future. In one way, he is actually doing the marketing and customer education for Eguana. With the size and penetration of the batteries from the Gigafactory into the market, Tesla will be naturally slower to pivot because of their mass. Eguana can modify products to fit changes in demand in a far shorter time frame. So they get the benefit of his marketing yet retain the flexibility of a small company.

In his speech at the Tesla annual meeting on May 31, 2016, Elon Musk said that the production of batteries could be a bigger business for Tesla than the manufacture of electric vehicles. Tesla believes their DESS business could grow from $160 million per year now to over a billion dollars in a couple of years.

For the next fifteen years, renewable energy is going to be "The Next Big Thing" as the decreasing cost of solar, wind power and battery storage solutions make renewable energy competitive with carbon based power generation. Eguana is perfectly positioned to ride that wave of economic opportunity. They have income now with experience in the market place and are aiming at a major push into serious revenue increases in the next year.

Eguana is just entering the most interesting and highest potential growth phase of what everyone believes will be an enormous market. Their ability to change and manage curvilinear growth will be the key to their success and potential down the road. I've talked to management at length about their plans and how they see themselves growing with the market. This is a management issue. The demand exists and will continue to expand. The only question is can Eguana expand with the market.

I believe they can and as a result I bought shares in the open market based on my belief they have both the technology and the management bandwidth to transition from a tiny Canadian junior to a major player in a big market.

Eguana shares were as low at $0.08 in January before starting a climb to a high of $0.39 a share in June. The share price has made a perfectly normal correction down to $0.25 this month and has just broken out higher. I expect them to be making a new yearly high shortly. Eguana did a $7 million private placement that closed in early July and is well cashed up for the next year and a half.

With Eguana you are buying blue sky. The company has a market cap of about CA$60 million. Based on their prior sales and projections for the future, that would seem perfectly reasonable. But I think investors have to take into account the growth rate of the industry and the potential for Eguana to execute.

Rather than look at a $60 million per year run rate, I think you have to think about a company doing $60 million a year but increasing at an annual growth rate of 45%. If you plug that into a spreadsheet, the numbers get big in a hurry. And the 45% is the average of all companies, not one that is a technical leader in their own niche. I really do believe Eguana has skunked Tesla.

Eguana is an advertiser and as such I am naturally biased. I own shares bought on the open market. Their website is a little too technical for my tastes but it will be easy to follow their financials which will reflect the success or lack of success of their business plan. Do your own due diligence.

Eguana Technologies

EGT-V $.29 (Aug 15, 2016)

EGTYF-OTCQX 199.3 million shares

Eguana

website

Bob and Barb Moriarty brought 321gold.com

to the Internet almost 14 years ago. They later added 321energy.com

to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more

Energy Report interviews like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation or editing so the expert could write independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Bob Moriarty: I or my family own shares of the following companies mentioned in this article: Eguana Technologies Inc. I personally am or my family is paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Eguana Technologies Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

Streetwise –

The Energy Report is Copyright © 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Energy Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 773-5020

Email:

info@streetwisereports.com