President Obama just had his first veto override of his entire presidency today, as the Senate and House both voted to override his veto of the 9/11 victims bill, Justice Against Sponsors of Terrorism Act (JASTA). As of this moment, the Sept 11 bill is now law.

Intense lobbying by both the Obama Administration and the Saudi government didn’t amount to much in the end, with strong public support leading to a 97-1 veto override vote today. The long defector from the unanimous vote back in May was Sen. Harry Reid (D – NV). The House easily cleared the two-thirds threshold with a 348-77 vote.

The bill, the Justice Against Sponsors of Terrorism Act (JASTA), S. 2040, allows the families of 9/11 victims to sue Saudi Arabia over its role in the plot. 15 of 19 terrorists on 9/11 were citizens of Saudi Arabia. Many believe the government has gone to great lengths to cover up the Saudi’s role in 9/11, as they are long-time friends and business associates of the Bush family. In fact, 29 pages of the 9/11 Commission Report were initially not released in order to prevent embarrassing the Saudi royal family.

Once the pages were finally released, it is clear to see why they were kept classified for so long. They show strong evidence that the government of Saudi Arabia was involved in sponsoring the terrorists, which calls into question our justification for going into Afghanistan and Iraq shortly after the attacks.

Page 415: “While in the United States, some of the September 11 hijackers were in contact with, and received support and assistance from, individuals who may be connected to the Saudi Government.… [A]t least two of those individuals were alleged by some to be Saudi intelligence officers.”

Page 417: One of the individuals identified in the pages as a financial supporter of two of the 9/11 hijackers, Osama Bassnan, later received a “significant amount of cash” from “a member of the Saudi Royal Family”during a 2002 trip to Houston.

Page 421: “a [deleted], dated July 2, 2002, [indicates] ‘incontrovertible evidence that there is support for these terrorists inside the Saudi Government.’”

Page 426: Bassnan’s wife was receiving money “from Princess Haifa Bint Sultan,” the wife of the Saudi ambassador. (Her correct name is actually Princess Haifa bint Faisal.)

And there are reports of several members of the Saudi family being secretly flown out of the United States on the morning of 9/11, with the clearance of government officials. Whether their motive was to get the U.S. military to attack their enemies in the Middle East or something else, the media has for years been quiet on the Saudi involvement, instead focusing on Saddam Hussein.

Saudi officials have previously threatened to collapse the US treasuries market if the bill becomes law. The kingdom holds nearly $100 billion in U.S. debt. Many believe that the massive selling of dollar-denominated assets will crush the value of the dollar and send it into a rapid death spiral. But Saudi Arabia is the 15th largest holder of U.S. debt and while $100 billion is more than chump change, it isn’t enough to crash the dollar.

The threat of the 9/11 bill passing has put on hold Saudi plans to issue its megabond, effectively putting even more pressure on the kingdom’s finances. This will effectively force them to sell off huge amount of U.S. bonds and equities, estimated at $500 billion to $1 trillion. While this might not be enough to crash the stock market, it could be the proverbial straw the breaks the camel’s back.

Obama responded to the veto override today:

Adding to the potential threats to the U.S. dollar is the fact that the IMF is going to change the makeup of its special drawing rights (SDR) calculation for reserve currencies on October 1. The SDR is a derivative reserve currency created by the IMF to try to diversify global reserve currencies, and to some degree that’s intended to lessen the reliance on the US dollar as the single reserve currency.

One well-known writer beleive this is a first step in the IMF taking over global currencies.

“Not only could this event gut the U.S. stock market… and cannibalize your retirement savings… but it could ultimately END what we’ve come to know as the American way of life.”

“… there is a new form of currency that’s about to flood the world economy. It’s not money for you. You’ll never get to withdraw it from an ATM, even if you travel overseas.

“This new form of money is strictly created for the financial elite.

“We call it ‘world money’ because of what it could ultimately do — and soon — which is replace U.S. dollar reserves around the world.

“That’s right — this is as close to the end of ‘king dollar’ as we’ve ever come.

“Now, what does that mean exactly? After all, what do you care if the people in Asia, Europe or the Middle East suddenly decide the dollar no longer gets #1 status around the world? ….

“Losing our #1 status means giving up a whole slew of benefits you never knew you had….”

“If you’ve got even a nickel in dollar-denominated wealth, you need to pay attention.

“Because, make no mistake, the day ‘world money’ fills that role… the value of the dollars in your bank account will plunge in value, virtually overnight.”

Well, that is a very scary scenario put forth by this widely-read analyst. But is there anything behind these threats or is he just trying to scare investors into buying his book/newsletter?

I think the latter is true. Why?

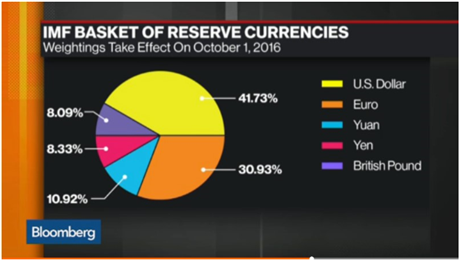

Currently, the SDR is made up of the U.S. dollar (41.9%), euro (37.4%), Japanese yen (9.4%), and pound sterling (11.3%). As of October 1, the makeup will be: U.S. dollar relatively unchanged at (41.73%), and weightings for the euro (30.93%), yen (8.33%) and pound (8.09%) fall to make room for a 10.92% slot for the Chinese currency.

The SDR is just a basket of currencies of which the dollar is the largest holding. The dollar’s allocation is essentially unchanged with the September 30 inclusion of the Chinese Yuan. Furthermore, there are only a few hundred billion SDRs in existence versus roughly 10 trillion US dollars in the global money supply. This could obviously change in the future, but as of right now, neither the SDR nor the Yuan have the liquidity or market depth to replace the dollar.

The markets have known about the SDR for decades and the inclusion of the Yuan was announced nearly a year ago. That means the dollar has already had a year to digest this news and has barely budged. Many of these same analysts have been claiming this “imminent collapse of the dollar” for years and the USD has mostly advanced versus other currencies.

Over the medium and long-term, I am bearish on the U.S. dollar. I believe it will continue losing purchasing power, as it has since politicians did away with the discipline of the gold standard. I think the devaluation could accelerate in the years ahead and will eventually lead to hyperinflation.

We have already seen sign of this in recent years. The dollar isn’t losing value versus other currencies, because they are debasing aggressively as well. But it is clearly losing value versus asset prices such as stocks and real estate. And it is part of the reason that gold and silver prices are finally catching fire this year.

But I don’t think there is an imminent threat of the dollar, stock or bond market collapsing on September 30th or shortly after this event. Even with the combination of the Saudi threat to dump Treasuries and the Yuan’s inclusion in the SDR, the world is not going to give up on dollars overnight.

This doesn’t mean that the stock market isn’t going to correct in the near term. It is vastly overvalued in my estimation and due for a major correction at some point in the months ahead. But this correction is unlikely to be sparked by the the inclusion of the Yuan in the SDR.

De-dollarization is very real and I have no doubt that the dollar will continue to slowly lose its role as reserve currency. But the key word is slowly, as has been the case over the past several years. Russia and China are leading that charge, along with other BRICS nations that are now trading outside of the U.S. dollar and setting up alternative financial systems to bypass Western financial institutions.

This continued devaluation of fiat money is a key reason that we remain long precious metals and hold shares in the companies that mine them. Those shares have been providing leverage of nearly 4X the advance in the metals and we remain long despite the recent pullback.

Gold and silver prices are holding above key technical support despite the threats of a rate hike by year end. Notice that $1,305 has been both support and resistance over the past year. It is coincides with the uptrend support line and is just below the 200-day moving average.

Support at $1,305 is likely to hold, but the series of lower highs is a bearish indicator. Longer-term support is strong in the $1,250 to $1,260 range, should $1,305 support fail.

The FED’s calls to hike rates multiple times in 2016 were a bluff. But even if the FED finally decides to hike rates by 25 basis points, I don’t believe it will will have much impact on the gold price. There is a long history of gold rising alongside interest rates. The most recent hike occurred in December of 2015 and was followed by a 30% advance in the gold price, 50% advance in the silver price and 100% advance in mining shares.

So, I continue to believe that the fear of a rate hike is misplaced and that the markets are incorrectly pricing gold and silver based off this fear. Investors can take advantage of this mis-pricing via buying the dips when others panic and keeping a long-term time horizon.

The next advance is likely to take the gold price above $1,600 and the silver price back above $30. This could happen very quickly as the fear over the impact of a rate hike subsides. It will happen even faster should the markets crash and the FED is forced to reverse course on rate hikes.

Either way, gold and silver prices will continue to be supported by easy money policies, skyrocketing debt loads, record low interest rates, currency devaluation wars and political uncertainty. After a long 4 year correction, the gold bull is well rested and this next major bull cycle is just getting warmed up.

I believe this is an opportune time to buy the dip, not because the dollar is going to crash on September 30, but because gold and silver remain undervalued. In addition, mining shares remain undervalued relative to gold and silver prices. So, we expect a continuation of the incredible leverage that was realized through the first half of the year from shares in quality mining stocks. Junior silver stocks in particular have the potential to generate outsized gains over the next 12 to 24 months and we have allocated the GSB portfolio accordingly.