Victoria Gold Corp. (VIT:TSX.V)

Victoria Gold Corp. (VIT:TSX.V) announced on

Jan. 24 that BNP Paribas has been appointed to arrange up to US$220 million of senior, secured project debt for the Eagle gold project. John McConnell, Victoria's president and CEO, stated, "This facility is expected to be the foundation of the financing package that will fund the Eagle Project through construction and into production."

Chris Thompson, an analyst with Raymond James, noted in a Jan. 25 report that the financing "satisfies ~80% of the estimated C$370 mln initial Capex required to build Eagle. Whilst VIT has ~C$66 mln in cash on its balance sheet, we see additional funds being raised via equity financing." He also stated that "Eagle is shovel-ready, fully permitted and enjoys the support of local First Nations. Further, while located in Yukon (some view as infrastructural challenged), we see Eagle as being well served by current (camp, road, water) and future (power) infrastructure."

"'With a global resource of 4.4 mln in-situ oz (2.7 mln oz in reserve), Eagle is capable of delivering a +200 koz/year production profile + 11 year mine—attractive to potential acquirers (we think) looking to add low cost North American production ounces," stated Thompson.

That positive sentiment was echoed by Richard Gray of Cormark Securities, who noted in a Jan. 26 report that the appointment of the lead arranger is a "good first step for Victoria in its efforts to fully fund the construction costs of the C$370 MM Eagle project. . .we expect the remaining C$60-100 MM of financing required will likely be some combination of equity and/or stream."

Gray also wrote that Eagle "continues to be well advanced with an invaluable suite of infrastructure already in place (or easily completed). The project is accessed via an existing year-round road connecting to the Silver Trail Highway. Grid power currently runs along the highway to support grid power via a spur line to be constructed along the existing access road. Access is further improved with a 1,400m airstrip located in Mayo approximately 85km by road from the project site and there is an existing 100-person camp is at site."

Victoria also

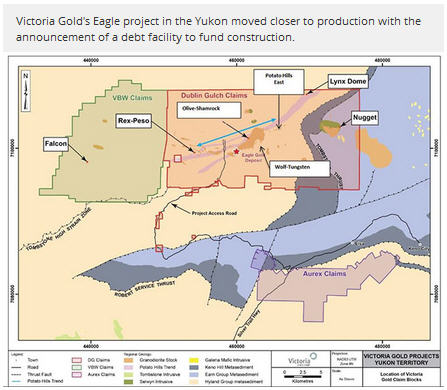

announced on Jan. 19 a $6.2 million exploration program in 2017 on the Dublin Gulch property. Gray commented that "several high priority exploration targets have been identified on the large Dublin Gulch Block that show potential to add to the current 4.0 MM resource at Eagle and could demonstrate to investors, and possible acquirers, that there is upside beyond just what has been drilled at the Eagle and Olive-Shamrock zones."

Gray concluded that Victoria is an "ideal opportunity for risk tolerant, long-term gold investors looking for a de-risked gold developer with assets located Canada. The shares currently trade at only 0.60x NAV, indicating significant upside on a re-rating or a takeout."

Read what other experts are saying about:

Want to read more

Gold Report articles like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Victoria Gold Corp. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

Disclosures from Raymond James, Victoria Gold Corp., Jan. 25, 2017

Analyst Compensation: Equity research analysts and associates at Raymond James are compensated on a salary and bonus system. Several factors enter into the compensation determination for an analyst, including i) research quality and overall productivity, including success in rating stocks on an absolute basis and relative to the local exchange composite Index and/or a sector index, ii) recognition from institutional investors, iii) support effectiveness to the institutional and retail sales forces and traders, iv) commissions generated in stocks under coverage that are attributable to the analyst’s efforts, v) net revenues of the overall Equity Capital Markets Group, and vi) compensation levels for analysts at competing investment dealers.

The views expressed in this report accurately reflect the personal views of the analyst(s) covering the subject securities. No part of said person's compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this research report. In addition, said analyst has not received compensation from any subject company in the last 12 months.

Raymond James Ltd. or its affiliates expects to receive or intends to seek compensation for investment banking services from all companies under research coverage within the next three months.

Victoria Gold Corporation:

Raymond James Ltd. has managed or co-managed a public offering of securities within the last 12 months with respect to VIT.

Raymond James Ltd. has provided investment banking services within the last 12 months with respect to VIT.

Raymond James Ltd. has received compensation for investment banking services within the last 12 months with respect to VIT.

Disclosures from Cormark Securities, Victoria Gold Corp., Jan. 26, 2017

We, Richard Gray and Graeme Jennings, hereby certify that the views expressed in this research report accurately reflect our personal views about the subject company(ies) and its (their) securities. We also certify that we have not been, and will not be receiving direct or indirect compensation in exchange for expressing the specific recommendation(s) in this report.

The firm does not receive compensation for any non-securities or non –investment banking related services. Neither the analyst nor the associate or any member of his/her household, serve as an officer, director or advisory board member.

Cormark disclosures related to Victoria Gold as of 1/26/2017 are available

here.