The answer to this sarcastic question is obviously yes…. the bigger question is when and how steep will the correction be when it happens.

I think the market action post US election, took many by surprise, it took me by surprise as well.

My thoughts were that if Trump wins, we will see heightened volatility, lower stock market prices and higher gold prices. Except for a few hours/days of that exact scenario, the following weeks and months have been the complete opposite. There has been a slow and gradual up move in stocks, not much volatility in most markets and gold went down pretty significantly before it made a retracement but still in a range.

Looking ahead the market is looking at possible higher rates with the French election and other geo political events in the midst. On the other hand, with interest rates being so low, I believe much of retirement money, investments, 401k, mutual funds etc. are pouring into stocks and continues to support prices.

The bottom line is: If you were a buyer on dips over the past 9 years or so, you would have done extremely well. Almost as if the FED conditioned investors NOT to short stocks and stock index futures as they would get punished…( QE).

This brings me back to the question in the title….and I resort to what I feel comfortable with – charts.

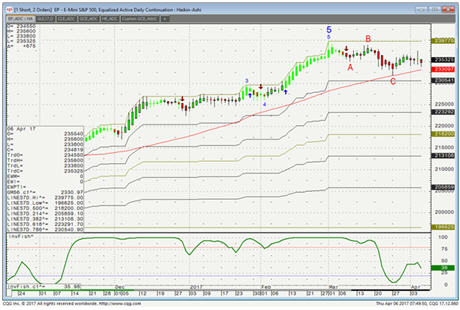

Below is

mini SP500 futures daily chart along with a few technical indicators I use:

You will notice I got 2 sell signals which failed back in December and February (Red down arrows). I received one buy signal that turned out to be a good signal in the end of February as well. (blue up arrow).

I received another sell signal recently at the middle of March which actually produced a good sell off and we saw a low of 2317 back on March 27

th. The market since then bounced a bit but failed to make new high. What we are finally seeing is a start of lower highs and lower lows starting to develop.

Notice the red moving average I use (it is actually not a moving average but acts like one…). It has held the recent rally for the last few months very well and even the last sell off was not able to close below.

This will be my trigger to get a bit more excited about the short side – if we can close below the red line which is currently (April 6

th 2017) at 2332. This value will change daily and you can feel free to contact us if you like to get updates on this one.

This possible move can be played either way depending on price action. One can use straight futures, spreads between the indices as well as options.

There are many ways to trade any market, many ways to lose money in any market and only very few ways to lock in gains - this one is not different. If you need help creating a trading plan,

visit our broker assist services.

Disclaimer - Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.