May 26, 2017 8:16:43 AM PDT

Happy Friday everybody. We hope you've had a nice week so far. It's been a tremendous week for the markets, and it sure looks like they're not going to back off anytime soon. However, just how much farther they can go before Wall Street gives it a nice big haircut is really starting to become a serious concern for many professional value investors out there.

Not really the type of landscape out there from a valuation perspective to suggest bargains right now - except for the entire commodity space and a few other select sectors, which is why we continue to expose small mining stocks for potential future price appreciation.

Although pretty much the entire metal and mining sectors still haven't really proved their in the process of a long-term bottom yet, it's never a bad idea to take the contrarian road, especially those with time and patience.

Today's new idea is one that has recently garnered a lot of trading interest here in the U.S. - and that's always good in the mining space, because it usually means the company has some legitimate promise, not always but more often than not.

North America, home to 12 of the top 50 gold mines in the world, is the most cost efficient continent on which to mine for gold. This is due in part to business efficiency but also to economic and political stability. Compared with Africa, which has 16 of the top 50 global gold mines, the cost to produce an ounce of gold is 38% cheaper in North America. In terms of numbers, it costs, on average, $598 to produce one ounce of gold in North America, and $957 to produce the same ounce in Africa.

It's pretty common knowledge Canada is an epicenter for gold mining promise lands. Comprised of ten provinces and three territories extending from the Atlantic to the Pacific, and northward into the Arctic Ocean, covering 3.85 million square miles, Canada is the world's second-largest country by total area, and the fourth-largest country by land area.

While sparsely populated, the majority of Canada's land territory is dominated by forest, tundra, and the Rocky Mountains. The nation's primary industries are timber and oil, and there is a substantial business sector related to indigenous mineral resources, which include gold, silver, nickel, copper, zinc, iron, molybdenum, uranium, potash and diamonds.

Thanks in part to Hollywood and other sources of lore, the western provinces of Canada (Saskatchewan, Alberta and British Columbia) and the three territories, Nunavut, Northwest Territories and the Yukon) claim most of the notoriety for Canada's timber, oil, and mineral business. However, the Quebec Province in the east was the largest producer of zinc in Canada, and the second largest producer of gold in the last 6 years. The province has 30 mines,158 exploration firms, and 15 primary processing plants. In 2010 the value of mineral shipments from the province was about $6.8 billion. The mining industry in Quebec accounts for 15,000 direct jobs and investment exceeding $2 billion.

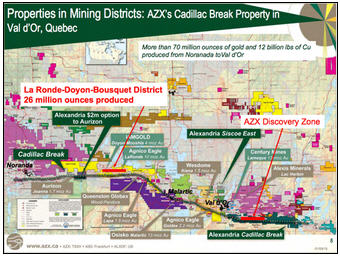

Enter Alexandria Minerals Corporation (OTCQB: ALXDF) (TSE: AZX.V), a junior gold exploration company engaged in the acquisition, exploration, and development of mineral resource properties in Canada. With strategic properties located in the world-class mining districts of Val d'Or, Quebec, Red Lake, Ontario and Snow Lake-Flin Flon, Manitoba, the company explores for gold, copper, zinc, and silver deposits.

Alexandria's primary focus is on its flagship property, the large Cadillac Break Property package in Val d'Or, Quebec. Val d'Or, which hosts important, near-surface, gold resources along the prolific, gold-producing Cadillac Break. It's viewed by geologists and analysts as a mining region with significant growth potential. Alexandria Minerals has been conducting diligent and continuous exploration in the area since 2007, successfully discovering resources of over 2 million ounces of gold at a cost of under $18/ounce of gold discovered.

Just as with personal real estate, the difference between a good thing and a so-so investment is location, location, location. It helps to have nice neighbors, too. Cadillac Break, located in southwestern Quebec, is a regional fault zone that has produced some 100,000,000 ounces of gold since the early 1900's. It currently ranks as the top gold producing region in Quebec. According to The Fraser Institute's Survey of Mining Companies, mining executives note that Quebec remains an international standout for investment because stable government policies offer them the certainty that reduces risk for long-term projects - location and nice neighbors.

Alexandria Mineral properties have been explored by various operators and miners since the early 1930s, with more than 2,400 drill holes completed and explored since that time. Other work undertaken by the company includes multi-property geophysical and geochemical programs, and trenching and mapping surveys, all of which Alexandria has been compiling into a single database for future exploration value.

It is worth noting that recent blind discoveries in the region at depths between 500 and 1500 meters show that the Cadillac Break property is highly under-explored, as most drilling has been in the upper 150 meters of the surface. This information is encouraging for both management as well as investors, yielding the potential for significant deposits to be explored and produced in future drilling programs.

In early December 2016, Alexandria Mineral Corporation entered into a partnership with Probe Metals to collaboratively spend up to $7.0 million on exploration over a period of 6 years. Eric Owens, President and CEO of Alexandria Minerals, stated, "This deal will unlock considerable value for Alexandria's shareholders on the early-stage exploration claims. This collaboration most importantly allows us to focus on our extensive drilling program on the western part of our property package where to date we have discovered 1.8 million ounces of gold. We are looking forward to working with the Probe group, as they, like us, will conduct exploration activities according to the highest standards. Moreover, they are a strong, successful exploration partner, having discovered the large Borden gold deposit in Ontario."

Then early in 2017, Alexandria Minerals Corporation announced a non-brokered private equity placement of $2.5 million. The proceeds from this transaction will be used to further explore gold projects in Val d'Or. Recent high grade gold assays (an analysis used to measure purity standards and content) on the company's property were encouraging, leading management to increase drilling capacity.

All this investment from the company points to a management team that is focused and dedicated to its core business. Collectively the management and Board of Directors has a strong background in mining, management and venture projects, with a deep understanding of the fundamentals of exploratory mining.

While the company continues focus on the Cadillac Break gold claims, it also has a substantial portfolio of promising properties in Ontario and Manitoba, which were acquired in 2002. All of Alexandria Minerals Corporation (OTCQB: ALXDF) (TSE: AZX.V) properties reflect its business model: they are located in areas with potential for multi-million ounce gold discoveries, and are in infrastructure-rich areas which allow the company to capitalize on smaller mineral discoveries while en route to the big mining discoveries.

As noted by one analyst, in a world of depleting reserves, Alexandria's promising properties and projects could be very attractive to a major gold producer. So, considering the trading behavior of ALXDF here in the U.S. in recent months, one could make a pretty good argument there's some excellent potential for the stock on a go-forward basis.

It's really only a matter of time before resources and metals come roaring back in a big way. Maybe it's when the broader market landscape has had enough speculating on itself, or maybe they'll be the reason to take the markets higher. But, one thing's for sure, at some point in this developing reflationary economy, commodities will have their day again.

Before we let you go, we hope all of you have an amazing Memorial Weekend. We'll always remember those who have given their lives for freedom, peace and justice.

Please view SmallCap Network's complete Disclaimer and SEC Rule 17b Disclosure.