In a deal completed in December of 2016, Probe can earn up to 70% interest in the eastern portion (one-third) of the Company’s Cadillac Break Property Group package by expending up to $7 million in exploration and completing a pre-feasibility study over a period of 6 years. Under the terms of the agreement, Probe has issued 300,000 common shares to the Company and can earn 60% interest by spending an aggregate of $5 million on exploration as a First Option.

In May 2016, Alexandria optioned its Chibougamau property package to Quinto Real Capital Corporation (“Quinto”), giving Quinto the right to earn a 65% interest in the Fancamp, Embry and Gwillim properties by issuing 1,500,000 common shares and expending $5 million in exploration expenditures over 5 years on the three properties. Quinto has the option to increase its ownership to 75% by completing a pre-feasibility study with a minimum gold resource of 1,000,000 ounces.

In 2015, the Company tripled its resource base by acquiring a subsidiary – Murgor Resources Inc. (“Murgor”). The Murgor acquisition provides exposure to world-renown gold and base-metal mining camps in Ontario and Manitoba. During the spring of 2016 Alexandria signed an Option Agreement with Prosper Gold Corporation (“Prosper”) giving Prosper the right to earn up to 90% interest in two Murgor properties – Wydee and Matachewan, located in the Matachewan Mining District of Ontario, near Alamos Gold Inc.’s Young Davidson Mine.

Alexandria’s management team has a solid junior-exploration pedigree. Led by co-founder, President and CEO, Eric Owens, the Company has persevered through challenging industry market conditions, while continuing to build its resource base and broker property deals for strategic real-estate in established mining camps. As renewed exploration activity marks resurgence in many of the country’s mineral belts, Alexandria does indeed appear to be well-positioned for future growth.

MANAGEMENT

Eric Owens, Ph.D. – President and CEO, Director. Dr. Owens, a co-founder of Alexandria Minerals, has 30 years of experience in the mineral exploration industry in North America, Mexico and Central America. He previously held positions with Newmont Mining, BHP Minerals, Phelps Dodge, and Echo Bay. He was involved in the discovery of the El Zapote silver deposit in El Salvador and definition drilling of the American Girl and Madre-Padre gold mines in California. He holds a B.Sc. in Geology from the University of California at Riverside (1981), an M.Sc. in Geology from Michigan Technological University (1986), and a Ph.D. in Geology from the University of Western Ontario (1992).

Philippe Berthelot, B.Sc. P.Geo – Vice President of Exploration since 2014. Mr. Berthelot brings 30 years of Quebec-based exploration experience to the Company. Formerly the Vice-President Exploration for Ressources Cartier, he has held positions with and consulted for a number of junior explorers and producers. Mr. Berthelot was part of the team responsible for the discovery of the Grevet deposit (now Langois Mine) and he supervised the delineation of the Desjardin Discovery deposit and the Lac Pelletier and Jolin deposits. Mr. Berthelot received a Bachelor of Science in Geology from the University of Québec in Montreal in 1984.

Mary Vorvis – Vice President, Corporate Development and Investor Relations. Ms. Vorvis has over 15 years experience in the natural resources, technology and venture capital industries. Her integral role in Alexandria includes building relationships with financial institutions, fund managers and brokerages as well as collaborating with management to advance strategic initiatives and orchestrate business development projects. Ms. Vorvis has past international project management experience with a technology-based clearing services provider for equities and options trading (NYSE, NASDAQ, AMEX and OCC), where she championed organizational change in human resources and optimized company operations.

Mario A. Miranda, CA – Chief Financial Officer joined the Company in 2011. Mr. Miranda has nearly 20 years experience leading the financial operations and strategic planning of multinational resource, manufacturing and consulting services organizations in Canada and Latin America. He has been involved in mergers and acquisitions, mining governance, and in delivering comprehensive financial structures and reporting systems, with various companies including: Kinross Gold Corporation; White Pine Resources Inc.; Southampton Ventures Inc.; Lake Shore Gold Corp.; International Nickel Ventures Corporation; and Alturas Minerals Corp, where he concurrently continues his role as Chief Financial Officer. A member of the Ontario Institute of Chartered Accountants (ICAO)and fluent in English, French and Spanish, Mr. Miranda holds a B.A. in Economics from Concordia University and a Graduate Diploma in Public Accounting from McGill University.

Property Location Map

CADILLAC BREAK PROPERTY GROUP (“CADILLAC GROUP”)

CADILLAC BREAK PROPERTY GROUP (“CADILLAC GROUP”)

Alexandria holds 100% interest in a 35-kilometre-long property package covering the prolific Cadillac-Larder Lake Break (“CLLB”), a major structure in close spatial association with many multi-million-ounce gold deposits. The property is located immediately south and extends east of the mining town of Val d’Or, Quebec, where several mills currently operating below capacity are in need of new ore.

Amalgamation of the flagship Cadillac Group began in 2007 with the acquisition of 14 properties from Aur Resources Inc. and IAMGOLD (formerly Cambior). The remaining properties were subsequently staked or acquired by Alexandria, subject to outstanding royalties.

The Cadillac Group is located in the south central part of the prolific Abitibi Greenstone Belt – one of the most famous gold- and basemetal-producing areas in the world. Over 650 km long by 150 km wide, the Abitibi belt extends from southwest of Timmins, Ontario, to Chibougamau, Quebec, in the northeast and has produced over 200 million ounces of gold, 900 million ounces of silver, and almost 40 million tonnes of copper and zinc.

Metal deposits are typically located near, or are controlled by structural fault zones, which act as conduits for mineral-rich solutions to travel along. Alexandria’s Cadillac Group package straddles the CLLB, a crustal-scale super-structure that cuts across the southern portion of the Abitibi Greenstone Belt. Characterized by intense shearing, mechanical deformation and conjugate faults, the CLLB, and its associated substructures, extends for in excess of 300 kilometres from Matachewan, Ontario in the west, to east of Louvicourt, Quebec. It is one of the most important metallogenic features of the Val d’Or area.

The Cadillac Group is underlain by Malartic and Piché Group volcanic rocks to the north of the CLLB and clastic sedimentary rocks of the Pontiac and Cadillac Group geologic domains to the south. Several gold and base metal mines and deposits are contiguous with or are located on the Alexandria property. The Canadian Malartic, Canada’s largest operating gold mine with annual production of 560,000 ounces, is located about 28 kilometres west of Alexandria’s flagship property and also straddles the Cadillac Break. Former producing Sigma and Lamaque gold mines, which accounted for a combined 9 million ounces of gold, are located two kilometres north of Alexandria’s property. Often these large mineral deposits do not reach surface or are under a thick blanket of overburden cover. Recent nearby discoveries in the area include the Goldex and Lapa deposits, which have been found at vertical depths of between 500 and 1500 metres. Virtually unexplored below three hundred and fifty metres, the Company’s Cadillac Group has considerable potential for discovery.

The complex scope of geological environments across the expanse of the Cadillac Group property provides for a number of potential deposit types. These range from intrusive-hosted porphyry copper to volcanogenic massive sulphide (“VMS”) related deposits and from skarn-type to vein deposits. Four gold deposits have been discovered on the Cadillac property: Orenada; Sleepy; and past producers Mid Canada and Akasaba. Alexandria sold the 14.8 M tonne Akasaba West Zone, grading 0.69 g/t Au and 0.41% Cu, to Agnico Eagle Mines Limited in 2014 for $5 million and a 2% NSR, while Probe has an option on the eastern portion of the Cadillac package, which includes the Sleepy gold deposit.

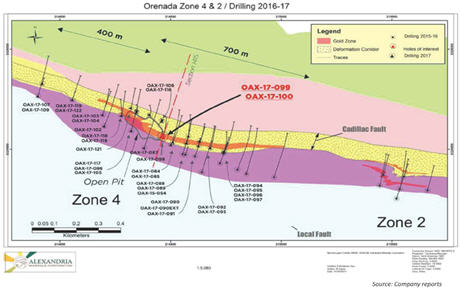

The current exploration focus is to expand the Orenada Zone 4 gold deposit and drill test the Triangle Too target, located adjacent to Integra Gold Corp’s Sigma-Lamaque gold deposit.

Orenada

The Orenada property comprises the western third of Alexandria’s Cadillac Group where the CLLB separates Malartic Group volcanic rocks and their related granitic intrusive assemblages to the north from the Pontiac sediments to the south.

Several types of gold mineralization are present on the Orenada property. The most significant type of mineralization consists of quartz-carbonate-tourmaline veining within shear zones in highly deformed sedimentary-volcanic units (Orenada Zones 2 and 4). A second type of mineralization consists of disseminated sulphides (pyrite, arsenopyrite, magnetite, chalcopyrite and pyrrhotite) and quartz-carbonate-pyrite veins within tuffaceous units. Porphyry- and intrusion-related-Cu-Au-type mineralization also occurs at Orenada Zone 5.

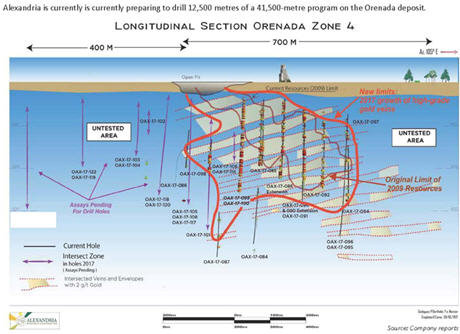

The most recent mineral resource estimate on the Orenada deposit was completed in 2009 by Geologica Group Conseil Inc. Using a 0.5 g/t Au cut-off grade, Geologica reported a near-surface Measured and Indicated Mineral Resource of 8.5 million tonnes grading 1.31 g/t Au, containing 360,000 ounces and Inferred Mineral Resources of 4.7 million tonnes grading 1.16 g/t Au, containing 175,000 ounces gold. Historical work by Brominco in 1985 includes the sinking of a 276-metre sha with 1,100 metres of exploration drilling and extracon of a 20,418-tonne bulk sample, grading 1.67 g/t Au. Aur Resources completed a bulk sample in the 1990’s producing 4,000 ounces of gold from 72,195 tonnes grading 1.72 g/t Au from within Orenada Zone 4.

Of the two primary gold zones (Zones 2 and 4) defined in the resource, the larger Zone 4 extends for a length of 700 metres and has been traced to a vertical depth of 300 metres. This sedimentary-hosted gold deposit consists of a stacked group of sub-horizontal, flat-lying gold veins (quartz-arsenopyrite-carbonate-tourmaline) formed within the broader gold-bearing shear-hosted horizons. The mineralized package dips south with an apparent plunge to the east.

In drilling programs prior to 2009, Alexandria completed several holes below 350 metres vertical depth, which generated results such as 8.12 g/t gold over 4.87 meters, 3.24 g/t gold over 10.5 meters, and 3.18 g/t gold over 6.60 meters. Although these intersections were the result of a drill program designed to target bulk-tonnage potential, data clearly demonstrates the possibility of high-grade gold veins in the system. The Company believes these higher-grade veins could become important in deeper parts of the deposit, and since 2015 has targeted holes to test for low-angle, high-grade gold veins within and beyond the bulk tonnage mineralization of the main shear zone to support their new geological model.

Drilling of Orenada Zone 4 in 2015 (OAX-15-54) intersected high-grade vein intervals of up to 17.0 g/t Au over 3.4 metres, within much wider lower-grade envelopes of gold-bearing rock (up to 1.43 g/t Au over 158.5 metres). Subsequent drilling in 2016 intersected multiple narrow high-grade gold veins of up to 9.48 g/t Au over 1.3 metres and 5.18 g/t Au over 1.8 metres within broader alteration envelopes with grades of up to 2.88 g/t over 10.8 metres and 1.24 g/t Au over 52.9 metres respectively in holes OAX-16-079 and OAX16-074. Results to date from the current drill campaign confirm additional near-surface multiple high-grade vein sets west of and below the previously know limits of the Orenada deposit. Hole OAX-17-084 intersected 3.95 metres at 21.32 g/t Au, which includes a 2.65-metre interval of 30.52 g/t gold. Hole OAX-17-100 intersected 2.84 g/t Au over 217 metres, including up to 8.99 g/t Au over 13.85 metres. This step-out hole extends the gold-bearing quartz-vein system 100 metres west and 100 metres below the limits of the current (2009) resource limits. Zone 4 is open to the north, along strike and at depth.

Recent drilling at Orenada Zone 2 also indicates that narrow high-grade veins of up to 8.88 g/t Au over 4.70 metres within broader mineralized envelopes appear to have a near vertical orientation.

Triangle Too Target (Airport Property)

Triangle Too Target (Airport Property)

The Triangle Too Target is located in the northeastern part of the Airport property and is contiguous with the Val d’Or municipal airport property to the west and with the southern boundary of Integra Gold Corp’s (“Integra”) Sigma-Lamaque project to the north, which in addition to hosting the past-producing Sigma-Lamaque mines also hosts the new Triangle gold deposit.

Underlain by Val d’Or formation rocks, the northern part of the Airport property has geological potential for both Sigma-Lamaque-type gold deposition and VMS copper-zinc-silver-gold sulphide mineralization, like that found in the past producing East Sullivan mine. Located two kilometres east of the property, East Sullivan produced 16.8 million tonnes at 1.03% Cu, 0.70% Zn, 9.6 g/t Ag and 0.3 g/t Au. Recent resource updates reported by Integra estimate their Triangle deposit, located about a half-kilometre northeast of Alexandria’s Triangle Too Target, contains an Indicated gold resource of 1,473,530 ounces at 7.32 g/t and Inferred Mineral Resources of 991,800 ounces gold at 5.67 g/t (Integra NR Mar.22, 2017).

In 2016, the Company delineated its Triangle Too target through geophysical surveys. Drill-testing of eight of the 25 prospective anomalies identified quartz-tourmaline-pyrite veins, associated with diorite intrusive rocks and containing up to 1.29 g/t gold. In light of Integra’s recent success on the Sigma-Lamaque project, Alexandria has stepped up exploration in the search for intrusion-related gold-bearing structures at its Airport property.

Porphyry Gold-Copper Exploration Targets (Zone 5, Hogg and Ducros)

In addition to vein-type gold deposits at Orenada, immediately north of the CLLB, Alexandria’s Cadillac Group exhibits a geological setting prospective for porphyry gold-copper deposition. Multiple zones and showings, containing increased thicknesses of gold-copper mineralization within widespread alteration zones, occur in and around two felsic intrusions underlying much of the western half of the project. Alexandria’s porphyry gold-copper program was triggered by the discovery and subsequent sale in 2014 of Akasaba West, a 14.8-million-tonne near-surface, bulk-tonnage deposit grading 0.69 g/t Au and 0.4% Cu, to Agnico.

Prospective porphyry gold-copper targets include the Zone 5 Breccia and Hogg prospects. Scattered drilling within this 2.5-kilometre gold-copper trend, located a few hundred metres north and east of the Orenada 2 and 4 Zones, intersected elevated concentrations of copper and iron sulphides. Previous drill intercepts of 5.47 g/t Au over 5.48 metres, and 2.4 g/t Au with 1.2% Cu over 16.8 metres were reported for the Zone 5 target – a 1.8 kilometre-long geophysical anomaly. Another nearby geophysical anomaly, the Hogg target, assayed up to 45.9 g/t Au over 1.5 metres, and 11.88 g/t Au with 0.64% Cu over 3.0 metres.

Drill hole OAX-15-056 intersected 0.45 g/t Au, 0.59% Cu and 8.35 g/t Ag over 23.1 metres while testing the Zone 5 Breccia target. Wide intervals of copper mineralization, including 0.37% Cu over 91.4 metres from hole D69-01, have also been intersected on the nearby Ducros property. Gold-copper mineralization here occurs within an intrusive and volcanic geological setting similar to that hosting the past-producing East Sullivan VMS deposit.

Akasaba Project

Situated about 25 kilometres east of Val d’Or, the Akasaba project is underlain by east-west trending Upper Malartic Group mafic to felsic volcanic rocks to the north, which in turn are overlain by Pontiac Group sediments to the south. The “mine horizon” occurs at or near the major volcanic/sedimentary rock interface in proximity to the CLLB.

The former Akasaba mine produced approximately 265,000 tonnes at an average grade of 5.2 g/t Au and 1.7 g/t Ag (roughly 40,000 ounces gold and 13,000 ounces silver) between 1960 and 1963. The Akasaba gold deposit is comprised of four altered volcanic-hosted stratiform lenses, which extend for a length of one kilometre and have been traced to a depth of more than 500 metres. Gold occurs in disseminated to semi-massive sulphides (pyrrhotite- chalcopyrite) and in quartz-carbonate +/- epidote veinlets and altered volcano-sedimentary rocks. The deposit has both open pit and underground resource potential. The most recent compliant resource estimate, completed by Geologica Groupe Conceil Inc. in 2013, reported potential underground Indicated Mineral Resources of 609,274 tonnes at 5.93 g/t Au containing 116,158 ounces gold, and 1.48 million tonnes at 5.58 g/t Au containing 264,886 Inferred Mineral Resource ounces. Potential open-pit Indicated Mineral Resources were also estimated as 3.0 million tonnes at 1.37 g/t Au, containing 132, 000 ounces gold in the Main pit. Continued exploration for lateral extensions of the deposit led Alexandria to the discovery of several new zones including, the Kettle, North and West Zones.

Over the past couple of years Alexandria has maintained its focus on its cornerstone Cadillac Break property Group by selling or optioning off some of its non-core properties:

WEST ZONE SALE

In January of 2014, Alexandria sold a 14-claim block of land hosting the Akasaba West Zone to Agnico for $5 million and a 2% NSR, of which Agnico has the right to purchase one-half (1%) for $7 million. Agnico retains a first right of refusal on the remaining 1% royalty, while Alexandria retains the right of first offer to re-acquire the claims after mining and reclamation for a sum of $1.

As of December 31, 2016 Agnico reported that Akasaba West currently hosts Probable Reserves of approximately 142,000 ounces gold (4.9 million tonnes at 0.89 g/t gold and 0.50% copper) and an Indicated Mineral Resource of approximately 53,000 ounces gold (2.5 million tonnes at 0.66 g/t gold and 0.40% copper). Less than 30 kilometres east of Agnico’s Goldex mine, Akasaba West is ideally located to utilize the extra milling capacity at Agnico’s operations. Permitting for the project at both federal and provincial levels is currently underway and expected to continue into 2018. According to Agnico, internal studies suggest that the Akasaba West deposit has potential to produce approximately 20,000 to 25,000 ounces of gold and 8.5 to 10.0 million pounds of copper per year for four to five years, with average total cash costs estimated to be approximately $400 per ounce. Agnico estimates capital costs (including closure costs) to be approximately C$50 million, and expects to begin sourcing open pit ore from Akasaba West in 2019 (Agnico website).

PROBE OPTION

Alexandria has partnered with Probe to explore the eastern portion of the Cadillac Group property package, which includes the Sleepy gold deposit. This transaction will generate up to $7 million in exploration expenditures, including a pre-feasibility study, over the next 6 years in exchange for a 70% interest in the eastern one-third of the property. In December 2016, Probe issued 300,000 common shares to Alexandria, and according to their agreement, after it expends an initial $5 million in exploration will issue another 200,000 additional shares of Probe to the Company. Probe sold its Borden Lake project to Goldcorp Inc. for $526 Million in 2015 and has since assembled a district-scale land position in the Val d’ Or area.

The Probe transaction adds a very accomplished exploration group with new ideas and deeper pockets, to advance the Sleepy gold deposit and other exploration targets on the eastern third of the Cadillac Group, while allowing Alexandria to focus on the western portion of the property. The Sleepy deposit has an Inferred Mineral Resource of 1.8 million tonnes at 4.7 g/t Au containing 280,000 ounces gold.

QUINTO OPTION

In May 2016, Quinto retained an option to earn a 65% interest in Alexandria’s Chibougamau, Québec properties (Gwillim, Fancamp and Embry), in exchange for $5 million over five years in exploration expenditures on the three properties, plus 1,500,000 common shares of Quinto, staged over three years. Alexandria granted Quinto a second option to increase its interest to 75% by completing a pre-feasibility study defining a minimum million-ounce gold resource. Alexandria acquired these Chibougamau properties as part of the Murgor acquisition in 2015.

Quinto also owns a 5% interest in the Monster Lake gold project, currently optioned to IAMGOLD Corporation (50 % IAMGOLD, 45 % TomaGold, and 5% Quinto). The Monster Lake project Lake garnered the market’s attention in 2012 when TomaGold’s near-surface drill hole, M-12-60, intersected 237.6 g/t Au over 5.7 metres.

Alexandria’s Fancamp property, located a few kilometres east of Monster Lake, straddles a regional deformation zone underlain by a bi-modal volcanic assemblage. The northeast-trending Fancamp Deformation Zone hosts at least 15-known gold deposits throughout the district, including the Chevrier and Chevrier South deposits located about 5 kilometres northeast and on strike with the Fancamp property. The 4.75-million tonne Joe Mann deposit (8.54 g/t Au) is also located 12 kilometres to the southeast.

In addition to its key Québec projects, Alexandria’s 2015-aquison of Murgor Resources has given shareholders increased exposure to future discovery within key mining jurisdictions in Ontario and Manitoba.

PROSPER GOLD OPTION

Prosper has acquired an option to earn 90% interest in Alexandria’s Matachewan, Ontario-based properties – Wydee and Matachewan, in exchange for 750,000 common shares of Prosper Gold and $5 million in exploration expenditures over a five-year term. The properties occur in the vicinity of the Young Davidson gold mine owned by Alamos Gold Inc. The projects are situated along the same structural-stratigraphic trend as the mine, with Wydee located about nine kilometres northwest of, and the Matachewan Project, which bounds the eastern limits of the town of Matachewan, lying about three kilometres east of the mine. Young Davidson has an estimated 2017 production of 200,000 to 210, 000 ounces with all-in sustaining costs of US$775 per ounce and a 15-year mine life (Alamos Gold website). This option enables Prosper Gold to create a compelling land position in an established but under-explored district, while providing Alexandria with a risk-free means to additional discovery potential and possible future shareholder value.

GULLROCK, RED LAKE

The 2161-hectare Gullrock property, located in the famous Red Lake district, is contiguous with Goldcorp’s Campbell-Red Lake Mine property. The Red Lake Mining District has produced more than 28 million ounces of gold since 1925, with over 66% of production coming from the Campbell-Red Lake Mine, one of the highest-grade gold deposits in the country. The Gullrock property is underlain by a seven-kilometre strike length of the same favourable mafic to ultramafic Balmer Assemblage rocks and Temiskaming sediments that host the Campbell-Red Lake deposits. Despite its extremely auspicious location, the Gullrock property has had limited previous exploration and would be best served by finding a joint venture partner.

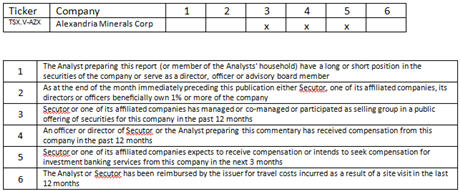

Secutor Capital Management Corporation Commentary Disclaimers

The information and opinions contained in this commentary were obtained or arrived at from sources we believe to be reliable at the time and neither Secutor Capital Management Corporation (Secutor) nor its employees, agents or information suppliers can guarantee that such information is accurate or complete and it should not be relied on as such. Investing in companies within the mining and resource sector typically carries a great deal of risk, including forecast, financial, valuation, exchange and political risks. Past performance should not be seen as an indication of future performance. Any securities in this commentary can fluctuate in value and accordingly you are not certain to make a profit by purchasing or selling them: you could make a loss. Dr. Robinson and Ms. Butella are independent contractors retained by Secutor for the purpose of generating company commentaries and updates.

Analyst Certification

I, Donald J. Robinson, certify that the views expressed in this commentary accurately reflect my personal views about the subject issuers. I also certify that I have not, am not, and will not receive, directly or indirectly, compensation in exchange for expressing my views in this commentary, from the subject issuers.

I, Catherine I. Butella, certify that the views expressed in this commentary accurately reflect my personal views about the subject issuers. I also certify that I have not, am not, and will not receive, directly or indirectly, compensation in exchange for expressing my views in this commentary, from the subject issuers.

Secutor does, and seeks to do business, with companies covered in this commentary. As a result, investors should

be aware that the firm may have a conflict of interest. Secutor and/or its employees from time to time may hold, buy and sell shares, options or warrants of any company included in this commentary.

This commentary is intended for use only in provincial jurisdictions where Secutor is registered and not to be construed as an offer or solicitation to buy or sell any security. The securities mentioned in this commentary may not be suitable for all investors and may not be eligible for sale in some jurisdictions. Our commentary (an analyst comment about an issuer that does not include a rating or recommendation) is only intended for professional investors. Secutor accepts no liability whatsoever for any loss arising from any use or reliance on this commentary or the information contained herein. Any reproduction, in whole or part, of this commentary, without permission, is prohibited.

Secutor is a member of the Investment Regulatory Organization of Canada and the Canadian Investor Protection Fund.