Download Report

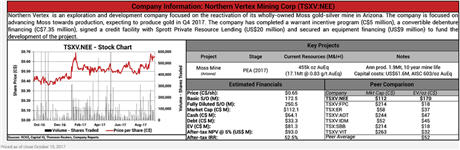

Northern Vertex Mining Corp. (TSXV:NEE) reported results from a PEA completed for its Moss mine outlining an alternative mine plan which includes existing resources currently excluded from the mine plan. The previous feasibility study (FS) completed in 2015 is based on a mine plan constrained by the company’s patented claims, not by resources, whereas the PEA removes this restriction, materially improving project economics. The key step for the company to realize this value is acquiring permits for the surrounding land, a process which is likely to start once the powerline and road upgrade permitting process is complete. While this upside potential is important, we believe that ongoing construction updates and first production are likely to be the key near-term catalysts for the stock.

Expansion to materially extend mine life. The reason for the PEA was to outline an alternative mine plan which includes additional resources from the company’s adjacent un-patented mining claims. The current FS is constrained by the company’s patented claims, not by resources, as highlighted by our

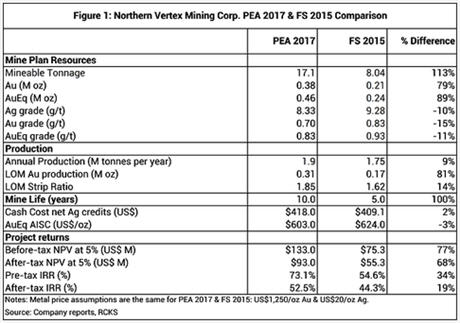

recent site visit. The expansion would siginificantly increase mine life from 5 years to 10 years, increasing mineable resources by 113% to 17.1 million and AuEq oz by 89% to ~455k. The PEA includes Federal public lands administered by the Bureau of Land Management (BLM), which would mean the company would require additional permits. The infrastructure currently under-construction for Phase II, is essentially what would be required for the contemplated mine-life extension, including some minor additions such as heap-leach pad and waste pile expansions. In addition, the company is planning to begin an exploration and resource expansion program within 6 weeks.

Longer-life contemplated in the PEA has better economics. Capital costs for the PEA are US$61.6 million which includes US$37.5 million for the construction of the Phase II mine, as well as Phase III expansion costs of US$2 million for permits, US$17.9 million for infrastructure and a contingency of US$4.2 million. Cash cost (net Ag credits) and AISC remained relatively unchanged. After-tax NPV increased by 68% over the 2015 FS to US$93 million with an IRR of 52.5%, a 19% increase. (Figure 1)

Valuation does not reflect likely reserve growth.

Valuation does not reflect likely reserve growth. Northern Vertex currently has an EV of ~C$81 million, implying an EV/oz of C$170/oz and while this is a premium to development stage peers (C$52/oz), this is warranted because the company is fully financed and close to the start of production. As well, the recent share price move, suggests the market is starting to apply some value for the mine-life extension contemplated in this PEA. We note that beyond the resources that could be brought into the mine-plan, there remains regional exploration upside. In our view, near-term share price movements are likely to be driven by construction and commissioning updates, along with the start of production, which continues to remain the company’s focus.

Derek Macpherson | VP Mining Analysis

Victoria Ellis Hayes | Associate

Red Cloud Klondike Strike Inc.

105 King Street East, 2nd Floor

Toronto ON, M5C 1G6

Priced as of prior trading day's market close, EDT (unless otherwise noted).

All values in USD unless otherwise noted.

Disclaimer

Red Cloud Klondike Strike Inc. is registered as an Exempt Market Dealer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland & Labrador, and the Yukon. Part of Red Cloud Klondike Strike Inc.'s business is to connect mining companies with suitable investors that qualify under available regulatory exemptions (the "Red Cloud KS Business"). Red Cloud Klondike Strike Inc., its affiliates and associates, and their respective officers, directors, representatives, researchers and members of their families (collectively, "Red Cloud KS") may hold positions in the companies mentioned in this publication and may buy or sell, or buy and sell their securities or securities of the same class on the market or otherwise. Additionally, Red Cloud KS may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services.

Red Cloud KS has prepared this publication for general information purposes only, NOT as part of the Red Cloud KS Business. This publication should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided by Red Cloud KS for the purposes of this publication has been derived from sources believed to be accurate, but cannot be guaranteed. Opinions or analysis contained in this publication may be subject to change and Red Cloud KS does not undertake to advise the reader of such changes. This publication does NOT take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud KS will not treat recipients of this publication as customers or clients by virtue of having viewed this report.

Company Specific Disclosure Details

Northern Vertex Mining Corp. - TSXV:NEE - 1,2,3,4

1) A member of Red Cloud KS team has visited/viewed material operations of the issuer.

2) In the last 12 months, Red Cloud KS has been retained under a service or advisory agreement by the subject issuer.

3) In the last 12 months, Red Cloud KS has received compensation for investment banking services.

4) Red Cloud KS or a member of the Red Cloud KS team or household, has a long position in the shares and/or the options of the subject issuer.

5) Red Cloud KS or a member of the Red Cloud KS team or household, has a short position in the shares and/or the options of the subject issuer.

6) Red Cloud KS or a member of the Red Cloud KS team own more than 1% of any class of common equity of the subject issuer.

7) A member of Red Cloud KS team or a member’s household serves as a Director or Officer or Advisory Board Member of the subject issuer.