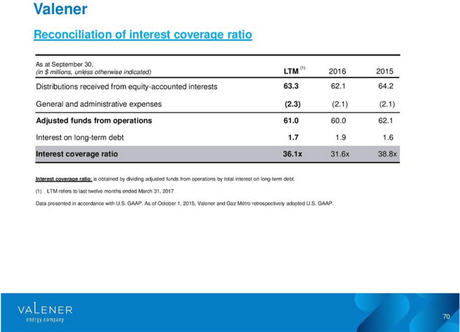

The long-term debt is subject to restrictive covenants requiring it to satisfy certain financial ratios or conditions at all times. Among other things, on a non-consolidated financial statements basis, the company must satisfy an interest coverage ratio of at least 3.00 times and a ratio of long-term debt to the total distributions and dividends received less general and administrative expenses of less than 4.25 times. Valener has been in compliance with all of the conditions of its credit facility over the last years with these two ratios being above 30 times and under 2.5 times respectively, as shown below:

Adjusted EBITDA and leverage: Adjusted EBITDA in FY 2016 was approximately C$80 million. After taking into account the results to-date, I project that adjusted EBITDA in FY 2017 will remain at the same levels reaching approximately C$80 million. As a result, the net debt to adjusted EBITDA ratio will remain in safe territory andunder 1.5 times in FY 2017.

Cash flow and dividend: The company is a cash flow and free cash flow generator. In the first nine months of FY 2017, operating cash flow was C$41.2 million, while cash flow used in investing activities was C$36.9 million due to two non-recurring items in Q1 2017.

Specifically, on March 31, 2017, Valener subscribed, in proportion to its current interest in Gaz Métro, for 1,318,291 Gaz Métro units for a total cash consideration of C$29 million. Moreover, during fiscal 2015, Valener entered into swaps for a total nominal value of C$44.8 million with a mandatory early termination date in October 2016, to cover the risk of interest rate fluctuations on an initially planned debt issuance. Since these swaps didn't meet the conditions for hedge accounting, changes in fair value were therefore recognized in income. These swaps were settled for C$7.8 million in October 2016.

Excluding these two non-recurring items, Valener generated free cash flow of approximately C$41 million for the nine months of FY 2017. And I project that it will generate free cash flow of approximately C$56 million in FY 2017.

Given that the dividends to common and preferred shareholders will total approximately C$43 million in FY 2017, the aforementioned free cash flow is more than enough to cover the dividends resulting in a payout ratio under 80%. As such, Valener will also have the opportunity to use the remaining free cash flow and reduce its bank debt in the coming quarters.

For reference, operating cash flow was C$56.7 million, while cash flow used in investing activities was less than C$1 million in FY 2016. Therefore, Valener generated free cash flow of approximately C$56 million in FY 2016, which was again more than enough to cover the annual dividend payments to the common equity and preferred holders.

Dividend Growth For The Common Stock Bodes Well For The Preferred Stock

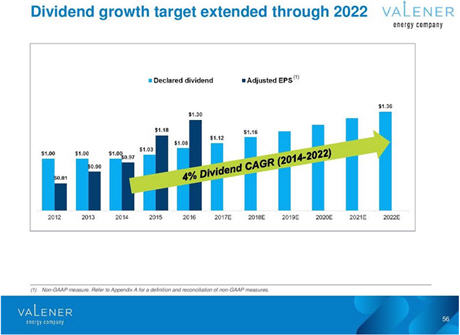

It's noteworthy that Valener has consistently increased the dividend for the common equity holders over the last years as a result of its excellent financial health.

Specifically, the annual dividend per common share was C$1 in FY 2014, C$1.02 in FY 2015, C$1.07 in FY 2016 and C$1.12 until August 2017, when the company announced another increase in the annualized dividend from $1.12 to $1.16 per common share.

This continued YoY growthtranslates into approximately 4% CAGR. More importantly, Valener has set a goal of achieving compound annual dividend growth of 4% for the common equity until 2022, according to the CEO, as shown below:

This dividend growth plan associated with the common equity bodes well for the Preferred holders who rank senior to the common equity holders. Since Valener aims to hit a 4% CAGR until 2022 for the common dividend, potential problems associated with the payment of the dividend for the Series A Preferred stock until 2022 are eliminated. This is common sense.

On that front, Valener has 4 million Series A Preferred shares outstanding that were issued in June 2012 and rank senior to the common equity. The Series A Preferred shares were paying cumulative dividends of C$1.0875 per share per annum, payable quarterly, for the initial period that ended on October 15, 2017.

The dividend rate is being reset every five years and was reset on October 15, 2017 at a rate equal to the five-year Government of Canada bond yield plus 2.81% that translated into 4.62%. This interest rate will last until October 15, 2022.

As expected, Valener didn't redeem the Series A Preferred stock at par on October 15, 2017 because it didn't afford to redeem it. Actually, Valener would need C$100 million in cash to redeem it. And given that it didn't have this cash, it didn't want to borrow money and max out its credit line.

Takeaway

Valener's Series A Preferred shares are for risk-averse income seekers in the Utilities sector. Currently, they stand at C$23.20 and their interest rate will be 4.62% until October 15, 2022. Also, it's very likely that the stock will come closer to the par value of C$25 and therefore, the holders will make an additional 8% by October 2022. This scenario isn't wishful thinking. This scenario is very likely thanks to Valener's balance sheet and free cash flow that are estimated to remain strong in the foreseeable future.

If you like this article and look for deep value ideas that are potential multi-baggers along with dividend plays, consider signing up for Value Investor's Stock Club. Members get exclusive access to our best ideas on unknown or underfollowed companies that are potential multi-baggers, as well as dividend ideas with 7%+ yields, trade alerts for when we close positions, and an active chat room to stay ahead of the crowd. Check out why our subscribers have given unanimously 5 star ratings and outstanding reviews.

Disclaimer: The opinions expressed here are solely my opinion and should not be construed in any way, shape, or form as a formal investment recommendation. Value Digger does not accept any liability for any loss or damage whatsoever caused in reliance upon such information. Investors are advised that the material contained herein should be used solely for informational purposes. Investors are reminded that before making any securities and/or derivatives transaction, you should perform your own due diligence. Investors should also consider consulting with their broker and/or a financial adviser before making any investment decisions.

Disclosure:I'm long VNR.PR.A. I wrote this article myself, and it expresses my own opinions. I'm not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.