Macerich (MAC)

Maserich is included into the S&P 500. Its major activity is acquiring, selling, managing, developing, and remodeling shopping malls all over the US. As of now, Maserich owns around 53M square feet of commercial property, which includes 48 retail shopping malls.

Maserich stocks fall into the Financial Retail category; over the last week, they fell by 0.55%.

Technically, the stock tried to break out the 200-day SMA and start forming an ascending trend. With $60 acting as a strong resistance, its breakout may issue a signal of such a trend really forming. Meanwhile, the support is at $57, while the first major target is 10 dollars higher, at $67.

The investment fund transactions show the market is becoming interested in the stock, and while the buys are still very low, at around 0.29%, one should bear in mind that Maserich had not been previously considered as something valuable at all, so even such a small buying volume may boost future performance.

Over the last two months, the stock declined, but for now open sell positions are not that high, just around 4.87%. As such, the decline did not draw too much traders' attention; it even acted in a contrary way, making Maserich quite attractive.

Dicerna Pharmaceuticals, Inc. (DRNA)

Dicerna Pharmaceuticals was founded in 2006. A biopharmaceutical company, its major is creating drugs for curing chronic liver and cardiovascular diseases.

The company falls into Healthcare/Biotechnology sector. It showed a good rise last week, jumping up by 12.88%.

Chiefly, this is due to the company having resolved its dispute with Alnylam Pharmaceuticals. Dicerna Pharmaceuticals finally agreed on paying $2M and grant Alnylam 983,208 shares (equals to around $12M), with more $13M to be paid within the Following four years.

2017 saw Dicerna Pharmaceuticals with $114M net profit; thus, the upfront payment of $2M (less than 2% of profit) is not going to weigh that much. The agreement on staged payments during the next 4 years was also positive, as the company would suffer much more losses if the dispute had not been resolved.

The board members did not take any significant actions during the trials, i.e. neither bought nor sold any shares. In the meantime, the funds cut their share by 2.3%, but with over 84% still remaining, this is not a big deal either. Besides, the news on the dispute being resolved came only Friday, with all market action going to take place this week.

Open selling positions percentage (2.74%) shows the investors are not very much interested in selling Dicerna, while many bears locked in their profits Friday, when the stocks rose as much as by 17.86%.

Technically, there is an ascending trend forming, with the price being above the 200-day SMA. As long as the price manages to break out $11 level and close above it, this trend may continue,

having a chance to test $17, the analysts say.

Comcast (CMCSA)

Comcast (CMCSA)

Comcast Corporation is a global telecommunication giant, being the leading broadcasting corporation in the world in terms of revenue. This is also the second biggest pay cable TV and internet provider company. Besides, Comcast has been involved into TV shows and movies production since 2011.

Comcast falls into Service (Entertainment - Diversified) sector. It has grown just by 0.58% over the last week.

The Service sector in general performed badly last week, with just 2.1% growth, which shows the overall situation is a bit sore.

Technically, a descending trend is prevailing, with the price being below the 200-day SMA. The support is currently located at $33, that, if broken put, may push the prices further below to $30.

The board members have recently decreased their share by 4.95%, while the investment funds are very little interested in the company, with just a 0.1% buy. Still, the open short positions are quite low, too, being at 1.33%, which allows some room for the company growth. Still, this may only happen in case the price breaks out $35, being then able to go towards $36.

Steven Madden, Ltd. (SHOO)

Steven Madden, Ltd. (SHOO)

Steven Madden was founded back in 1990 and named after its founder, Stephen Madden, who is both a businessman and a fashion designer. The company creates and sells footwear and fashionable accessories for men, women, and kids.

Steven Madden, Ltd. falls into the Consumer Goods (Textile - Apparel Footwear & Accessories) sector. Over the last week, the company stocks rose by 2.05%.

Overall, Consumer Goods sector was the weakest one last week, having fallen by 3.4%. The way Steven Madden are doing is quite optimistic compared to that, and this allows one to assume this rise is going to continue.

The investment fund longs are very low, at around 0.33%, but this is quite obvious, as their overall share has already reached 95.6%.

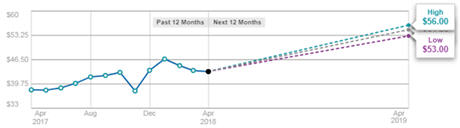

Technically, there is an ascending trend forming, with the price being above the 200-day SMA. Breakout of $48 may lead to the stock growing further.

Many analysts say Steven Madden may well reach $53 or even $58 per share.

Abeona Therapeutics Inc. (ABEO)

Abeona Therapeutics Inc. (ABEO)

Abeona Therapeutics Inc was founded back in 1974; this biopharmaceutical company develops methods of curing rare and life-threatening genetic diseases.

The company falls into Healthcare/Biotechnology sector. Over the last week, its price per share increased by 5.82%.

Overall, Healthcare fell by 0.1% last week, which makes ABEO a pretty much attractive asset.

The percentage of open short positions is very high (37.11%), which may lead to a very sharp increase in price. Meanwhile, the company shares have already increased from $14 further on, as many traders started closing their selling transactions after the analysts missed the quarterly earnings forecast.

With such a high sell-off percentage, the investment funds have still increased their share by 1.14%, to reach 63.20%.

Technically, there is an ascending trend forming, with the price being above the 200-day SMA. The key support at $20 has already been broken out, which may allow the price go further to reach its target at $26.

The analysts say ABEO may well reach $26 or even $36 per share.

By Dmitriy Gurkovskiy, Chief Analyst at RoboMarkets

Disclaimer

Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.