Brent crude is a primary classification of crude oil used as a reference price for trading crude oil around the world. It is also known as London Brent and Brent Blend.

It was first extracted in 1976 from a small area in the North Sea called the Brent field by Shell U.K. Limited (now Royal Dutch Shell), which made it a practice of naming oil fields after water birds. For this particular area, the name comes from a small water bird called the Brent goose.

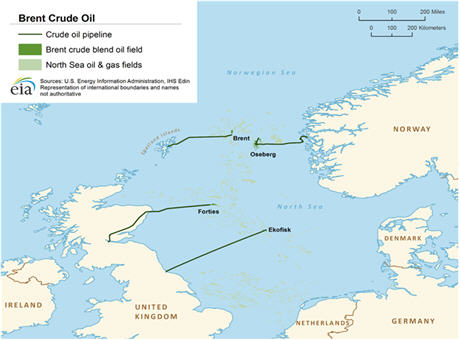

While the Brent field is now no longer economically viable, Brent crude is now comprised of oil extracted from fifteen later-developed oil fields located throughout the North Sea, an area of roughly 220,000 square miles. This area comprises by far the largest oil reserves in western Europe – land or sea.

Source: https://en.wikipedia.org/wiki/Brent_Crude#/media/File:Brent_crude_oil_map.png

Other classifications or benchmarks include West Texas Intermediate, Dubai Crude and the OPEC Reference Basket. Among them and nearly 200 others, Brent is used as the benchmark to price fully two thirds of

crude oil traded globally.

Brent is graded as sweet to describe its low (less than 0.42%) Sulphur content, and indeed has a mild sweet taste (early oil explorers would actually determine oil quality by tasting it). Sweet, low Sulphur crude oil is preferred in the processing of gasoline, diesel fuel and kerosene.

Although there is some subjectivity to the definition, Brent is also a type of light crude oil, meaning it has a low density and viscosity; at room temperature it flows relatively freely. Hand in hand, it produces a higher percentage of the refined products listed above than “heavy” crude – commonly extracted from tar sands and is also used to produce asphalt and other heavy oils.

The means by which Brent crude’s benchmark status is utilized is through its related commodity futures contract traded on the Intercontinental Exchange. Each futures contract is equal to one thousand barrels. Its price is quoted in U.S. dollars per barrel and the contract trades in one-cent increments. Each one-cent change in the price of the contract is equal to $10. The contract currently trades from Sunday, 8:00 P.M. Eastern Time to Friday, 6:00 P.M with a two-hour closing period each week day between 6:00 P.M. and 8:00 P.M. It is one of the largest and most liquid futures contracts in the world.

While the

Brent crude futures contract is the principal benchmark for buyers and sellers of crude oil worldwide, it’s not alone in importance. West Texas Intermediate (WTI), another light, sweet grade, (though less so than Brent) and sourced primarily from wells located within the Mid-continent oil field in the United States, is customarily referenced with Brent crude to convey the global range of crude oil prices. Traded on the CME Group’s NYMEX, the WTI crude futures contract is the largest energy futures contract in the world by volume. Although without a related futures contract, the OPEC Reference Basket is an important benchmark as it’s comprised of a blend of crude products extracted from thirteen of OPEC’s fourteen member countries.

Mid-continent Oil Field

Source: https://en.wikipedia.org/wiki/File:Mid-continent_Oil_Field_map.png

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this letter are of opinion only and do not guarantee any profits.

There is not an actual account trading these recommendations.

Past performances are not necessarily indicative of future results.

Author Bio: Mark O’ Brien is a Senior Commodity Broker at Cannon Trading Company. Mark also specializes in analyzing the markets based on timing methods, using

support and resistance levels and looking at multiple time frames.