Last week the world got its first look ever at a black hole, one of those cosmic bodies so supermassive and powerful that not even light can escape its pull. These things literally destroy all matter that comes within their reach, making them the trash compactors of the universe.

Some of you reading this right now can probably point to a few investments you made over the years that had more in common with black holes than you would care to admit.

Gold, I’m happy to say, is not among those investments, despite all the negative press it sometimes gets. The evidence keeps rolling in that the yellow metal has historically been a wise investment. Because it has a negative correlation with the market, gold has helped investors diversify their portfolios and improve their risk-adjusted returns. Back in January, I shared several charts showing how the

price of gold has beaten the market over several time periods, including the 21st century (so far).

Take a look at the chart below, using data released last week by JPMorgan. For the 20-year period ended December 31, 2018, gold as an asset class had the second best annualized returns at 7.7 percent. Only REITs (real estate investment trusts) did better at nearly 10 percent.

The S&P 500, by comparison, returned only 5.6 percent on an annualized basis, but that’s after it underwent

two huge pullbacks that greatly impacted performance. Bonds—which include Treasuries, government agency bonds, corporate bonds and more—came in next at 4.5 percent. Not bad, considering the asset class has lower overall volatility and risk than equities.

In last place is the “average investor” with a lackluster 1.9 percent.

Everyday Investors Have Lagged the Market by a Wide Margin

Surprised? You shouldn’t be. Quantitative analysis of investor behavior, conducted by research firm DALBUR, has shown time and again that everyday retail investors regularly lag the market, in good times and in bad, by an alarmingly wide margin. Last year they

lost approximately 9.42 percent, or more than twice as much as the S&P did.

This is due mainly to bad timing. Instead of taking a buy-and-hold approach and riding out short-term volatility, many investors tend to sell at the absolute worst time. And that’s often after missing the rally and buying at the peak.

I shouldn’t have to tell you that this strategy, if it can be called that, is like a “black hole” for your money.

Don’t get me wrong. Trading can be fun and sometimes very profitable. But it’s not investing. If you insist on trading, I believe it’s still crucial to maintain a sizeable allocation in high-quality stocks and bonds, exercise discipline and

allow your investment to compound over time.

And as always, I recommend the 10 Percent Golden Rule, which you can learn about by

clicking here.

Ray Dalio Remains a True Believer in Gold

Someone who follows the Golden Rule, with his own and other people’s money, is Ray Dalio, the billionaire founder of the world’s largest and most successful hedge fund firm, Bridgewater Associates. Last year the firm’s flagship Pure Alpha strategy delivered an incredible 14.6 percent gain (compared to “average” investors’ return of negative 9.42 percent, remember). This was not only Bridgewater’s best performance for the year since 2011, but it also helped keep Dalio atop the list of the most profitable hedge fund managers.

If you drill down into

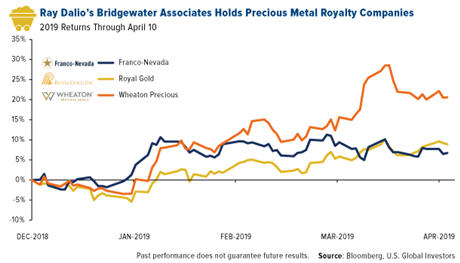

Bridgewater’s SEC filing for the fourth quarter of 2018, you’ll find that Dalio holds significant positions in gold across all tiers in the industry. These positions include physical gold (via SPDR Gold Shares and the iShares Gold Trust), senior gold miners (Barrick Gold, Newmont Mining, Goldcorp, etc.), junior gold miners (Yamana Gold, B2Gold, New Gold, etc.) and gold royalty and streaming companies (Franco-Nevada, Wheaton Precious Metals and Royal Gold).

As many of you know, I like to get access to the precious metal market with royalty companies. Back in January, Paradigm Capital showed that this small group of companies

crushed all other tiers in the gold mining industry, delivering an unbelievable 16 percent in compound annual growth from 2004 to 2018. That’s Ray Dalio-caliber performance.

Dalio Sounds Off on Capitalism

Dalio Sounds Off on Capitalism

While on I’m the topic of Dalio, the multibillionaire recently had some choice words to say about capitalism. In a lengthy post on LinkedIn, which you can read

here, Dalio shared his belief that it is no longer working as it should for most Americans. As such, he argues, capitalism must be “reformed.”

In one of the more eye-opening segments of his essay, Dalio says that political divisiveness and the widening “opportunity gap” in the U.S. is creating what he sees as eerie similarities between now and the late 1930s:

Disparity in wealth, especially when accompanied by disparity in values, leads to increasing conflict and, in the government, that manifests itself in the form of populism of the left and populism of the right and often in revolutions of one sort or another. For that reason, I am worried what the next economic downturn will be like, especially as central banks have limited ability to reverse it and we have so much political polarity and populism.

This definitely isn’t cheerful bedtime reading. I’m not asking you to agree with Dalio here—he doth protest too much, methinks—but if his thoughts resonate at all with you, I believe it’s even more reason to make sure you’re invested in gold.

Central Banks Continue to Gobble Up Gold

On a final note, the price of gold crossed above $1,300 an ounce again last week following news that China increased its gold holdings in March for the fourth straight month. The People’s Bank of China raised reserves to 60.62 million ounces, or 1,885 tonnes, as trade tensions between the U.S. and the Asian giant continue to drag on. This puts it on course to overtake Russia and Kazakhstan, the top buyers of the yellow metal in 2018.

China wasn’t alone, however. Global central banks bought a net 51 tonnes of gold in February, the largest monthly increase since October 2018, according to a recent report by the

World Gold Council (WGC).

“Central banks’ gold holdings have grown by 90 tonnes in the first two months of the year, compared with 56 tonnes in the same period in 2018 (and the highest level of growth since 2008),” writes the WGC’s Krishan Gopaul. “This shows that collectively, central banks—mostly from the emerging markets—continue to accumulate gold at a healthy pace.”

For even more timely market insight on gold and natural resources, subscribe to my award-winning CEO blog, Frank Talk!

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2019): Barrick Gold Corp., Newmont Mining Corp., Yamana Gold Inc., B2Gold Corp., Franco-Nevada Corp., Wheaton Precious Metals Corp., Royal Gold Inc.

A real estate investment trust is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and timberlands. Some REITs engage in financing real estate. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.