Not that much happened on the financial markets last week. Stocks extended their uptrend while the price of gold went sideways. Everyone seemed to be waiting for this week’s Wednesday’s FOMC Statement release. But there will be more interesting economic news releases in the coming days. Let’s take a look at the details.

The week behind

The week of January 20 - January 24 has been pretty quiet on the financial markets. The stock market kept advancing ahead of quarterly earnings releases, but

gold went sideways. On Thursday the Euro sold-off following the

European Central Bank’s Monetary Policy Statement release. Early in the week the

Bank of Japan has released its

Monetary Policy Statement and the

Yen has been strengthening throughout the whole week. Last but not the least, Wednesday’s economic data releases from Australia and Canada have triggered some meaningful

currency moves.

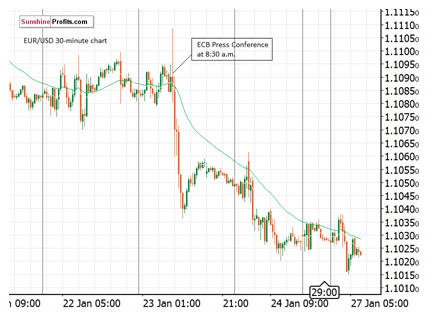

Let’s focus on last week’s Thursday’s EBC’s releases and their impact on the EUR/USD. The

volatility much increased after the ECB’s Press Conference at 8:30 a.m. The price jumped above the short-term

resistance level of 1.1100 before quickly going down and reaching a local low of around 1.1040. Since then it was extending the downtrend, as it got closer to 1.1000 mark today.

The week ahead

The week ahead

What about the coming week? The financial markets will certainly focus on Wednesday’s

FOMCMonetary Policy Statement release. But there will also be series of the U.S. economic data releases throughout the whole week. Be sure to check the details below. We will also get

quarterly earnings from the most watched: AAPL, MSFT, AMZN. Last but not the least, the Monetary Policy from BOE and Canadian GDP number. Let’s take a look at key highlights:

- Wednesday’s FOMC Monetary Policy Statement release will be the most important economic event of the coming week.

- We will also have a bunch of pretty important U.S. economic data releases: Durable Goods Orders, Consumer Confidence on Tuesday, the Advance GDP number on Thursday, Personal Spending and Personal Income along with the Chicago PMI release on Friday.

- The quarterly earnings season is in full swing this week. We will have releases from Apple, Microsoft, Amazon, among others.

- On Thursday, the Bank of England Monetary Policy Report will be released.

- Canadian dollar traders will be looking ahead to Friday’s GDP number release.

Let’s focus on the Wednesday’s FOMC Statement release.

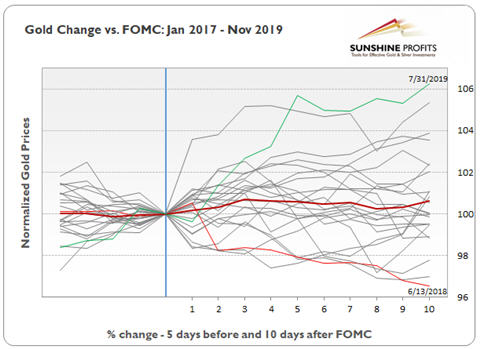

Where would the price of gold go following that news release? We’ve compiled the data since January of 2017, a 36-month-long period of time that contains of twenty four FOMC Statement releases. The following chart shows that gold price was generally slightly higher following the release. But we’ve also had some sell-off’s in gold like the one after the June 13, 2018 FOMC release. However, the gains in gold price were generally higher than losses – gold moved the most after the August 31, 2019 FOMC release, as it gained 6.3%.

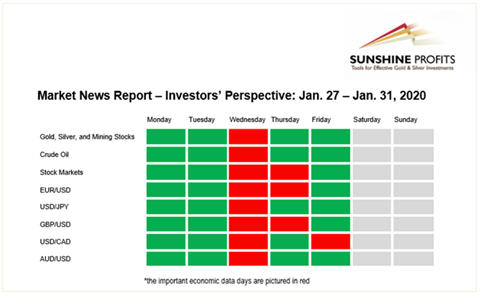

You will find this week’s the key news releases below (EST time zone). For your convenience, we broken them down per market to which they are particularly important, so that you know what to pay extra attention to, if you have or plan to have positions in one of them. Moreover, we put the particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that are not in bold usually don’t result in bigger intraday moves, so unless one is engaging in a particularly active form of

day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Our Market News Report consists of two different time-related perspectives. The investors’ perspective is only suitable for the long-term investments. The single economic data releases rarely cause major outlook changes. Hence, we will only see a handful of bold markings every week. On the other hand, the traders’ perspective is for traders and day-traders, because the assets’ prices are likely to react on a single piece of economic data. So, there will be a lot more bold markings on potentially market-moving news every week.

Investors’ Perspective

Gold, Silver, and Mining Stocks

Gold, Silver, and Mining Stocks

Tuesday, January 28

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

- 8:00 p.m. China - Manufacturing PMI

Crude Oil

Tuesday, January 28

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

- 10:00 a.m. U.S. - CB Consumer Confidence

- 4:30 p.m. U.S. - API Weekly Crude Oil Stock

Wednesday, January 29

- 10:30 a.m. U.S. - Crude Oil Inventories

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

- 8:00 p.m. China - Manufacturing PMI

Friday, January 31

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m

- 9:45 a.m. U.S. - Chicago PMI

Stock Markets

Tuesday, January 28

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

- 10:00 a.m. U.S. - CB Consumer Confidence, Richmond Manufacturing Index

- After Close U.S. – AAPL Quarterly Earnings

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

- After Close U.S. - AMZN Quarterly Earnings

- 8:00 p.m. China - Manufacturing PMI

Friday, January 31

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m

- 9:45 a.m. U.S. - Chicago PMI

EUR/USD

Monday, January 27

- 4:00 a.m. Eurozone - German Ifo Business Climate

Tuesday, January 28

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

Friday, January 31

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m

- 9:45 a.m. U.S. - Chicago PMI

USD/JPY

Tuesday, January 28

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

- 8:00 p.m. China - Manufacturing PMI

GBP/USD

Tuesday, January 28

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 7:00 a.m. U.K. - BOE Monetary Policy Report, MPC Official Bank Rate Votes, Monetary Policy Summary, Official Bank Rate

- 8:30 a.m. U.S. - Advance GDP q/q

USD/CAD

Tuesday, January 28

- 10:00 a.m. U.S. - CB Consumer Confidence

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

Friday, January 31

- 8:30 a.m. Canada - GDP m/m

AUD/USD

Tuesday, January 28

- 10:00 a.m. U.S. - CB Consumer Confidence

- 7:30 p.m. Australia - CPI q/q, Trimmed Mean CPI q/q

Wednesday, January 29

- 2:00 p.m. U.S. - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Thursday, January 30

- 8:30 a.m. U.S. - Advance GDP q/q

- 8:00 p.m. China - Manufacturing PMI

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Market News Report - this analysis' full version. The full Alert includes also the

Traders’ Perspective which is very useful for the people who trade within shorter time frames. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to

subscribe today.

Check more of our free articles on our website – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts.

Sign up for the free newsletter today!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.