Stockhouse Ticker Trax is published to subscribers every Monday (annual cost only $195). We focus on best-in-class high growth small companies trading on the TSX and TSX.V between 5 cents and $3 with a market cap below $300 million.

Equity Analyst Danny Deadlock has 30 years of experience speculating on Canadian penny stocks and targets capital gain opportunities and diversification in metals and minerals exploration, energy, and technology.

For the experienced investor, Ticker Trax provides an extra set of eyes and ears (idea generation) and for those learning to invest in micro cap stocks, we provide stock picks and market education.

Subscribers receive; (1) new research (stock picks) weeks in advance of being featured on this weekend column (2) exclusive access to our list of junior gold exploration companies (critical for peer valuation), (3) exclusive access to our list of Cash Rich micro cap companies (our Virtual Vulture Fund) which contains 80 companies with almost $3 Billion.

Both tables are updated monthly.

Moly Mines Ltd. (TSX: T.MOL, Stock Forum) (8.5 cents)

www.molymines.com

Shares Outstanding: 385 million (1 Chinese shareholder owns 207 million)

Financials Dec 31st:

Cash $77 million + Receivables $8 million / Liabilities $15 million

Approx. Net Cash & Investments = $70 million or 18 cents per share

"Cash is king and patience is a virtue. We are very well positioned in the market to go for quality projects in accordance with our strategy. Every effort will be made to ensure we secure key assets best suited to the future growth profile of the company." [Moly Mines CEO April 9th]

"Cash is king and patience is a virtue. We are very well positioned in the market to go for quality projects in accordance with our strategy. Every effort will be made to ensure we secure key assets best suited to the future growth profile of the company." [Moly Mines CEO April 9th]

On February 21st I featured MOL in this weekend column at 11.5 cents but the stock took a hit when it was announced April 9th that they would temporarily lose their Australian Stock Exchange (ASX) listing on April 22nd for failing to meet listing requirements.

The company has been unable to put their war chest of cash to use and secure a merger or acquisition. I cannot blame them for taking their time but many older shareholders are tired of waiting and started dumping on the delisting news.

The TSX has more liberal listing requirements and there are dozens of TSX listed companies simply sitting on cash hoping to put it to work. MOL has one of the largest bank accounts in this cash rich category and is also trading at the deepest discount to cash value.

I have followed MOL for several months now (since 11 cents) and I will continue to follow their progress. The delisting notice in Australia could be creating an opportunity in the current price range - so long as investors understand this merger / acquisition process can be lengthy.

The company has also made senior management changes to preserve cash until a merger or acquisition target is secured.

If MOL is successful in their hunt, investors will have no choice but to initially by MOL on the TSX because the company will need to apply to get their trading in Australia reinstated. As selling dries up from disgruntled Australian shareholders, there will be limited paper available on the TSX - in theory a simply case of supply and demand imbalance that should push the share price higher once a deal is identified.

Because the CEO and Board of Directors are taking their time to find a company capable of rebuilding significant shareholder value, one can assume the stock should then trade near or above cash value.

And so long as they are controlling their burn rate (which they are) failure to identify a suitable project in a reasonable amount of time may lead to liquidation of the company and distribution of the cash to shareholders. Which even in this case, should generate substantial returns from the current level.

________________________________________________

February 21, 2014 - Original Report Copy

Even A Cash Rich Dog Can Have its Day

I always concern myself with management’s past track record but for these cash rich companies I don’t worry about them so long as I am monitoring the quarterly cash burn to ensure they are not doing anything foolish to waste their war chest.

With cash rich micro cap companies I speculate on “cash and time” – assuming that eventually the board of directors is under enough pressure from majority shareholders to restore shareholder value. This takes patience.

Moly Mines (MOL.T 11.5 cents)

www.molymines.com

Net Cash: $78 Million CDN= 20 cents per share

Shares Outstanding: 385 million

This one reads more like a mining Soap Opera. It involves a BIG bank account, Asian & Australian investors, and what was initially believed (last month) to be the “execution” of a Billionaire CEO by the Chinese government.

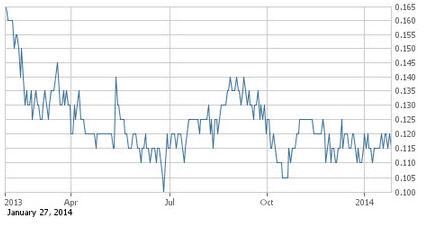

Since peaking at $1.80 in Q1/11, Australian based Moly Mines fell for the next two years and has now flat-lined since the second quarter of 2013. A huge percentage of their shareholders threw in the towel during the past year and now they are left with a relatively loyal shareholder base.

After three years of shareholder value destruction, 2014 (in theory) should be the year they turn this around. And because so many investors have grown tired of waiting for something to happen with the company (and because they are based out of Australia), the discount to their giant cash value is very large.

Moly had an iron ore mine which was sold in 2013 and added to their already large bank account. A person in theory would hold this one waiting for them to find a good use for all that cash. With so many projects in desperate need of capital, the possibility exists to acquire a high quality asset and rebuild shareholder value this next year.

TWO RISKS – TIME & THE CHINESE

My primary concern would be that this becomes long term idle money. As I mentioned, they have approx. $78 million CDN in the bank and are looking for an acquisition or merger. However a large percentage of their stock is owned by a Chinese Investment Group with a VERY questionable past - Hanlong Group.

The founder of Hanlong was billionaire Liu Han. He was arrested in March of 2013 for harbouring a fugitive but many believed his charges in China were extended to include corruption and graft. He went to trial recently but there was no public coverage. A month ago it was reported in Australian media that sources believed Liu Han was found guilty and executed by the Chinese government.

It has Surfaced this week that Liu Han is alive - maybe not doing so well, but alive.

And the drama goes deep. The following article provides a good overview but here is a quote:

"36 people including Liu and his brother Liu Wei are being prosecuted by the Xianning People’s Procuratorate in Hubei Province on suspicion of six murders and other gang-related crimes."

https://www.smh.com.au/world/billionaire-kingpin-liu-han-accused-of-heading-organised-crime-gang-20140221-hvd7z.html

LIU HAN A HUGE EMBARASSMENT FOR MOLY MINES

Hanlong invested a lot of money in Australia and that included Moly Mines. When problems began to surface with Hanlong (including an insider trading scandal), many outside investors painted Moly Mines with a tainted brush. Unfortunately MOL was guilty by association only but it was bad enough to harm their image in the eyes of investors and many shareholders.

Moly Mines has seen several changes to its board of directors (BOD) over the past year and what is left is a slate of very professional people.

https://www.molymines.com/about/Directors-Officeholders.aspx

Typically the BOD on a shell company like this is groomed ahead of acquisitions or mergers and that is hopefully what they are doing here. The timing of such a transaction is the unknown variable. Raising $80 million for a junior public mining company would be a massive undertaking so these guys have a huge advantage in this market.

The speculation is how well do they leverage that money to rebuild shareholder value?

MOL has very good liquidity from 11 to 13 cents and what "appears" to be attractive risk/reward – if you can look beyond the negative history of Hanlong.

October 30, 2013 (news release excerpt)

The board is aware of the urgent task ahead to restore shareholder value and will be embarking on two large and very important initiatives.

The first is to take the steps necessary to start rebuilding the reputation of Moly Mines.

The second is to grow the value of the company. While the board is keen to make progress on these fronts as soon as possible, all opportunities will be considered in a very careful and measured way. Getting it right is critical. The early view of the board is to concentrate on substantial advanced projects in copper and gold in countries with acceptable sovereign risk. Ideally, there will be more than one project, with both commodity and geographic diversification.

As the board refines its thinking, further detail will be provided.

** TWITTER NOTE: I maintain a twitter page at - twitter.com/tsxalerts

_______________________________________________________________________

_______________________________________________________________________

Disclosure: Danny Deadlock owns 200,000 shares of MOL

_______________________________________________________________________