Stockhouse Ticker Trax is published to subscribers every Monday (annual cost only $99). We focus on best-in-class high growth small companies trading on the TSX and TSX.V between 5 cents and $3 with a market cap below $300 million.

Equity Analyst Danny Deadlock has 30 years of experience speculating on Canadian penny stocks and targets capital gain opportunities and diversification in metals and minerals exploration, energy, and technology.

For the experienced investor, Ticker Trax provides an extra set of eyes and ears (idea generation) and for those learning to invest in micro cap stocks, we provide stock picks and market education.

Subscribers receive; (1) new research (stock picks) weeks in advance of being featured on this weekend column (2) exclusive access to our list of junior gold exploration companies (critical for peer valuation), (3) exclusive access to our list of Cash Rich micro cap companies (our Virtual Vulture Fund) which contains 80 companies with almost $3 Billion.

Both tables are updated monthly.

On October 25th I posted in my weekend Stockhouse report that October 28th I would be featuring (for paid Ticker Trax subscribers), a new social media stock with explosive potential.

https://stockhouse.com/opinion/ticker-trax/insights/2013/10/25/monday,-a-tiny-tech-stock-with-explosive-potential

That stock LX Ventures Inc. (TSX: V.LXV, Stock Forum) (43 cents) is now up 90% but as I mentioned on the 25th I am now making that same (updated) report available for free weekend readers. The market cap of LXV now sits at $21 million but considering the incredible valuations we are seeing on social media stocks, this may be the tip of the iceberg for LX Ventures (assuming they fully execute on their business model in 2014).

On December 1st a subsidiary of LXV called Mobio will officially launch Mobio Insider. For the past several months Mobio has been in a Beta testing phase and over the past couple weeks they announced the following social media influencers (celebrities) who are working with them ahead of the official launch.

Scott Disick Twitter 3.7M Facebook 300k

Romeo Miller Twitter 500k Facebook 50k

Paul Wesley Twitter 2.5M Facebook 900k

Jessica Gomes Twitter 55k Facebook 70k

Bella Thorne Twitter 4.7M Facebook 5.1M

Pamela Anderson Twitter 1M Facebook 600k

Lucy Hale Twitter 3.2M Facebook 1.5M

Total Influence: Twitter: 16 Million Facebook: 9 Million

With respect to valuations that border on the insane (including the recent IPO doubling of Twitter to $24 Billion), one only needs to look at 2 YEAR OLD messaging service Snapchat with ZERO REVENUE but an apparent offer from Facebook in the range of $3 Billion.

_______________________________

https://online.wsj.com/news/articles/SB10001424052702303789604579196023009484870

Wall St Journal Excerpt – November 13th

“In a sign of the fervor once again rising around Internet start-ups, the 23-year-old CEO of a two-year-old company with no revenue has rejected a $3 billion buyout offer.

Snapchat Inc. co-founder Evan Spiegel in recent weeks spurned an all-cash offer from Facebook for close to $3 billion, according to people briefed on the matter. The offer, and rebuff, came as Snapchat is being wooed by other investors and potential acquirers. Chinese Internet giant Tencent Holdings had offered to lead an investment that would value Snapchat at $4 billion.

Mr. Spiegel's company has no sales and no business model—but it does have a Smartphone app that delivers hundreds of millions of messages, mostly from teenagers and young adults, that disappear in 10 seconds or less.”

Further Insight is also available here:

https://finance.yahoo.com/news/snapchat-spurned--3-billion-acquisition-offer-from-facebook-212857394.html

_______________________________

MOBIO – THE NEW BIG BROTHER OF SOCIAL MEDIA

As social media commands incredible valuations, TIME ran the following article that highlights how companies like Facebook & Twitter are getting rich off celebrity users.

https://newsfeed.time.com/2013/11/07/interactive-this-is-how-much-money-twitter-owes-you/

Ellen DeGeneres @TheEllenShow - 8 Nov

Whaaat?! According to this article, Twitter owes me over $3 million. I accept personal checks & Claire's gift cards. https://ellen.tv/1d5saPj

Whether its music, movies, modelling or sports, celebrities are all too familiar with large corporations taking advantage of their popularity to make a dollar. And nothing is worse than the Internet and Social Media.

In 1999 Napster came along and turned the music industry upside down by robbing musicians of their royalties. This led to many similar services that allow people to share (pirate) music and movies. It has been a problem for the past decade and will continue to be a problem.

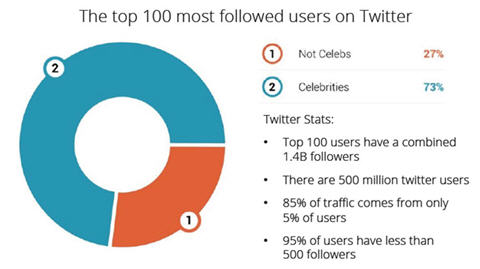

You will see in my report below where 85% of Twitter traffic comes from 5% of the users. And who are those users? Musicians, actors, models, and sports celebrities. And while the valuation of Twitter is $24 Billion and Facebook is $128 Billion – how did they get there? Off the back of celebrity traffic that in many cases has not generated a single dollar for the celebrity.

In fact, most celebrities cannot begin to handle their social media traffic and must hire a team to do it for them. Now it is costing them money while the social media company sells very expensive advertising.

ENTER MOBIO INSIDER – www.mobio.net - THE MONETIZATION OF SOCIAL MEDIA CONTENT

LX Ventures through Mobio is stitching together the largest mobile advertising real estate play in existence today by being able to deliver ad units to the most engaged users on the top social media platforms.

The next time a celebrity interacts with their fan base and uploads a photo or video based upon what their fans would most like to see (determined with the help of Mobio) the celebrity will be putting money in their own pocket or sharing a portion of it with their favorite charities (again doing so through Mobio technology).

The Mobio platform will support the monetization of content by posting links to Facebook Inc. (NYSE: FB, Stock Forum) and Twitter Inc. (NYSE: TWTR, Stock Forum). They will then add further platforms that may include: Google+, LinkedIn, Wordpress and Line.com

Their model is clear - Consume an ad per piece of content: a photo or video and Mobio revenue shares with the content producer. Eventually this could become something like the impact Google Adwords had on the blogging industry.

People that produce viral and engaging content will be rewarded for their quality content.

A ONE-STOP SHOP FOR THE CELEBRITY

The question arises “what keeps Facebook or Twitter” from doing something similar? I believe that is always a possibility but you must consider how complex the coding is behind sites like Facebook. Implementing the same type of functionality as Mobio would require massive functional changes to their platforms. The social media sites would almost need to duplicate each other’s business.

Also another huge benefit Mobio has is that they work across multiple platforms. It is VERY doubtful that Facebook, Twitter, Google+ , Line, Tumblr, Instagram, Linkedin, etc. are going to work together.

Mobio should eventually work across all these major social media platforms and that is a HUGE benefit to the power social media user. They learn and utilize one system versus multiple services under multiple platforms.

Not to mention the fact NO one else is offering this service so Mobio is first to market and that in theory gives them a huge competitive advantage in a very fast moving digital world.

Below is the report I sent to paid Ticker Trax subscribers October 25th. It is just as relevant now.

____________________________________________________________________

October 28, 2013

Stockhouse Ticker Trax

Equity Analyst: Danny Deadlock

Today Mobio signed Percy Miller Jr. (Lil’Romeo). Miller’s father is Percy Miller (aka Master P) with a net worth estimated > $300 million and a tremendous influence on the rap music industry.

"I was sold on Mobio from the first look. I love my fans and I am going to blow it up for them," said Romeo Miller.

1ST – BIG U.S. TECH STOCKS ON FIRE

A VERY small percentage of the stocks listed on the TSX and TSX Venture exchange are tech related. In fact I believe tech makes up less than 5%.

And while numerous companies within the tech sector have been generating huge gains for investors on the NYSE and NASDAQ (Facebook alone is up 100% since the summer), most speculators in Canada have been drowning in losses associated with resource exploration. Even the biggest and best brokerage firms and funds are down 30% to 40% this past year on their metals and mining stocks.

Because the TSX and TSX Venture are so heavily weighted to resource companies, many investors and speculators are missing out entirely on what is happening south of the border with tech.

There is no doubt Internet and Social Media is white hot. Not just public company valuations, but private companies are commanding top dollar.

2ND – PAST PERFORMANCE OF JUNIOR TECH IN CANADA

Other than the huge run in Canadian listed technology stocks late 1999, tech for the most part is often overlooked in Canada. This is particularly evident in the micro and small cap space.

2011 INT.V GAINS > 2000%

Even in the resource sector over the past few years, there have been few Canadian stocks that produced the type of gains we saw with a small software company called Intertainment Media Inc. (TSX: V.INT, Stock Forum) (5 cents). Heading into 2011 this stock was trading below 10 cents and within six months it was up over 2000% as the market cap went from $20 million to $1/2 Billion!

The volumes were huge as the stock traded millions of shares daily and it seemed every speculator in Canada was trading this company. Unfortunately it was a disaster in the making and I even published a report in February 2011 warning people.

https://stockhouse.com/opinion/independent-reports/2011/02/22/irrational-exuberance-and-the-importance-of-share

Little did I know there were still huge gains to be made from February but when the smoke settled, this company left a path of shareholder destruction.

INT simply demonstrated that there is a definite appetite for small tech plays in Canada IF the story hits a passionate note with speculators.

LXV which I am introducing today has a far better share structure, a blue chip management group and a healthy balance sheet backed by a very strong business model. Whether it has the same type of “sex appeal” as INT did, I don’t know.

They do have the ability to issue high profile news releases (as evidenced this past week) and the sector is doing extremely well south of the border. If they start firing on all cylinders this winter we could see the market valuation change quite dramatically.

THE LEADING CHALLENGE IN SOCIAL MEDIA… GENERATING REVENUE

A HUGE revenue challenge in the 1990's was with search engines. Even with their massive traffic they struggled to convert visitors to dollars. Then a small company came along in 1998 called Goto.com that helped launch a ground breaking idea called pay-per-click (PPC) advertising.

Goto was a start-up with 25 employees that become Overture and was bought out by Yahoo in 2003 for $1.6 Billion. Google launched their Adwords system in October 2000 but PPC was not introduced by Google until 2002.

It was the PPC concept that revolutionized advertising on search engines.

Advertising on social media remains a MAJOR challenge because Internet users have become experts at tuning out advertising. This has become particularly challenging for smart phones.

The giants like Facebook continue to make acquisitions and develop their own methods of advertising but for the most part, it remains a major challenge because unlike Goto, no one has come up with a system that works exceptionally well.

TWITTER will soon face the most advertising pressure. As they go public they will need to justify their sky-high valuation and with their current financials, they have a LONG way to go.

ENTER LXV & MOBIO

LX Ventures (LXV.V 43 cents)

www.lxventures.com

Shares Outstanding: 49 million

Net Cash should be close to $2.5 Million

LX acquires, integrates, and accelerates early stage high growth technology companies. They currently control three companies (Sosido, Mobio, and Fodio) but my current interest lies with Mobio and that is the subject of this report.

Should Mobio become something big, the valuation could be many multiples of what we are seeing now. Mobio has been under beta test since the summer and will be going live December 1st. Future valuation will be dependent upon their success in 2014.

As I mentioned earlier, big companies associated with the Internet and Social Media are doing exceptionally well. Twitter is expecting to raise $1 Billion at a sky-high valuation yet their financials leave a lot to be desired.

Facebook Valuation - $128 Billion

Instagram (photo sharing) - $1 Billion

Google - $340 Billion

Apple - $483 Billion

Twitter - $12 Billion + (pre IPO estimate).

Twitter in the last quarter reported revenue of $168 million but a loss of $65 million.

Consider the following:

Top 100 chart

As the chart above shows, a VERY small percentage of Twitter users account for a HUGE percentage of their social media traffic. These users are typically high profile celebrities in sports, music, and entertainment.

The twitter users who “passionately” interact with them tend to be young. Typically they are teenagers.

Consider the purchasing power of the teenager:

> 47% of all teens have a smartphone and 23% own a tablet

> 95% of teens use the internet

> In the United States there are 26 million teens

> Products bought by and for U.S. teens - $209 Billion annually

> Percentage of teens who have placed an online order in the past 3mths (2012) – 26%

> Percentage of girls who identify shopping as their hobby or activity – 80%

> Girls sourcing trends via: Ads 68% , Websites 44% , Celebrities 33%

Long story short…. Celebrities are a HUGE influence on teenage consumer spending and this is a Giant demographic market for advertisers and advertising dollars.

THIS is the (lucrative) target market for MOBIO – initially on Twitter and Facebook – the two giants.

The industry standard for display advertising is estimated near 0.5% and Mobio tests to date have shown advertising unit engagement near 35%.

WHAT IS MOBIO

Mobio (owned by LXV) is launching December 1st but has been beta testing since summer.

Mobio allows these celebrities with huge audiences to not only better manage the flow of information and two-way interaction with fans, but GENERATE REVENUE! Either for themselves or a charity.

As the statistics with Twitter showed, social media is dominated by a very small percentage of power users. This group of even 100 users is responsible for Billions of visits and interactions every month. The company(s) that can capitalize on this traffic and provide a workable revenue model “may” be sitting on a technological gold-mine.

We won't know for sure until Mobio launches in December but if (after one or two quarters) this is ground breaking advertising technology for social media, then the market capitalization (at least in theory) could go through the roof.

All it would take is for some huge name like Justin Bieber with 46 Million Twitter followers to start using Mobio (either for personal gain or for charitable purposes).

I have compiled the following from LXV Presentations:

FANS WANT MORE ACCESS

> Celebrities use social media platforms to build their brand by getting closer to their fans

> The ability to connect celebrities directly to their audiences has made social media platforms the top choice for their fans to reach out

> Celebrities are inundated with hundreds or thousands of incoming requests per day

Bottom Line: Celebrities need a solution that determines which requests are the most important to reply

MONETIZE CONTENT

> The current model of paying celebs to endorse or recommend a product or brand through their social media posts doesn’t work

> They can be viewed as “selling out” and this has shown to have an immediate negative effect

Bottom Line: Celebrities need a solution that monetizes their content without the negative image

WHAT DOES IT DO?

> Monetizes social media streams (posts) by inserting advertising around, in-front of or within content

> Allows true 2-way fan engagement that is scalable and reduces hours of fan reply each day

> Tells celebrities what their fans most want to know and what types of content will have the most positive impact on followers

>Publish to existing popular social media platforms…not another platform to join and grow

> Earn revenue each time the celebrity posts new content

With the Mobio platform, they turn user engagement: likes, retweets and other social sharing into a revenue stream

> They do this by having fans consume an ad unit before unlocking content

> Advertisers want access to celebrities fan’s and are willing to pay industry leading rates for these ad units

Mobio would work with key influencers (celebrities) with 500k + followers. This business model generates ongoing monthly ad revenue for the celebrity and also Mobio (LVX). The celebrity may choose to keep all of his or her revenue or share all or part of it with a designated charity.

Celebrities are the most vital content producers for social media platforms yet, the vast majority of this activity and traffic goes unpaid. At the same time it becomes a HUGE drain on time and financial resources to maintain a proper social media presence (critical in today’s digital society).

______________________________________________________________________

THE “WAKE-UP CALL” MOMENT FOR SOCIAL MEDIA

Mobio INsider gives fans personalized two-way social media contact with the celebrities they love while enhancing their experience and deepening fan loyalty. The Mobio platform allows fans to request content (pics, videos, questions), vote on the best requests, and receive truly personalized content in return – an industry first.

The Mobio INsider platform, in addition to deepening the fan connection, gives celebs an efficient way to monetize the fan relationship beyond concert tickets, t-shirts and singles.

Why does this matter? Well, the “wake-up call” moment for social media has arrived. The “talent” is driving the value proposition for Twitter and Facebook. Advertisers are charged more as traffic and subscribers grow on Twitter and Facebook, but (a huge BUT) Twitter and Facebook give little (if any) revenue to the stars that create the value.

Stars and celebrities are already creating content for social media on a daily, or hourly, basis. But by utilizing Mobio Insider, a star will create better content, specifically desired by their fanbase, and be rewarded financially for their content and fan interactions.

______________________________________________________________________

LX VENTURES (LXV) MANAGEMENT

Management, directors and advisory board all have huge venture capital and tech experience. As a group they have participated early in big U.S. tech companies and cashed out over $2 Billion.

https://www.lxventures.com/i/pdf/Presentations/LXV_Presentation.pdf

______________________________________________________________________

Disclosure: Danny Deadlock owns 100,000 shares of LXV purchased in the open market

______________________________________________________________________

ADDENDUM:

The following article appeared as I was going to print with this report.

It’s worth viewing as it demonstrates how relevant (and timely) Mobio is.

https://finance.yahoo.com/blogs/the-exchange/justin-beiber--katy-perry-and-twitter-s-biggest-risk-231651990.html

Here is a link to the PDF version this week's column.

https://stockhouse.com/media/tickertrax/TTraxFriNov15-LXV.pdf