That ACB offer in its current form. The market is saying it is dead. The Senvest letter was the final nail in the coffin.

Senvest Management, LLC, as agent for and on behalf of the funds for whom it acts as investment manager or advisor (“Senvest”), with a significant ownership position of approximately 8% of the outstanding shares of CanniMed Therapeutics Inc. (“CMED”), announced today that it has delivered a letter to the Board of Directors of Aurora Cannabis, Inc. (“ACB”) expressing serious concerns regarding the proposed terms of ACB’s takeover bid for CMED launched on November 24, 2017.

| | | CMED / ACB Contribution Analysis | |

|

In its letter to the Board, Senvest expresses its view that the proposed price under the ACB bid significantly undervalues CMED and does not fairly recognize CMED’s relative contribution to the pro forma combined business, citing a number of objective metrics which inform this view. Senvest believes strongly that the combination of CMED with Newstrike Resources, Ltd. (“HIP”) will bring together the most trusted medical brand with a recreational brand featuring the endorsement of Canada’s iconic band “The Tragically Hip,” positioning CMED to take a leading position in the emerging Canadian cannabis market. Senvest has voted its shares in favour of CMED’s acquisition of HIP and will not be tendering its shares to the ACB takeover bid. Senvest encourages all CMED shareholders to do the same.

For further information, please contact:

Senvest Management, LLC, Media Department

E-Mail Address: Media@Senvest.com

STRICTLY PRIVATE & CONFIDENTIAL

January 16, 2018

Board of Directors

Aurora Cannabis Inc.

1500 – 1199 West Hastings Street

Vancouver, British Columbia

Canada V5E 3T5

Dear Members of the Board:

Senvest Management, LLC (“Senvest Management”) advises private investment funds, which as of January 15, 2018, own 1,896,500 shares of common stock of CanniMed Therapeutics Inc. (“CMED”), equal to approximately 8% of its shares outstanding, and 3,500 convertible bonds of Aurora Cannabis, Inc. (“ACB”). We are writing to you to express our view and concerns regarding ACB’s proposed transaction to acquire CMED by way of a tender offer launched November 24, 2017, with ACB shares offered as consideration (“the ACB Offer”). We believe that the ACB Offer significantly undervalues CMED and does not fairly recognize CMED’s relative contribution to the pro forma combined business. We note a number of objective metrics which inform this view, as outlined below.

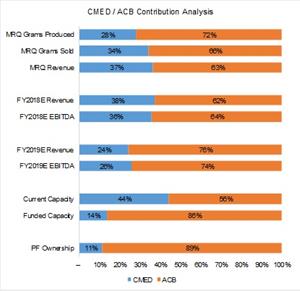

- On a pro forma basis based on the current market price1 of ACB shares at approximately $11.50 per share, under the terms of the ACB Offer, CMED shareholders would own approximately 11% of the new entity, significantly less than the 36-38% pro forma relative FY2018 revenue and EBITDA contribution, and 24-26% pro forma relative FY2019 revenue and EBITDA contribution that is described below.

- The Canadian cannabis stocks2 have all traded significantly higher since ACB’s initial announcement of an intention to make a formal bid on November 14, 2017 to acquire CMED and markedly higher in the past month. In the last 21 trading days, an equal-weighted index of Canadian cannabis stocks has increased by approximately 38%, while CMED stock has increased by only 23%. We believe that the price per share under the ACB Offer is likely constraining CMED’s stock price due to the cap price of $24.00 per share (“Cap Price”) imposed in the ACB Offer. If ACB had not imposed the Cap Price, the value per share under the ACB Offer for CMED would amount to approximately $52 per share.

- The chart below illustrates the relative contribution of various metrics that CMED would provide on a pro forma basis to the combined ACB-CMED entity, based on the most recent quarter (“MRQ”) financial results reported by CMED and ACB and estimates provided by Bloomberg, which clearly demonstrates that the 11% pro forma ownership of CMED shareholders in the combined ACB-CMED company would be significantly less than the relative contribution provided by CMED.

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae01369c-171e-4b16-ac63-844611873071

Source: Company Filings and Bloomberg Consensus Estimates as of 1/16/18

1 As of January 15, 2018

2 Canopy, Aphria, MedReleaf, Cronos, CannTrust, Hydropothecary, Supreme, OrganiGram, Emerald, ABcann, Maricann, and Emblem, as listed in ACB December 2017 Presentation

We believe that a consolidation strategy has become a critical factor to future success in the competitive Canadian cannabis market. As you know, CMED has entered into an agreement to acquire Newstrike Resources Ltd. (“HIP”), which is subject to HIP and CMED shareholder votes expected to occur on or about January 17, 2018 and January 23, 2018, respectively. We believe that it is a foregone conclusion that HIP shareholders will approve the transaction based upon, among other things, the voting support agreement signed by shareholders representing approximately 58% of HIP shares outstanding. As a result, we believe that CMED shareholders voting on the deal will determine its fate. As an 8% shareholder of CMED, coupled with the fact that approximately 36% of CMED shareholders are required to vote against the deal, we believe that Senvest Management holds a key independent vote, focused on maximizing shareholder value, in the HIP transaction.

Finally, we note that if CMED and HIP market capitalizations were added together, and divided by the pro forma CMED shares outstanding, it implies a CMED stock price of approximately $33 per share. This further demonstrates the woefully inadequate terms of the ACB Offer. Moreover, we believe strongly that the combination of CMED with HIP will bring together the most trusted medical brand in Canada with a recreational brand that has no peer. This brand, UP Cannabis, features the endorsement of Canada’s most iconic rock band, The Tragically Hip. We believe that this truly Canadian combination will make CMED the industry player to beat. As a result of the foregoing, we voted our significant stake in favour of the HIP transaction and will not be tendering our shares to the ACB Offer. Senvest encourages all CMED shareholders to do the same.